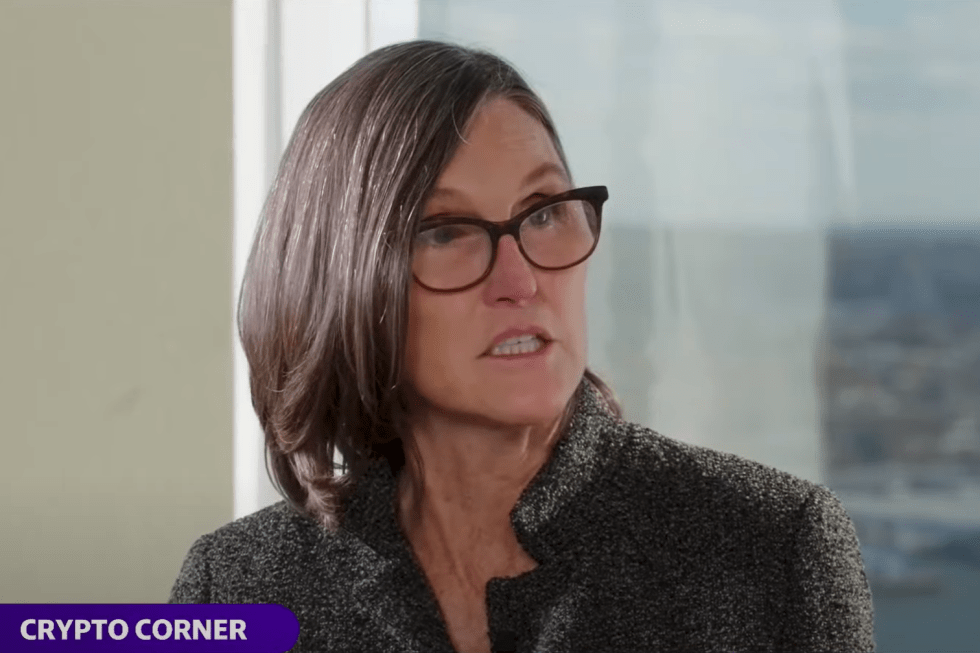

Cathie Wood, the CEO of Ark Invest, in an interview with Yahoo Finance, provided a deep dive into the status and future prospects of a spot Bitcoin ETF. Her detailed insights offer a rare glimpse into the interactions with the Securities and Exchange Commission (SEC).

Ark Invest’s SEC Engagement

Wood described a significant shift in the SEC’s response to Ark Invest’s ETF filings, contrasting their current engagement with previous experiences. “We had put in a number of times a filing and we were just denied. Never got any questions, really never got any response. This time, this summer, we got questions back from the SEC,” she noted. This change, according to Wood, indicates a more active and detailed review process by the SEC.

She expressed excitement about the SEC’s questions, seeing them as a sign of genuine engagement. Wood also lauded the SEC’s research team for their sophistication and depth of understanding. “They are extraordinarily sophisticated. They know what they’re talking about,” she said, adding that the level and nature of the questions suggested that the SEC was delving deeply into the matter.

Wood also mentioned that Ark Invest had answered the SEC’s questions and had not received further communication, which she interprets as a potentially positive indicator. “They never tell you that you’ve satisfied them but if you don’t hear from them, that usually means that you have satisfied the answers to the requests,” Wood explained.

Spot Bitcoin ETF Odds Are Up, But …

Wood cautiously optimistic stated that the odds of approval have increased. However, she highlighted a new wrinkle in the process: the SEC’s likely approach to approve multiple ETFs at once to avoid selecting a “winner.” This collective approval process introduces complexity, particularly with Grayscale’s intent to convert its Bitcoin trust into an ETF.

Wood expressed uncertainty about the feasibility of this conversion and the potential legal challenges it might pose. “Grayscale has said it will sue the SEC again if it denies the conversion. If they were to do that before January 10th, I don’t know if that would throw everything up in the air again. For the others as well. For everyone,” she said.

Nate Geraci, while commenting on Wood’s observations, expressed astonishment about how the Grayscale situation might impact the timeline for other ETF approvals. “Interesting comments from ARK’s Cathie Wood… Says rumblings that SEC may not allow Grayscale to convert GBTC into ETF. Could hold up timeline for launch if SEC wants to batch approve everyone. Not sure what to make of this,” Geraci remarked.

In another interview with CNBC Squawk Box, Wood discussed SEC Chair Gary Gensler’s potential influence on the ETF approval process. She speculated that Gensler’s aspirations for a higher position in the Treasury and the focus on the dollar could be contributing to the delay in approving a spot ETF.

“I don’t know what it is but there’s speculation that he is interested in the Treasury Secretary position at one point… They are very focused on the dollar. I don’t understand it myself because he definitely understands Bitcoin,” Wood stated.

Only 2 Of 12 Without An Updated Filing

On another note, James Seyffart, a Bloomberg ETF analyst, highlighted the nearing deadlines for three spot Bitcoin ETF applications and expressed confidence in a 90% chance for approval. “Okay, we’re nearing in on deadline dates for 3 spot Bitcoin ETF applications. I want to get ahead of it because there’s a pretty good chance we’ll see delay orders from the SEC. Delays WOULD NOT change anything about our views & 90% odds for 19b-4 approval by Jan 10, 2024.”

He also reported an update from GlobalX, which filed their amended Bitcoin ETF prospectus, leaving Wisdom Tree and Franklin as the only two of twelve applicants to update their filings.

At press time, BTC traded at $35,641.