While the Bitcoin and crypto markets are still dealing with the aftermath of the FTX collapse, IMF chief Kristalina Georgieva is warning of a global collective recession that will affect one-third of all economies. In an interview, the managing director of the International Monetary Fund said the global economy will face a challenging year in 2023.

In doing so, Georgieva described China‘s slowing growth as the biggest threat this year, with the world economy’s other main growth engines – the U.S. and Europe – also set to experience a slowdown.

“For the first time in 40 years, China’s growth in 2022 is likely to be at or below global growth,” Georgieva said. A slowdown is already evident in the EU, triggered by the war between Ukraine and Russia, she said.

The IMF chief also warned that the new year “will be tougher than the year we leave behind,” citing that emerging markets will also be hit hard by the slowdown in major economies,

We expect one-third of the world economy to be in recession. Even countries that are not in recession, it would feel like recession for hundreds of millions of people.

“Half of the EU will be in recession next year,” she added, going on to say that the U.S. could avoid a recession because it was “the most resilient” and could avoid a recession. “We see that the labor market remains quite strong,” Georgieva said, arguing further:

This is … a mixed blessing because if the labour market is very strong, the Fed may have to keep interest rates tighter for longer to bring inflation down.

Consequently, as has already become clear at past FOMC meetings, the U.S. labor market will be a key focus for the U.S. central bank when it comes to deciding when a pivot is justified. In the first week of the new year, a number of key data on the labor market are due, and in addition, the next inflation data will be released on December 12.

2023 IMF PREDICTION: “We expect one-third of the world economy to be in recession,” IMF Managing Director Kristalina Georgieva tells @margbrennan. But, a strong U.S. labor market might help the world get through a difficult year, she says. pic.twitter.com/Vbhj478pFo

— Face The Nation (@FaceTheNation) January 1, 2023

What Does It Mean For Bitcoin And Crypto?

This question is one of the key ones for 2023, and arguably the most contentious. Clearly, Bitcoin has yet to deliver on the promise of an inflation hedge in 2022. While gold posted a YTD performance of -1%, the BTC price lost a staggering 65%.

It’s also a fact that Bitcoin and crypto have never traded in a recession, so historical comparables are lacking. Furthermore, it should be obvious that retail investors especially will have a hard time investing in BTC when the majority is doing badly economically.

On the other hand, it could be a new opportunity for Bitcoin to establish itself as the “hardest money” in the world with a maximum supply of 21 million. The question, therefore, is where will the purchasing power go in a recession? Will it be gold, as it has historically been, or will Bitcoin get a fair share as digital gold?

Central Banks Can’t Stop Printing 💸

Here’s why: pic.twitter.com/dD1nrQbYa4

— Swan Bitcoin Client Services (@SwanBitcoin) January 1, 2023

At press time, the BTC price still remained flat. Bitcoin recorded a slight gain of 1% over the past 24 hours and was trading at $16,671.

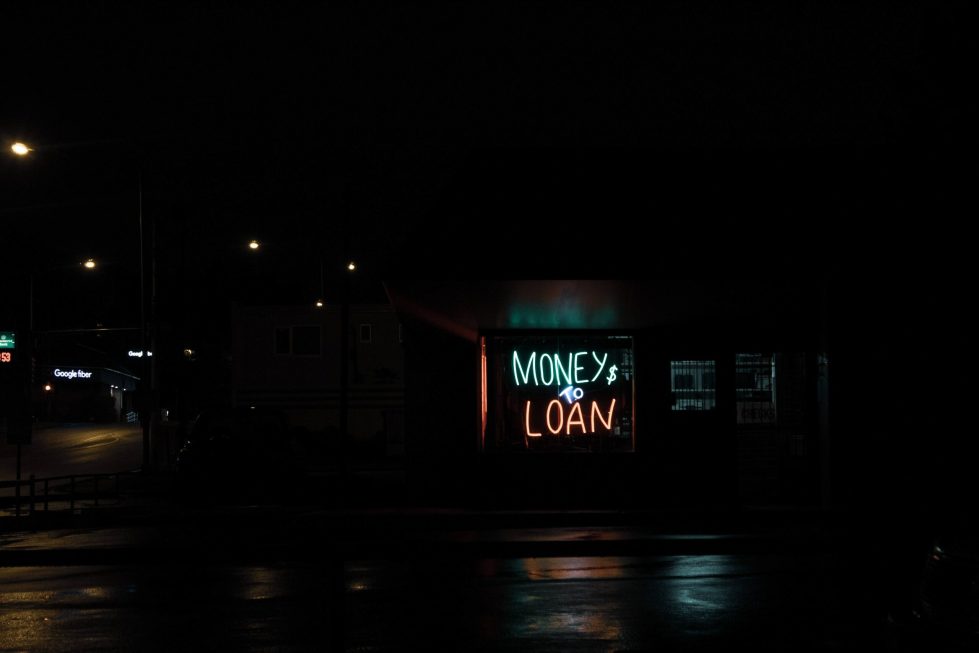

Featured image from Daniel Thomas / Unsplash, Chart from TradingView.com