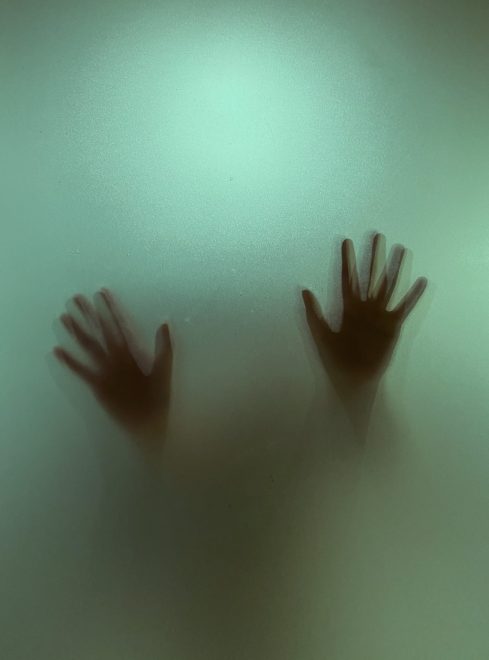

Despite reports to the contrary, the Bitcoin hash rate has crashed to its lowest level since Q3 2019, at 58 million TH/s. @caprioleio described this situation as a chart “to give you nightmares.”

Source: @caprioleio on Twitter.com

This then raises questions over the relationship between the price of Bitcoin and its hash rate and whether we should expect the price of BTC to follow the hash rate downwards.

What’s Behind The Bitcoin Hash Rate Crash?

The Bitcoin hash rate was plodding along as expected until the energy FUD of a few weeks ago. A strong recovery in hash rate followed this. That was until the mining crackdown in China.

The chart above shows a resulting freefall in hash rate, breaking the trend of higher lows.

Although China crackdowns have happened on several occasions in the past, this time seems different as authorities in local provinces, specifically Inner Mongolia and Sichuan, followed through with orders from the top. This included the refusal of electricity service to known mining operations.

In response, miners have signaled interest in setting up new locations, with the U.S., El Salvador, Paraguay, and Kazakhstan named as potential new homes for Chinese mining firms.

Commenting on this, MicroStrategy CEO Michael Saylor said this might well turn out to be a “trillon dollar mistake” by China.

“China had 50% market share of bitcoin and they were generating $10 billion a year, in a business that was growing 100% a year, year-over-year.”

Should We Be Concerned With A Slump In Hash Rate?

Hash rate refers to the total combined computing power used to mine and process transactions on a Proof-of-Work blockchain. Some view it as a metric to determine the health of a network.

The relationship between a cryptocurrency’s price and its hash rate is a contested one. However, given that high prices make mining more profitable, it’s logical that more miners will join a network when the price is rising. In other words, the hash rate follows the price.

Indeed, with Bitcoin down since its $65k all-time high in mid-April, it appears that the hash rate has followed.

But others, including Max Keiser, thinks that price follows hash rate. Keiser views the hash rate as a measure of adoption and realization of the cracks in the legacy financial system.

As things stand, there isn’t sufficient data to say with conviction which theory is correct.

In counter to the hash rate follows price theory, Bitcoin’s 11% growth since the weekend shows no effect on a hash rate that continues to decline. Then again, would hash rate data be affected over two days and by “one-off” causes, such as a mining exodus from China?

Equally, the price follows hash rate theory falls flat when considering that on October 19, 2020, over two weeks, the Bitcoin hash rate dropped from 146 million TH/s to 107 million TH/s – a 27% decrease. Meanwhile, there was no discernable drop in the BTC price, which went on to break a three-year resistance level of $20k the following month.

For now, we can only assume a weak correlation between the two.