The US Securities and Exchange Commission’s Investor Advisory Committee (IAC) has issued a bold recommendation to SEC Chair Gary Gensler, urging him to take assertive action over crypto assets that are classified as securities.

According to the committee, nearly all digital tokens should be treated as securities, prompting the regulator to prioritize enforcement efforts in the crypto space.

This call to action signals a potential shift in the regulator’s approach to cryptocurrencies, and underscores the need for greater regulatory oversight of this emerging market.

IAC: Crypto Tokens Should be Regulated as Securities

In a letter addressed to SEC Chair Gensler, the IAC Chair Christopher Mirabile and Vice Chair Leslie Van Buskirk expressed the collective view of the IAC members.

The committee strongly believes that almost all, if not all, crypto tokens should be considered securities and that they, along with the platforms and custodians involved in their transactions, must be regulated under the federal securities laws to safeguard investors.

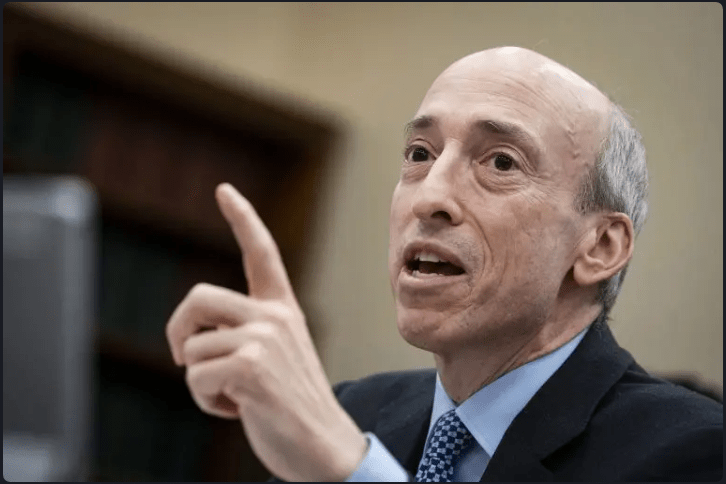

Image: Reuters/Jonathan Ernst/File Photo

The IAC highlighted that various players in the crypto sector who engage in illicit activities have caused substantial losses to investors, many of whom are unsophisticated and seek quick profits. The committee noted that these losses have amounted to over $2 trillion, affecting numerous investors in the recent past.

By treating crypto tokens as securities, the IAC believes that investors will have greater protection from fraudulent practices and be able to make informed decisions while investing in the crypto market.

The move will also promote transparency and accountability, ensuring that the crypto sector operates within the legal framework established for securities.

Image: Forbes

IAC to SEC Chair: Take Aggressive Action

The IAC has also raised concerns about the state of the cryptocurrency industry. According to the committee, several prominent companies in the space have already filed for bankruptcy or are on the brink of doing so. Additionally, others have been embroiled in legal troubles, facing both civil and criminal charges.

In response to these developments, the IAC is urging the SEC chair to take a more active role in regulating crypto assets. Specifically, the committee is calling on the SEC to “aggressively” assert its authority over crypto assets that are considered securities. The IAC has also asked the SEC to prioritize enforcement efforts related to crypto assets.

XRP total market cap currently at $26 billion on the daily chart at TradingView.com

SEC has been ramping up its enforcement efforts in the cryptocurrency industry in recent years. This comes as the industry has experienced explosive growth and faced a number of high-profile scandals and controversies.

One of the most notable cases was the SEC’s lawsuit against Ripple Labs, alleging that the company had sold unregistered securities in the form of XRP tokens.

The lawsuit has been closely watched by the industry and could have significant implications for how other cryptocurrencies are regulated.

-Featured image from New York Post