Crypto cards aim to close the gap between legacy banking and digital assets. They allow users to benefit from holding funds in cryptocurrencies, with the flexibility to convert to cash via ATMs or spend them in the same way they can spend their fiat money from a bank account, at over 53 million merchants worldwide.

Crypto cards remove the hassle and slow process of converting crypto to fiat via an exchange and withdrawing to your bank account, mitigating the difficulties of merchant acceptance and lowering the barriers to mainstream adoption.

The growing interest in the crypto space, and card payment demand in general, has led to a variety of different crypto card offerings, covering markets around the world and providing a range of functionality for users.

Crypto.com Card

The metal Crypto.com Visa Card is available to users in Asia, Europe, and the United States. CRO holders can also stake the native token to receive enhanced cashback and rewards.

The card connects to the Crypto.com mobile app, the wallet service providing access to buy and sell 7 fiat and 53 cryptocurrencies. It also links to the entire Crypto.com ecosystem enabling users to earn interest, access credit, invest, accept payments, and exchange their crypto.

- No minimum balance and no annual transaction fees.

- No fees on ATM withdrawals up to $1,000.

- Zero-fee foreign-exchange.

- Fiat and crypto deposit support, with zero-fee crypto to fiat conversion.

- Up to 8% CRO cash back rewards on each transaction.

- 100% rebate for Spotify, Amazon Prime, and Netflix subscriptions.

- 10% rebate for Expedia and Airbnb purchases.

CoinZoom Card

The CoinZoom Visa Card offers Bitcoin, Ethereum, XRP, and other cryptocurrency pairs for the US market, expanding internationally. Behind the card is CoinZoom, a traditional brokerage firm aiming to become a digital banking solution for both crypto and fiat.

The card and corresponding wallet app are combined with CoinZoom’s institutional-grade secure custody and registered digital currency exchange that expects to become the third US platform to be awarded a BitLicense, following Coinbase and Gemini.

- Apple Pay and Samsung Pay connectivity.

- Up to 5% cashback on all card purchases.

- Up to 50% exchange discounts for ZOOM token holders.

- Earn up to 8% APR on select cryptocurrencies.

- Free “ZoomMe” instant Venmo-style remittance in USD or crypto, up to $10,000 per day.

- Referral rewards of up to $50,000.

- Automatic debit roundups to convert change to cryptocurrencies.

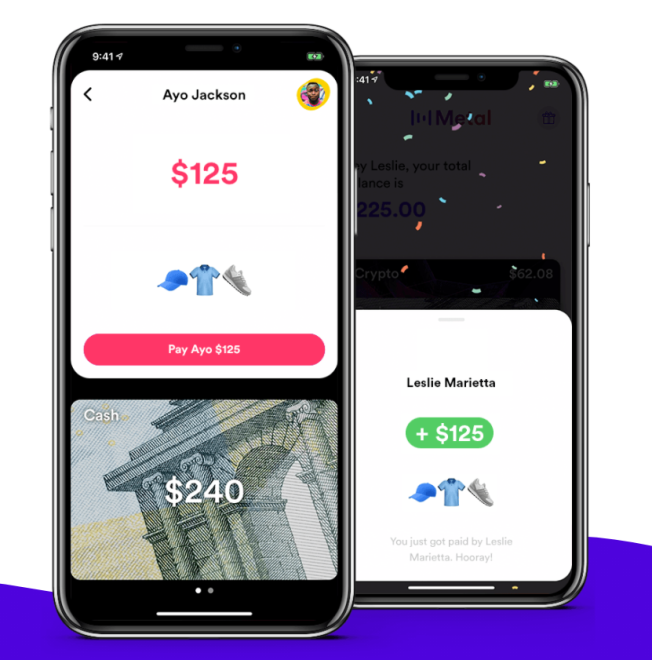

Metal Pay

Metal Pay works slightly differently, offering a solution that is connected to existing bank accounts or debit cards, more like a Venmo or PayPal for crypto but providing similar benefits.

It authorizes the seamless transfer of funds to a Metal Pay account. Users can then create cash and crypto cards in the app to easily buy, sell, send, and receive over 30 cryptocurrencies.

The Metal Pay app supports FDIC-insured banks, so you can essentially get an FDIC insured cash account with Metal Pay. Currently available in the US, it has plans to expand globally.

- “Pop” transaction rewards of up to 5%, paid in Metal token (MTL).

- Instant deposits via linked bank account transfers and debit cards.

- Fee reductions for MTL holders.

- Free to send to friends and family.

- Send funds and make payments using phone numbers.

- Custodial and non-custodial wallets.

- A cash wallet that is FDIC insured (US residents).

Binance Card

The Binance Crypto Card taps into one of the largest global cryptocurrency exchanges, allowing users to automatically transfer crypto from their main Binance wallet to their Binance Card wallet. It follows Binance’s acquisition of Swipe, a leading digital wallet and debit card platform.

Currently supporting BTC, SXP, BNB, and BUSD, the card is available throughout Europe, with more countries expected soon.

- Zero subscription or maintenance fees.

- Up to 8% BNB cashback on transactions.

- Google Pay and Samsung Pay integration.

- Funds are SAFU benefiting from Binance’s enhanced security features.

- Auto top-up triggers from your main Binance wallet once the minimum balance hits.

- Less than 0.9% transaction fees.

- Spend up to €8,000 daily.

Wirex Card

Wirex offers a multi-currency Visa card and dedicated smartphone app, supporting 18 traditional and cryptocurrencies, with a built-in utility token, WXT. Users can benefit from cashback on purchases and the highest level of security protection.

Currently operating in parts of Europe and the Asia-Pacific, Wirex is now seeking to expand into Canada, Japan, and the US.

- Up to 1.5% “Cryptoback” in BTC on all in-store purchases.

- High limits up to $50,000 per day.

- Fiat and crypto deposit support.

- Up to 100% discount on fees using the WXT token.

- Multi-signature, cold storage cryptocurrency accounts.

- Flat fee for ATM withdrawals.

- $1.50 monthly card management fee.

The Future for Crypto Cards

Crypto cards provide a revolutionary step in adoption by simplifying the process of holding, exchanging, and spending cryptocurrencies, expanding market access, and helping entrants navigate a world of growing crypto utility.

The benefits developed so far are just the start, with increasing incentives including staking, interest-earning, and payment acceptance services, only broadening the potential of physical and virtual card-based crypto services in the years ahead.

Disclaimer: The information presented here does not constitute investment advice or an offer to invest. The statements, views, and opinions expressed in this article are solely those of the author/company and do not represent those of Bitcoinist. We strongly advise our readers to DYOR before investing in any cryptocurrency, blockchain project, or ICO, particularly those that guarantee profits. Furthermore, Bitcoinist does not guarantee or imply that the cryptocurrencies or projects published are legal in any specific reader’s location. It is the reader’s responsibility to know the laws regarding cryptocurrencies and ICOs in his or her country.