Bitcoin mining has been pushing the growth of important chipmakers, such as Nvidia and Advanced Micro Devices Inc. (AMD). Now, tech giant Taiwan Semiconductor Manufacturing Co Ltd. (TSMC) plans to significantly increase its revenue from the crypto-mining devices segment.

Crypto-Mining Driving TSMC’s Growth

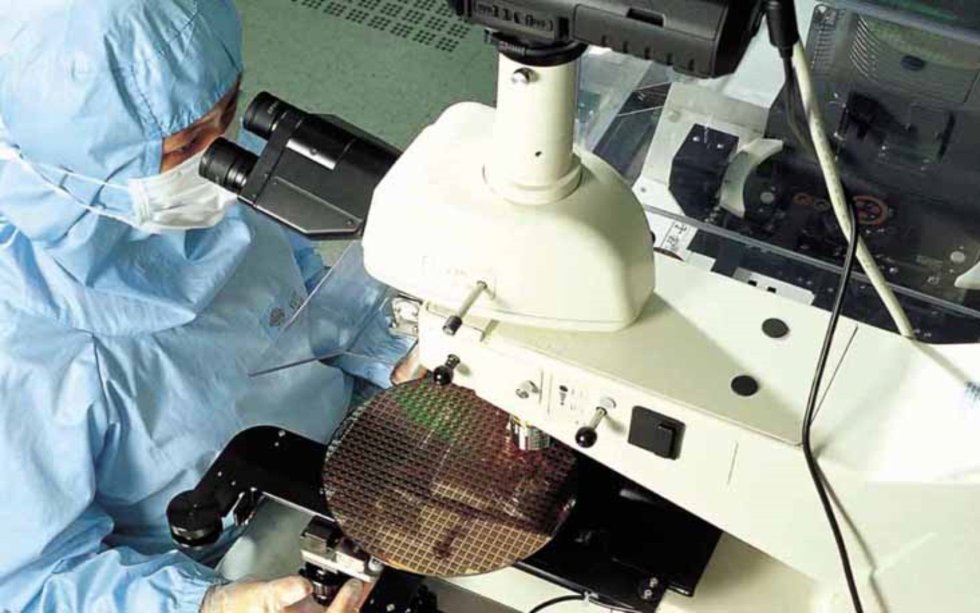

TSMC provides semiconductor manufacturing devices and services for a range of industries. Most notably, the company supplies chips to Apple.

AppleInsider reports that TSMC might have reached a deal to be the exclusive supplier of the “A11” bionic processor that will be embedded in Apple’s 2018 iPhones.

However, TSMC management is bullish on the cryptocurrencies. Motley Fool writes that TSMC expects to profit more from the cryptocurrency industry than from supplying electronic components for Apple’s iPhone.

Already, TSMC’s fastest growing segment involves the designing and assembling of application-specific integrated circuits (ASICs) for Bitcoin and other cryptocurrencies mining. According to Bloomberg, manufacturing crypto-mining devices could represent about one-tenth of TSMC’s revenue in 2018, thus becoming its fastest-growing segment.

Why Taiwan Semiconductor Manufacturing Co. Stock Jumped 26.4% in 2017 – Motley Fool https://t.co/Pq3K9KiFui pic.twitter.com/Kb2wGJGntM

— Hsinchu News (@hsinchunews) January 16, 2018

Data from S&P Global Market Intelligence shows that TSMC achieved a 28 percent return in 2016, partly thanks to the surging interest in cryptocurrency mining. And, in 2017, fueled by crypto-based sales, TSMC rose 26.4 percent. According to Motley Fool:

When TSMC reported 18% sequential sales growth in the third quarter, CFO Lora Ho pointed to cryptocurrency miners as a significant growth driver.

Bitcoin Mining Fueled Chipmakers’ Spectacular Growth

In 2017, the biggest chipmakers such as Nvidia, AMD, and other manufacturers of electronic components fared well. They continued to profit from manufacturing devices used in cryptocurrency mining, IoT, artificial intelligence, robots, driverless cars, and other Fourth Industrial Revolution innovations.

Regarding cryptocurrency mining, for example, in August 2017, cryptocurrency mining devices had pushed Nvidia’s sales to rise 52 percent to $1.2 USD billion. This year, Nvidia’s stock continues its spectacular ascending trajectory, reaching an all-time high of $227 USD, on January 16, 2018.

Not only manufacturers of Fourth Industrial Revolution technologies, including Bitcoin-related devices, remain bullish for 2018. So do financial entities. For example, most recently, Daiwa, the big Japanese investment bank, upgraded TSMC believing that 1Q revenues will be higher partly because of “continued demand strength from cryptocurrency processors.”

What are your thoughts about the relationship between Bitcoin and Nvidia, AMD, and TSMC? Let us know in the comments below!

Images courtesy of Taiwan Semiconductor Manufacturing Company Limited, Twitter