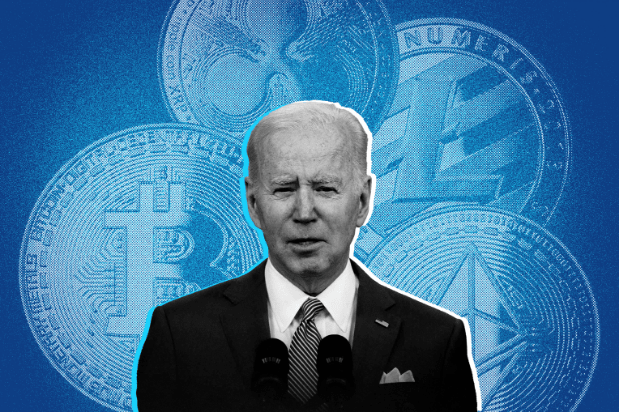

Crypto traders face a setback as United States President Biden takes a strong stance, declaring that no debt deal will be made to protect them. He expressed his disapproval of the deal and his concerns about the effects it would have on the bitcoin industry and its users.

Biden emphasized the need for cautious consideration and regulation of the digital currency industry. He was concerned about the potential loopholes and dangers associated with the debt ceiling agreement’s provision of benefits to bitcoin traders in particular.

After the (Group of Seven (G7) summit in Hiroshima, Japan, Biden held a press conference on Sunday to inform the public on the status of ongoing budget talks and the financial problem facing the US.

After proposing over $3 trillion in deficit reduction “through the combination of spending cuts and new revenues,” the President said he has done his part and that they are putting out a recommendation that reduces spending by more than a trillion dollars.

Biden concluded his participation in the G7 (Group of Seven) forum in Japan by criticizing “wealthy tax cheats and crypto traders” who benefit from Republican legislators.

Possible Consequences On Debt Default

In an attempt to avoid financial market turmoil and rising interest rates, the US Treasury Department warns of possible consequences if the federal government defaults.

BREAKING: President Joe Biden speaking on the final day of the G7 summit

“I’m not going to agree to a deal that protects wealthy tax cheats and crypto traders while putting food assistants at risk.”https://t.co/q2ATjj9RFh

📺 Sky 501, Virgin 602, Freeview 233 and YouTube pic.twitter.com/PIf0O5tKXq

— Sky News (@SkyNews) May 21, 2023

The administration is presently discussing a new budget that is crucial to preventing a potential default on the repayment of debt by the US government before the deadline.

On Crypto And Tax Loss Harvest

Crypto merchants are purportedly protected from a so-called “tax loss harvesting.” Currently, the White House and Republican leaders are discussing barring bitcoin and related transactions, according to reports.

Investors employ tax-loss harvesting as a way to minimize their overall tax obligations in the realm of cryptocurrencies. This approach involves selling a cryptocurrency at a loss, with the aim of balancing out any capital gains derived from profitable cryptocurrency investments.

Within 30 days before or after the sale of the assets, the proceeds must be used to purchase a similar asset to claim a loss. Additionally, the mechanism is available for equities and other assets.

G7 At A Glance

The G7 is an international forum comprised of the seven most advanced economies in the globe. Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States are members.

These countries meet to discuss and coordinate policies on a variety of global issues, including economic development, international trade, security, and environmental sustainability.

The G7 has acknowledged the increasing significance of cryptocurrencies and has discussed their implications and regulatory challenges during meetings.

While the G7 has not formulated a unified stance on cryptocurrencies, individual member states have taken measures to tackle the regulatory facets of this emerging technology.

The primary topics of discussion within the G7 regarding cryptocurrencies are safeguarding consumers and anti-money laundering (AML) measures.

As decentralized digital assets, cryptocurrencies present unique challenges for consumer protection and battling unlawful financial transactions.

BTCUSD still below the key $27K region today. Chart: TradingView.com

Heightened Regulatory Pressure

Meanwhile, Biden’s adamant opposition to a debt agreement that protects crypto traders coincides with heightened regulatory scrutiny of the cryptocurrency market.

The move sends a clear message that the Biden administration is dedicated to holding the industry liable and avoiding unfair benefits for the affluent and tax cheats.

-Featured image from Getty Images