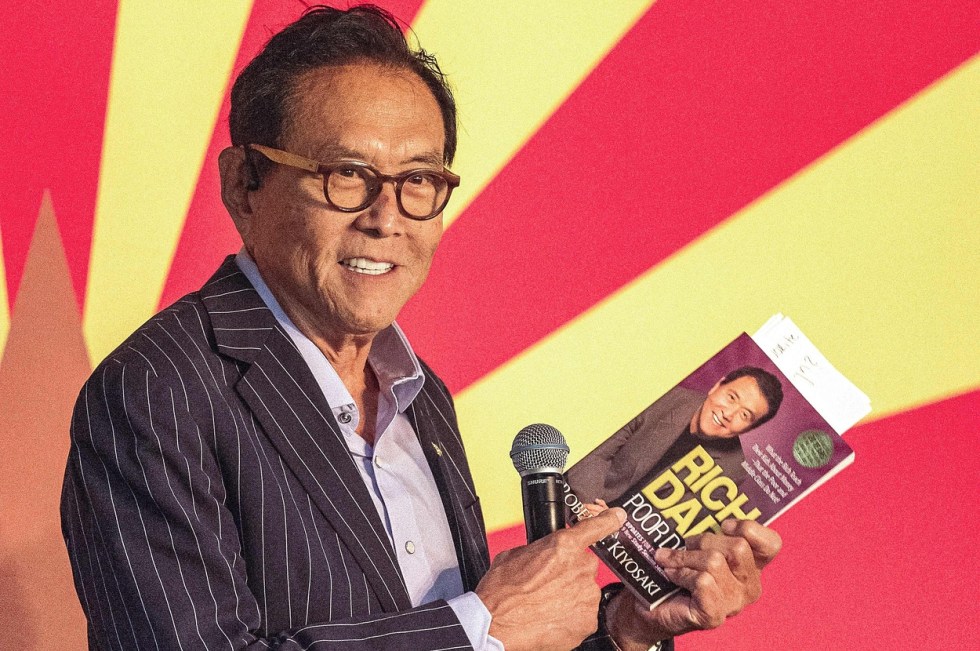

Robert Kiyosaki, the author of the bestselling personal finance book “Rich Dad, Poor Dad,” has fired another financial warning shot, this time targeting the US dollar and a potential challenger – a gold-backed stablecoin from the BRICS nations (Brazil, Russia, India, China, and South Africa).

Kiyosaki, a longtime advocate for “real money” like gold, silver, and Bitcoin, fears the BRICScoin could trigger hyperinflation in the US, causing the dollar to lose its global dominance and ultimately collapse.

Hyperinflation Or Hyperbole?

While Kiyosaki paints a stark picture of a dollar deluge flooding the US economy, experts remain divided on the BRICScoin’s true impact. The very existence of the stablecoin is still under discussion within the BRICS alliance.

If it does materialize, its primary purpose would likely be to facilitate internal trade between member countries, potentially reducing their dependence on the US dollar for international transactions.

Currently in South Africa a country I love. Watching and listening to rumors of what will happen when BRICS nations, Brazil, Russia, India, China, South Africa produce BRICS crypto, possibly backed by gold. If BRICS gold crypto happens trillions in fake money, fiat US dollars…

— Robert Kiyosaki (@theRealKiyosaki) May 12, 2024

This shift could undoubtedly chip away at the dollar’s global hegemony, but financial experts are more cautious than Kiyosaki when it comes to predicting hyperinflation. The US economy, despite its challenges, still holds significant weight. A complete dollar collapse seems unlikely in the immediate future.

On Hyperinflation And Stablecoins

So, what exactly is a BRICScoin, and why does Kiyosaki fear it so much? Stablecoins are cryptocurrencies pegged to a real-world asset, like gold, to prevent the wild price fluctuations often associated with traditional cryptocurrencies.

Bitcoin is currently trading at $62.584. Chart: TradingView

A gold-backed BRICScoin would theoretically offer stability and potentially challenge the dominance of the US dollar in international trade, particularly for commodities like oil currently priced in dollars.

Kiyosaki: A Prophet Or Provocateur?

Kiyosaki is no stranger to bold financial predictions. While his “Rich Dad, Poor Dad” series has sold millions of copies, some of his past forecasts haven’t materialized.

His dire warnings about the US dollar and hyperinflation should be taken with a grain of salt, especially considering his vested interest in promoting alternative assets like gold and Bitcoin.

Beyond The Hype: Building A Resilient Portfolio

The BRICS stablecoin, if it materializes, is unlikely to be an overnight revolution. But it could signal a shift in the global financial landscape. The US, facing a potential erosion of its dollar dominance, might have to focus on strengthening its own economic fundamentals.

Featured image from Getty Images, chart from TradingView