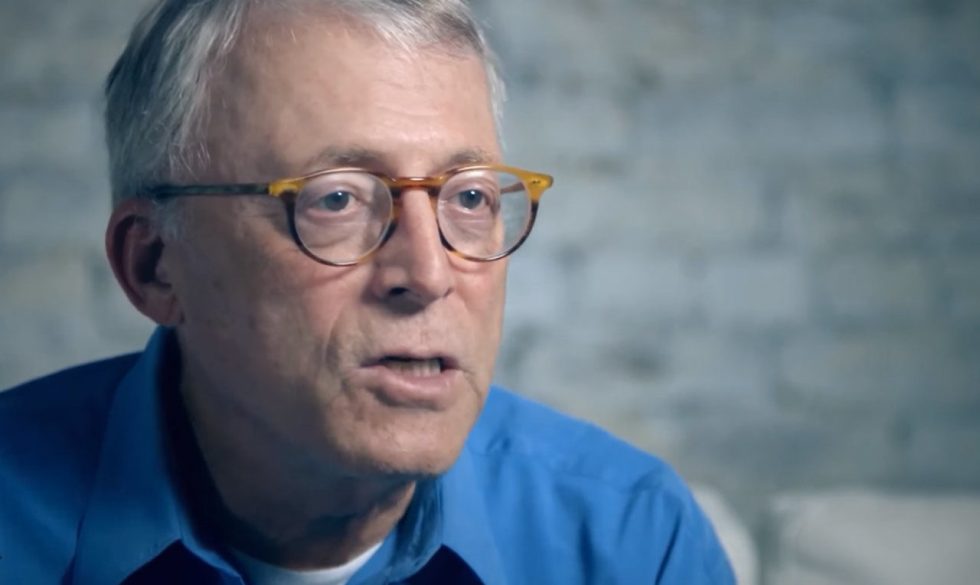

Bitcoin price is in the “definition” of a descending triangle but the potential for upside remains, veteran trader Peter Brandt has said in fresh advice for investors.

Brandt Urges Caution On Short-Term Bitcoin

In a series of social media updates on September 7, Brandt, who is well known as a bullish Bitcoin proponent, said that while downward pressure was evident, a breakout could still occur.

“Bitcoin meets the definition of a descending triangle. Don’t let newbie chartists tell you different,” he wrote, commenting on two recent BTC/USD charts.

He continued:

“There have been numerous occasions over the years when prices blew out of the upside of a descending triangle.”

Brandt applies classical charting techniques to Bitcoin markets, a practise which continues to earn him criticism from some who believe Bitcoin does not conform to them.

Under current conditions, Bitcoin will most likely exit the triangle through the longer horizontal side – in this case falling lower.

“Right-angled triangles imply (but do not demand) a resolution thru the horizontal boundary,” he reiterated.

Time To Long BTC?

At this point, Brandt continued that he was long on BTC, given the relative price suppression compared with recent months. The trader has holdings of between 10 and 100 BTC, he revealed.

As Bitcoinist reported, Bitcoin’s technical strength appears increasing at odds with its lackluster price performance over the past weeks.

As an example, the cryptocurrency’s network hashrate continues to hit new all-time highs, this week coming within striking distance of 100 quintillion hashes per second.

The metric suggests Bitcoin’s security and profitability are at unprecedented levels, capping a renaissance which began at the start of 2019.

Among analysts meanwhile, others painted a similar picture to Brandt. Mia Tam, an increasingly popular forecaster on Twitter, also eyed a step downwards for BTC/USD on Monday, this nonetheless giving way to upside afterwards.

Overall opinion points to several events influencing Bitcoin for the rest of the year. The first, later this month, is the long-awaited debut of Bakkt’s physical Bitcoin futures.

With institutional interest unleashed, attention will then focus on October’s decision on whether to allow two Bitcoin exchange-traded funds (ETFs) to hit the market.

The latter have seen repeated delays and rejections from US regulators, with operators seeking to get their products the stamp of approval since March 2017.

What do you think about the short term for Bitcoin prices? Let us know in the comments below!

Images via Shutterstock, cryptoconsulting.info