Are you interested in making money when the price of cryptocurrencies goes down? Shorting crypto can be a smart way to profit from the market’s ups and downs. In this article, we’ll show you the 5 best exchanges to short crypto, so you know where to go to make the most out of your trades.

Whether you’re experienced or just getting started, picking the right exchange is key to your success. Ready to find out which platforms can help you reach your trading goals? Let’s jump in and check out the best places to short crypto.

List of the best exchanges to short sell crypto

- BYDFi – Best exchange overall (Highest rated) – Accepts US traders – 200x leverage – Short sell in the trading interface – Lowest fees (0.02%) – No KYC – No VPN – Demo account – Great mobile app

- Phemex – Best mobile app – Short on the go with margin – Accept US traders with VPN – No KYC requirement – 100x leverage – Welcome rewards up to $8,800 – 0.05% Fee

- PrimeXBT – Short positions with 1000x leverage – Accepts US traders – No KYC – No VPN needed – 0.02% fees – Deep liquidity – Expert trading tools – Use isolated margin – Tradingview charts

- MEXC – Lowest market maker fee shorting (0%) – No KYC required – VPN is needed for US traders – Mobile app available – Buy crypto with fiat – Perpetual futures contracts

- BTCC – Short sell crypto with leverage (225x) – Futures trading – 0.045% fee – Instant crypto deposits – VIP programme – Copy trading

Investment risk and affiliate disclosure: Trading cryptocurrencies carries significant risk and can lead to rapid losses. Ensure you understand the risks involved before investing. Always do your own research. This article contains affiliate links. If you sign up or make a purchase through these links, we may earn a commission at no extra cost to you. Our recommendations are based on independent research and analysis to provide you with the most accurate information possible.

Which crypto exchanges allow shorting?

Not every crypto exchange lets you short, and the ones that do can be very different in terms of features, fees, and security. To make things easier for you, we’ve reviewed the top 5 exchanges that allow shorting.

We chose these platforms based on how reliable they are, how easy they are to use, and the tools they offer for short traders. Keep reading to find out which exchanges are the best for shorting crypto and why they made our list.

1. BYDFi – Best exchange overall

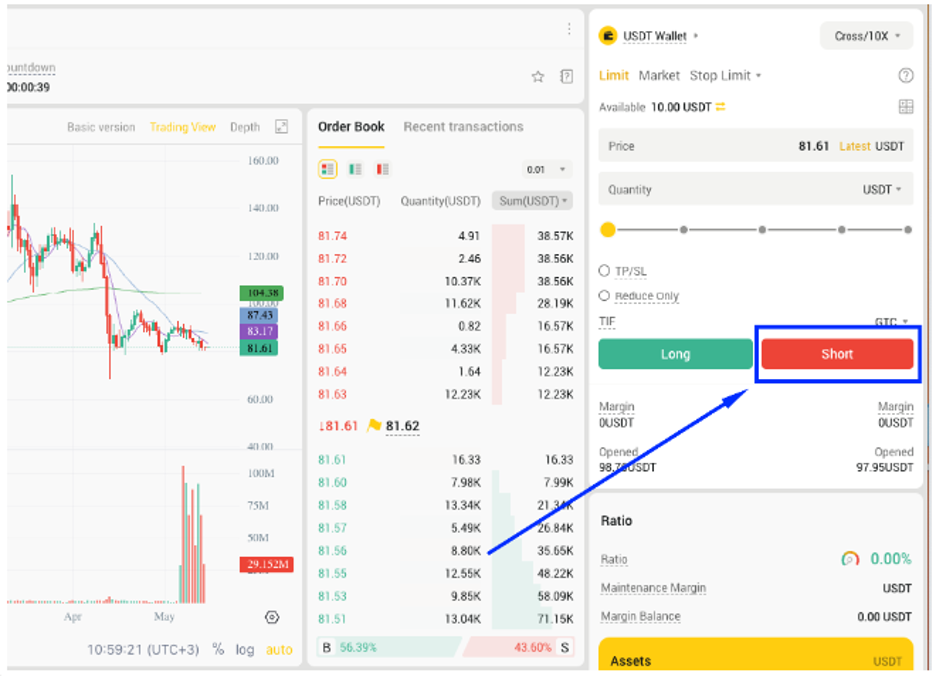

BYDFi is one of the best exchanges for shorting crypto. It started in 2020 as BitYard and rebranded to BYDFi in January 2023. Based in Singapore, BYDFi offers user-friendly trading options like spot trading, lite contracts, perpetual contracts, and copy trading.

BYDFi supports over 400 cryptocurrencies, including exclusive ones you can’t find elsewhere. You can deposit and withdraw using various cryptos, credit/debit cards, and bank transfers. With more than 500,000 users in over 150 countries, BYDFi is popular worldwide for both beginners and experienced traders.

Trading Tools and Fees

BYDFi has advanced trading tools, such as interactive charts with technical indicators for deep analysis. For derivatives trading, you can use perpetual contracts with leverage up to 200x. Being the best short-term crypto trading platform in our list makes it one of the most popular exchanges while betting in a negative direction.

Fees are competitive and transparent: spot trading fees are 0.1% to 0.3%, and perpetual contracts have taker fees of 0.06% and maker fees of 0.02%. Withdrawal fees depend on the blockchain network.

Security and Customer Response

BYDFi prioritizes security with features like phone verification, Google Authenticator, fund passwords, anti-phishing codes, and withdrawal address whitelists. Most digital currencies are stored offline in cold storage wallets.

Customer support is available 24/7 through live chat and email, and the platform has a helpful FAQ section and active social media presence.

User Experience and Feedback

Users love BYDFi for its easy-to-use interface, wide range of cryptocurrencies, and strong security. The platform offers a simple registration process and a demo account for beginners. Forbes listed BYDFi among the top ten best crypto apps and exchanges of 2023, highlighting its reliability and transparency with fees.

In short, BYDFi combines great trading tools, low fees, strong security, and excellent customer support, making it the best exchange overall for shorting crypto. Whether you’re new or experienced, BYDFi is a reliable choice for your trading needs.

2. Phemex – Best alternative

If you’re looking for a great exchange to short cryptocurrencies, Phemex is a top choice. Since launching in 2019, Phemex has quickly become known for its user-friendly platform, strong security, and innovative features. Whether you’re a beginner or an experienced trader, Phemex has everything you need to trade successfully.

Fees and Trading Tools

Phemex offers low trading fees. For spot trading, both makers and takers pay just 0.1%. For derivatives trading, the fees drop to 0.01% for makers and 0.06% for takers. There’s also a VIP program that gives active traders even lower fees.

Phemex supports over 250 cryptocurrencies and provides advanced trading tools powered by TradingView, making it easy to perform technical analysis.

Security and Customer Feedback

Security is a top priority at Phemex. They use a unique cold wallet system and keep 100% of user funds in reserve. They also offer Proof-of-Solvency, updated monthly, so users can verify their funds are safe. Customers praise Phemex for its reliability and helpful customer service, making it a trusted platform for traders around the world.

User Experience and Features

Phemex has a simple, easy-to-use interface that’s great for both beginners and experts. It supports multiple fiat currencies, including USD, EUR, and JPY. The platform also offers bot trading, copy trading, and a Phemex Earn feature where you can earn interest on your crypto holdings.

Additionally, the VIP program and other rewards programs offer great benefits for high-volume traders and influencers.

Phemex is a fantastic exchange for shorting crypto, thanks to its low fees, strong security, and user-friendly interface. With a wide range of tools and features, Phemex is a solid choice for anyone looking to trade cryptocurrencies.

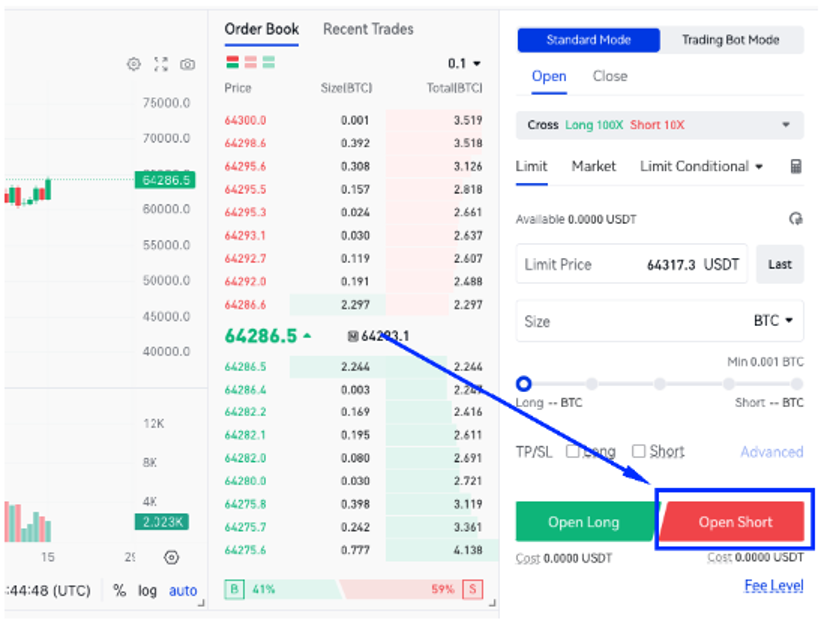

3. PrimeXBT – Best for high leverage

If you’re looking to boost your trading potential with high leverage, PrimeXBT is a top choice. Since its launch in 2018, PrimeXBT has become a leading crypto margin trading platform, offering access to crypto CFDs, commodities, indices, and forex. With over one million users in more than 150 countries, it’s known for its high liquidity and advanced trading tools.

Trading tools

PrimeXBT offers up to 200x leverage on Bitcoin and Ethereum, 100x on altcoins and indices, and an impressive 1000x on forex pairs. This means you can significantly increase your potential profits, though it also comes with higher risks. Being a crypto exchange with trailing stop loss makes it easier to control your risk while locking in profits at teh same time. The platform is highly customizable, allowing you to set it up according to your needs. It also features super-fast order execution, averaging just 7.12 milliseconds.

Competitive Fees

PrimeXBT’s fees are very competitive. They charge a 0.01% maker fee and a 0.02% taker fee on BTC/USDT futures, and a 0.05% maker and taker fee on the BTC/USD market. There are no minimum deposits, making it easy for new traders to get started. PrimeXBT supports trading in major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE).

Security

Security is a big deal at PrimeXBT. They use two-factor authentication (2FA), encrypted SSL, and Cloudflare to protect against DDoS attacks. Most user funds are stored in offline, cold storage with multi-signature technology, making them very secure. They also offer crypto address whitelisting for extra security.

Customer Feedback

Customers generally have good things to say about PrimeXBT. The platform has an above-average rating on Trustpilot, with users praising the fast execution times, high leverage options, and variety of trading tools. However, some people are concerned about the lack of regulatory oversight and the absence of features like staking and lending services.

4. MEXC – Best for low fees

Trading Fees

Looking for an exchange that allows shorting and at the same time is the crypto exchange with lowest fees for market makers without compromising on features and security? MEXC might be the perfect choice for you. With trading fees as low as 0% for makers and 0.1% for takers in the spot market, MEXC stands out as one of the most cost-effective options available.

For futures trading, the fees are even more impressive, with a 0% maker fee and a 0.01% taker fee. These low fees make MEXC an attractive option for both new and experienced traders who are keen on maximizing their profits.

Trading Features

MEXC isn’t just about low fees; it’s also about offering a comprehensive trading experience. Founded in 2018, this global crypto exchange supports over 2300 cryptocurrencies and 2800 trading pairs, making it a haven for altcoin enthusiasts.

You can engage in spot trading, futures trading with up to 200x leverage, copy trading, and even demo trading to practice your strategies. The exchange’s high-performance trading engine, capable of handling 1.4 million transactions per second, ensures smooth trading even during peak times.

Security

Security is a top priority at MEXC, with features like two-factor authentication (2FA), cold storage for the majority of funds, and withdrawal address whitelisting. These measures provide a high level of protection for your assets, ensuring that your trades are secure and your funds are safe from potential threats.

User Experience

Users have generally positive experiences with MEXC, praising its user-friendly interface and robust customer support, which includes live chat and a comprehensive help center. The exchange’s app for Android and iOS makes it easy to trade on the go.

Despite being restricted in some regions, including the United States, MEXC’s reputation for low fees, extensive coin selection, and strong security measures make it a top choice for traders looking to short crypto efficiently.

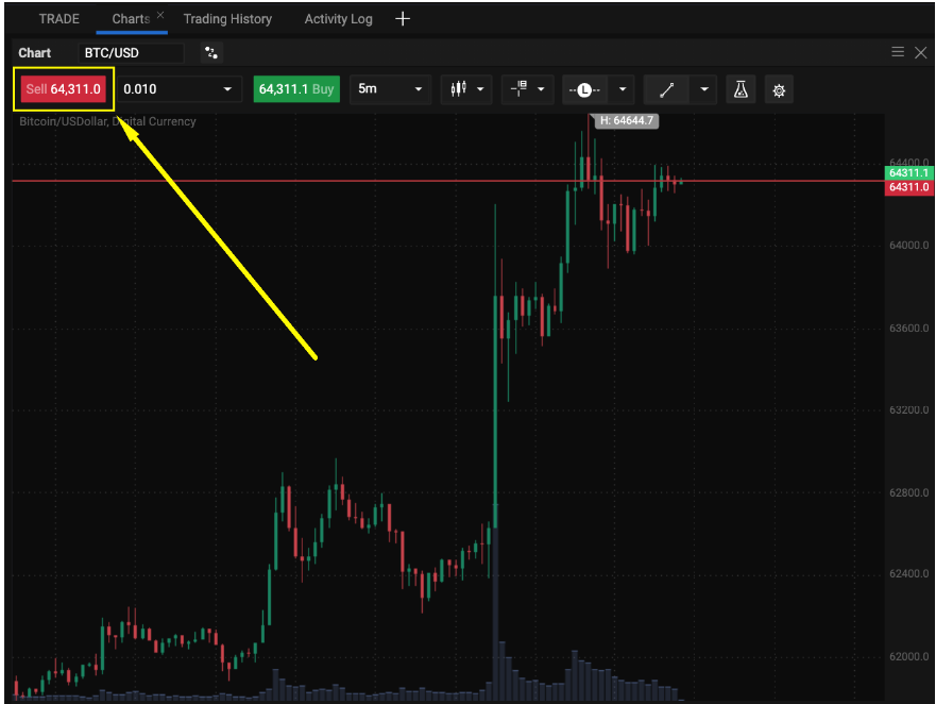

5. BTCC – Best for rewards

BTCC is a top choice for traders looking to earn short sell while trading crypto. Founded in 2011, BTCC aims to make crypto trading easy and trustworthy for everyone. With a simple, user-friendly design and a strong focus on futures trading, BTCC is great for both beginners and experienced traders. It’s also an excellent platform for crypto rewards, offering high leverage options to maximize potential profits from market downturns.

Trading pairs and leverage

BTCC offers over 300 USDT-margined perpetual trading pairs, including popular altcoins and meme-coins. Traders can leverage up to 225x on futures, which can lead to high profits. For beginners, BTCC offers spot trading and a demo trading mode to practice without real money. The copy trading feature lets users follow the strategies of successful traders, making it easier to get started.

Security

BTCC has strong security measures, with no fraudulent activity since it started. User assets are stored in multi-signature cold wallets and kept in trust accounts. BTCC uses SSL encryption to protect personal data and requires identity verification (KYC) for fiat transactions. These measures ensure a safe trading environment and build trust among users.

Fees and deposits

BTCC has low transaction fees for trading and withdrawals. Deposits can be made using credit cards, debit cards, wire transfers, and cryptocurrencies. Withdrawals are only processed in cryptocurrency, which comes with a transaction fee.

MobileaApp

BTCC’s app, available in 14 languages, has been downloaded over 5 million times. Users love the clean design, easy navigation, and lack of annoying ads. The exchange provides real-time market data, customizable trading tools, and a comprehensive guide for beginners. Customer feedback highlights the platform’s reliability and ease of use.

BTCC is a great exchange for shorting crypto. Its combination of high leverage options, a wide range of trading pairs, strong security features, and user-friendly interface make it a top choice in the market. Whether you’re looking to make big profits through futures trading or start with spot trading, BTCC offers the tools and support you need to succeed.

What is short selling crypto?

Short selling crypto is like betting that the price of a cryptocurrency will go down. It’s a strategy traders use to profit from market drops. Imagine you believe Bitcoin’s price is going to fall. Instead of waiting around for it to drop and then buying it at a lower price, short selling lets you make money from that drop directly.

Here’s how shorting crypto works:

You borrow Bitcoin from someone and sell it at the current market price. Now, you have cash, but you owe that Bitcoin back to the lender. If Bitcoin’s price drops as you predicted, you can buy it back at the lower price, return it to the lender, and pocket the difference. For example, if you sell one Bitcoin at $10,000 and then buy it back at $8,000, you make a $2,000 profit (minus any fees).

Short selling can be thrilling and potentially very profitable, but it’s also risky. If the price goes up instead of down, you could face significant losses. This is why it’s crucial to use a reliable exchange that offers the right tools and security for short selling.

In short selling, timing is everything. You need to stay on top of market trends, news, and technical indicators to make smart decisions. Some traders use leverage to amplify their potential gains. Leverage allows you to borrow more funds to increase your position size, but it also increases the risk. If the market moves against you, your losses can multiply quickly.

So, why would someone short sell crypto? There are several reasons:

- Market Volatility: Cryptocurrencies are known for their price swings. Traders can take advantage of these fluctuations by short selling.

- Hedging: Investors holding long positions in crypto might short sell to protect against potential losses if the market turns bearish.

- Speculation: Some traders thrive on predicting market movements and enjoy the challenge and potential rewards of short selling.

Overall, short selling crypto is a strategy that requires knowledge, skill, and a bit of daring. With the right approach and tools, it can be a valuable addition to your trading arsenal. Just remember, the crypto market is unpredictable, so always trade with caution and use risk management strategies to protect your investments.

How to short crypto

If you’re new to this, don’t worry—I’ve got you covered with a simple guide to get started.

Steps to short crypto

- Choose a Reliable Exchange: Pick a trustworthy exchange that allows shorting. Platforms like BTCC, which offer high leverage and a user-friendly interface, are great choices for beginners.

- Sign Up and Verify Your Account: Create an account on the exchange and complete any necessary identity verification (KYC). This step is crucial for security and compliance.

- Deposit Funds: Deposit the cryptocurrency you want to use as collateral. Most exchanges accept various payment methods, including credit cards, debit cards, and wire transfers.

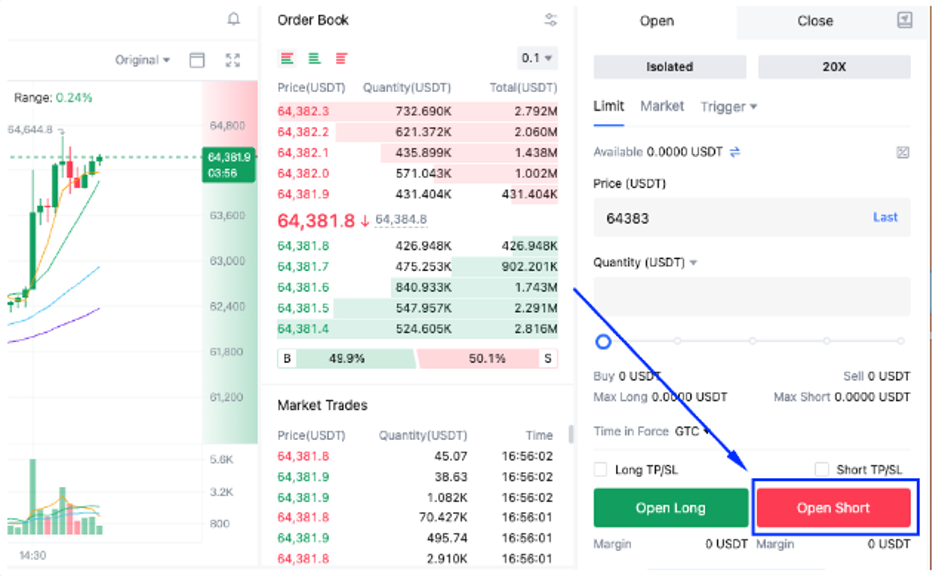

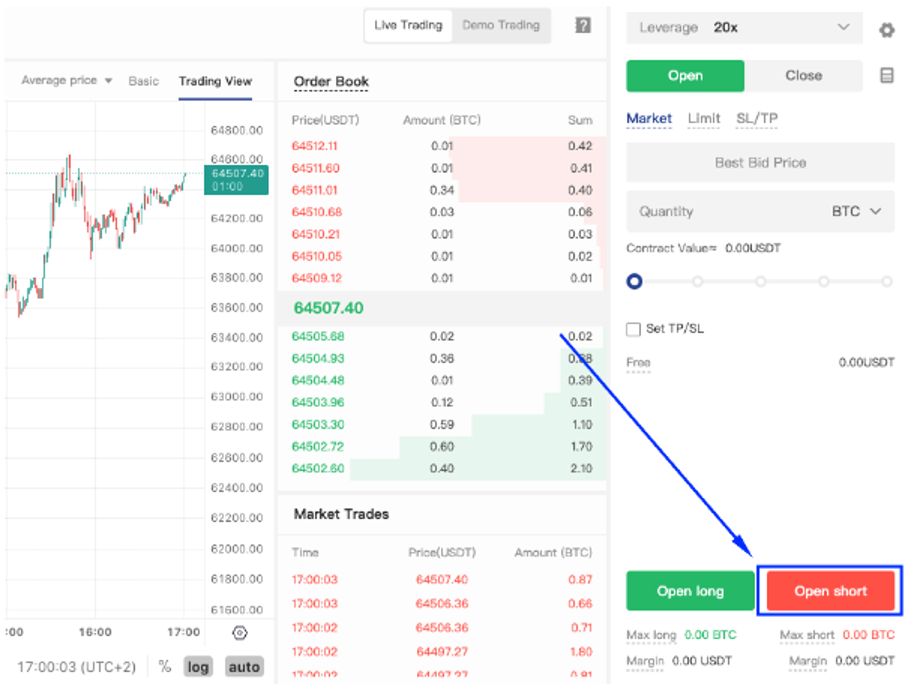

- Navigate to the Futures Market: Once your account is funded, head to the futures trading section of the platform. Here, you’ll find various trading pairs and options for shorting.

- Place Your Short Order: Select the cryptocurrency you want to short and decide on the leverage. Higher leverage means higher potential profits but also higher risk. Enter the amount you wish to short and place your order.

- Monitor the Market: Keep an eye on the market and your position. Use the trading tools provided by the exchange to analyze trends and make informed decisions. Setting stop-loss and take-profit orders can help manage your risk.

- Close Your Position: When the price drops to your target, buy back the cryptocurrency at the lower price to close your position. Return the borrowed amount to the lender and pocket the difference as your profit.

By following these steps, you’ll be well on your way to mastering the art of shorting.

Two reasons why you would want to short sell

- Make money in a falling market

Ever wondered how you can profit when the market is tanking? Short selling is your golden ticket. When you short sell, you’re betting that the price of a cryptocurrency will drop. You borrow the crypto, sell it at its current price, and then buy it back later at a lower price, pocketing the difference.

This strategy can be a game-changer, especially in a bear market. Instead of just sitting around watching your portfolio lose value, you can actively turn those dips into dollar signs. It’s like having an umbrella that not only keeps you dry but also collects rainwater for you to use later. So, next time the market’s on a downward spiral, think of it as an opportunity to make some serious gains.

- Hedge your positions

Think of hedging as your financial safety net. If you’ve already invested heavily in certain cryptocurrencies, short selling can help protect those investments from sudden drops. Let’s say you’ve bought a bunch of Bitcoin and you’re worried it might dip in the short term.

By shorting Bitcoin, you can offset some of the losses if the price falls. It’s like buying insurance for your car; you hope you never have to use it, but it’s great to have just in case. Hedging your positions through short selling gives you peace of mind and adds a layer of security to your trading strategy. It’s a smart move to balance your risks and stay ahead in the crypto game.

What are the risks?

When it comes to shorting crypto, there are several risks you should be aware of. First off, the most obvious one is that prices can skyrocket instead of dropping. Unlike buying, where the maximum you can lose is your initial investment, shorting can lead to unlimited losses since there’s no cap on how high prices can go. This can be particularly dangerous in the crypto market, known for its wild price swings.

Another risk is liquidity. Not all cryptocurrencies have enough trading volume to support shorting. Low liquidity can lead to significant price slippage, meaning you might not be able to execute your trades at the desired prices. Plus, exchanges might have different rules and fees for shorting, which can eat into your profits if you’re not careful.

Lastly, there are regulatory risks. Cryptocurrency regulations are still evolving, and what’s legal today might not be tomorrow. Changes in regulations can impact your ability to trade or even result in the loss of funds. Always keep an eye on the legal landscape to stay compliant and protect your investments.

What are the benefits?

Despite the risks, shorting crypto has its perks. One of the biggest benefits is the potential for huge profits. When you short a cryptocurrency and its price drops as expected, you can make a lot of money in a short period. This is especially true in the volatile crypto market, where prices can plummet just as quickly as they rise.

Shorting also allows you to hedge your bets. If you’re holding a portfolio of cryptocurrencies and expect a market downturn, shorting can offset potential losses. It’s a way to balance your risk and ensure you’re not overly exposed to market volatility.

Moreover, shorting provides opportunities to profit in any market condition. Unlike traditional investing, which typically benefits from a rising market, shorting lets you capitalize on declines. This can be a game-changer during bear markets or when specific cryptocurrencies are losing value.

Lastly, platforms like BTCC offer advanced trading tools, high leverage options, and features like demo trading and copy trading. These tools make it easier for both beginners and experienced traders to navigate the complexities of shorting crypto and maximize their returns.

FAQ

Which cryptocurrency is best for short trading?

Bitcoin (BTC) and Ethereum (ETH) are popular choices for short trading due to their high liquidity and market volatility, making it easier to capitalize on price swings.

Does Coinbase allow shorting?

No, Coinbase does not currently support shorting cryptocurrencies. For short trading, consider using exchanges like BYDFi or Phemex.

Can I short crypto on Binance?

Yes, Binance allows you to short crypto through its futures trading platform, offering various tools and leverage options to maximize your trading potential.

How do you short crypto safely?

To short crypto safely, use a reputable exchange like BYDFi or Phemex, set stop-loss orders to manage risk, and never invest more than you can afford to lose.

Can I short on KuCoin?

Yes, KuCoin offers shorting options through its futures trading platform, providing multiple leverage choices and advanced trading features.

Conclusion

Ready to turn market downturns into profit opportunities? Shorting crypto is a powerful strategy that lets you capitalize on falling prices, and with the right exchange, you can maximize your gains while minimizing risks. Throughout this article, we’ve explored the top 5 exchanges to short crypto, each offering unique advantages tailored to different trading needs.

From BYDFi’s comprehensive tools and low fees to Phemex’s mobile-friendly platform and PrimeXBT’s high leverage, these exchanges provide robust options for every trader. MEXC’s unbeatable low fees and BTCC’s rewarding features make them standout choices for both novice and seasoned traders.

Each platform is equipped with advanced trading tools, high security measures, and excellent customer support, ensuring you have everything you need to succeed in the volatile crypto market. Whether you’re looking to hedge your investments, make profits in a bear market, or simply explore new trading strategies, these exchanges have got you covered.

Dive into our detailed reviews to find the best platform for your shorting needs and start trading smarter today. The crypto market is full of opportunities—don’t miss out on your chance to make the most of them!