The U.S. Securities and Exchange Commission (SEC) recently initiated legal action against crypto influencer Richard Schueler, widely recognized as Richard Heart, along with his trio of cryptocurrency ventures – Hex, PulseChain, and PulseX.

The regulatory body contends that these ventures engaged in unregistered offerings of “crypto asset securities,” accumulating a huge amount of $1 billion from investors.

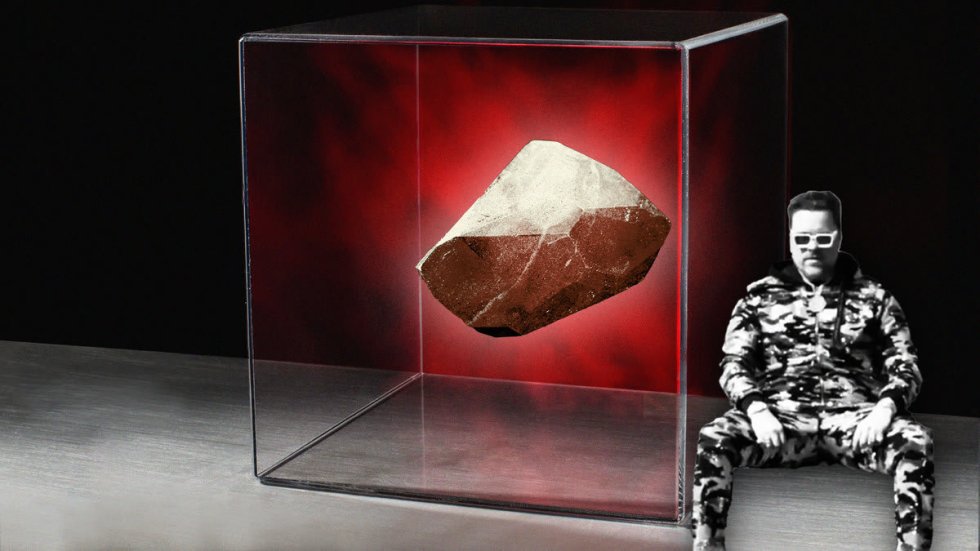

The Commission further accuses Heart of defrauding investors by using approximately $12 million of the raised funds to purchase extravagant goods, including luxury cars, watches, and a 555-carat black diamond.

Today we charged Richard Heart (aka Richard Schueler) and three unincorporated entities that he controls, Hex, PulseChain, and PulseX, with conducting unregistered offerings of crypto asset securities that raised more than $1 billion in crypto assets from investors.

— U.S. Securities and Exchange Commission (@SECGov) July 31, 2023

Unregistered Token Offerings And ‘Recycling’ Tactics

The allegations against Heart, a YouTube streamer and crypto personality, trace back to 2018 when he began marketing Hex as the first high-yield “blockchain certificate of deposit.”

He claimed that investing in his crypto products would lead to significant wealth for investors, which attracted millions of dollars in Ethereum contributions.

The regulator claims that Heart and Hex carried out unregistered token offerings, with some transactions involving “recycling” tactics to gain control over a substantial number of Hex tokens while presenting a false impression of high trading volume.

In addition to the unregistered Hex token offering, the regulator alleges that Heart orchestrated two more unregistered crypto asset security offerings between 2021 and 2022, each raising hundreds of millions of dollars more in crypto assets. This extensive fundraising brought the total amount raised by Heart’s projects to over $1 billion.

Total crypto market cap at $1.12 trillion on the daily chart: TradingView.com

‘The Enigma’ And Other Extravagant Purchases

The alleged spending spree included acquiring luxury sports cars such as a 2020 white Ferrari Roma and a McLaren, along with luxury watches like the Rolex Daytona Eye of the Tiger.

However, the most significant and astonishing purchase was “The Enigma,” a 555-carat black diamond touted as the largest in the world, for which Heart allegedly paid over $4 million at a Sotheby’s auction.

SEC High-Profile Legal Actions

SEC’s Eric Werner condemned Heart’s actions, emphasizing that he encouraged investors to buy crypto asset securities without registering them, and then spent some of their assets on extravagant luxury goods. The lawsuit aims to protect investors and hold Heart accountable for his alleged misconduct.

This lawsuit is part of a series of high-profile legal actions against players in the crypto industry. Companies like Gemini, Bittrex, and Tron, as well as major exchanges Coinbase and Binance, have all faced legal challenges from the the commission.

Featured image from The Daily Beast / Getty / Instagram