Finding the right crypto exchange by Googling around can feel overwhelming, especially if you’re trading from the Netherlands, where regulations and trading conditions have their own quirks. In this article, we’re covering the 6 best crypto exchanges and trading platforms for Dutch traders, meaning, we’ve done the homework so you don’t have to.

Whether you’re looking for a platform for crypto day trading with up to 200x leverage or you prefer a straightforward platform to buy and hold your favorite altcoins, there’s something here for you. Some of these platforms, like BYDFi, don’t even require KYC and offer ultra-low fees, while others specialize in security, keeping your funds safe in cold storage.

By the time you finish this guide, you’ll have a clear idea of which exchange is perfectly tailored to your trading style. We’ll also break down the key risks, how to get started, and what makes these platforms stand out for Dutch traders specifically.

Best crypto exchanges Netherlands quick list

- BYDFi: Best overall for day traders – 200x leverage – no KYC – fully regulated – 0.02% fees – 450+ altcoins listed – TradingView charts – Funds kept in Cold Storage

- Phemex: Best for all-rround traders – 100x leverage – built on TradingView charts – cold wallet storage – $4,100 in bonuses for new users

- BTCC: Best for high-leverage futures traders – 225x leverage – long-standing reputation since 2011 – advanced order types (OCO) – cold storage – perfect for high-risk, high-reward

- Binance: Best for altcoin traders – over 600 cryptocurrencies – 0.1% maker/taker fees with a 25% discount for BNB holders – whitelisting and anti-phishing codes

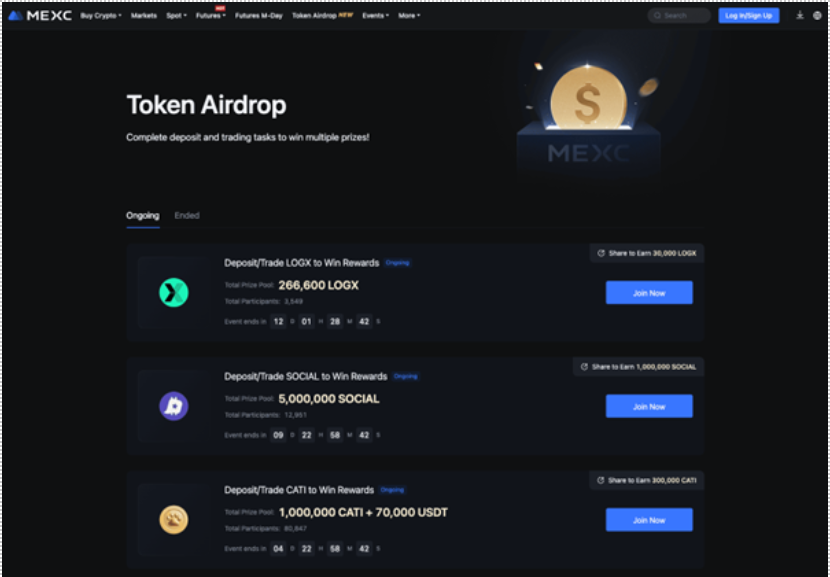

- MEXC: Best for low fees – 2300+ cryptocurrencies – up to 200x leverage – no KYC with 10 BTC daily withdrawal limit – 0% maker fees and 0.01% taker fees for futures

- Coinbase: Best for security and long-term investing – compliant with Dutch and EU regulations – 200+ coins – 98% funds held in cold storage – insured digital assets

(This article is not financial advice. Research before investing. Some links are affiliate links, earning us a commission without extra cost for you. Our content remains unbiased regardless of affiliates.)

Key takeaways TL;DR

- BYDFi is the top choice for Dutch day traders, offering 200x leverage, low fees, and no KYC, making it ideal for high-stakes strategies.

- Binance offers the best altcoin selection, with over 600 cryptocurrencies and competitive fees, perfect for both beginners and advanced traders.

- Coinbase stands out for security and compliance, making it a trusted platform for Dutch traders prioritizing asset protection and regulatory alignment.

Comparison of all exchanges

If you want to make a comparison of all the most important features between all the exchange, take a look a the table below:

| Feature | BYDFi | Phemex | BTCC | Binance | MEXC | Coinbase |

| Leverage | 200x | 100x | 225x | 125x | 200x | 0x |

| KYC Required | No (limited features) | No (for basic features) | Yes | Yes | No (up to 10 BTC withdrawals) | Yes |

| Trading Fees | 0.02% (maker) / 0.06% (taker) | -0.025% (maker) / 0.075% (taker) | 0.0015 BTC withdrawal fee | 0.1% (maker/taker), 25% discount with BNB | 0% maker / 0.01% taker (futures) | Standard fees, higher than competitors |

| Cryptocurrencies Supported | 500+ | 350+ | 300+ | 600+ | 2300+ | 200+ |

| TradingView Integration | Yes | Yes | No | Yes | Yes | Yes |

| Fiat Deposits/Withdrawals | Third-party services only | No direct fiat support | USD (primary fiat) | Limited fiat options | Limited fiat options | Yes (EUR support) |

| Cold Storage | Yes | Yes | Yes | Yes | Yes | Yes (98% of assets) |

| Bonus/Promotions | Yes 2888USDT | Up to $4,100 in bonuses | None | BNB fee discount, SAFU fund | Futures M-Day bonuses | Coinbase One (€30/month) |

| Advanced Risk Management | Stop-Loss, Trailing Stops | Stop-Loss, Take Profit, Trailing Stops | OCO Orders | Stop-Loss, Take Profit | Trailing Stop Orders | Limited (staking, stop orders) |

| Security Features | Cold storage, 2FA | Cold storage, multi-signature | Cold storage, KYC verification | Cold storage, address whitelisting, anti-phishing | 2FA, anti-phishing | Cold storage, biometric logins |

| Mobile Trading | Yes | Yes | Yes | Yes | Yes | Yes |

| Best For | Day traders, leverage trading | All-round traders | High-leverage futures traders | Altcoin traders | Low-fee trading, variety | Long-term investors, security |

1. BYDFi review

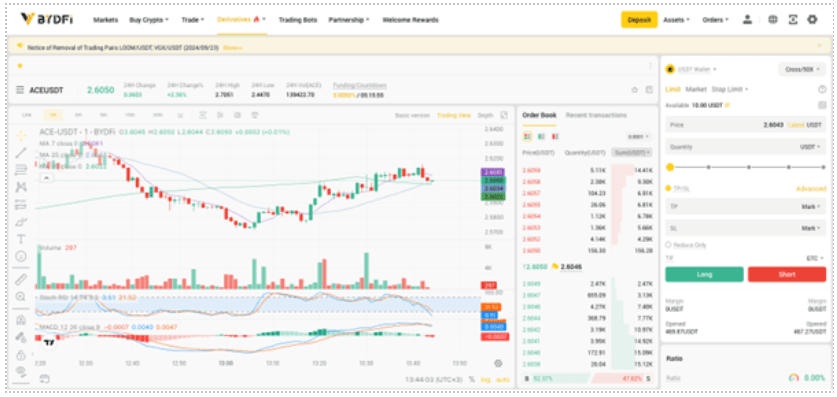

Founded in 2020 and headquartered in Singapore, BYDFi is a standout platform for crypto traders, now considered the best short-term crypto exchange in the Netherlands. Whether you’re a seasoned trader aiming for high leverage or just starting out, BYDFi has designed its platform to accommodate both ends of the spectrum. It has listed over 400 cryptocurrencies and allows for 200x leverage in derivatives trading, making it a strong choice for those who want to push the limits of their trading strategies.

BYDFi has you covered with customizable risk management tools like stop-loss, take-profit, and trailing stop orders. It’s a strong option for those seeking a crypto exchange with trailing stops and other flexible trading options.

One of the platform’s key strengths is bot trading, where you can automate your trades without needing to constantly monitor the markets. If you’re interested in a futures trading platform for crypto, BYDFi’s perpetual contracts are highly recommended. For Dutch traders, it’s hard to beat a platform that combines such low fees with advanced trading features and strong security protocols.

Key features

- 200x Leverage: Perfect for high-stakes traders who want to magnify their positions and take on more market exposure.

- 400+ Cryptocurrencies: Access to a wide variety of digital assets including Bitcoin, Ethereum, and many altcoins.

- Bot Trading: Automate your trades with BYDFi’s built-in bot functionality, making it easier to implement strategies without manual intervention.

- Low Trading Fees: Spot trading fees range from 0.1% to 0.3%, while perpetual contracts start at 0.02% (maker) and 0.06% (taker), making it one of the lowest fee crypto platforms.

- Third-Party Fiat Payment Options: Convert fiat to crypto easily with services like Banxa and Transak, though fiat withdrawals aren’t supported.

- Cold Storage: Most user funds are kept in cold storage, providing a high level of protection against potential security breaches.

Pros

Pros

- Advanced Charting Tools: BYDFi’s platform integrates sophisticated charting features, including real-time market data and customizable indicators, allowing traders to perform in-depth technical analysis directly from the platform.

- Lightning-Fast Execution: The platform is built on an advanced trade aggregation engine programmed in the kdb+ language, often used in high-frequency trading. This ensures minimal latency, so orders get executed with top-tier speed, crucial for day traders and scalpers.

- Customizable Risk Management: With features like Stop-Loss, Take-Profit, and Trailing Stop orders, BYDFi gives traders the flexibility to fine-tune their risk management strategies, protecting gains while minimizing potential losses.

- Mobile Trading: The BYDFi mobile app isn’t just a trimmed-down version of the desktop platform. It provides a full range of features including spot trading, derivatives, and bot trading, so you can manage your portfolio on the go with ease.

- 24/7 Customer Support: BYDFi offers round-the-clock customer service with both automated and manual support options, which is a huge plus if you ever hit a snag, regardless of your time zone.

- Privacy Options: While KYC is required for full access, BYDFi does allow for limited trading without full KYC, offering a degree of privacy for users who prefer to keep their personal information to a minimum.

Cons

- No Direct Fiat Withdrawals: While you can deposit fiat via third-party services, withdrawals are limited to crypto assets only.

- Limited Educational Resources: BYDFi doesn’t offer much in the way of tutorials or guides for beginners.

2. Phemex review

Phemex has earned the spot as the second best margin trading platform for crypto in the Netherlands for serious traders thanks to plenty of different trading options such as derivatives, spot, and fiat on-ramps. Launched in 2019 by a team of ex-Wall Street executives, Phemex aims to deliver institutional-level trading to the masses.

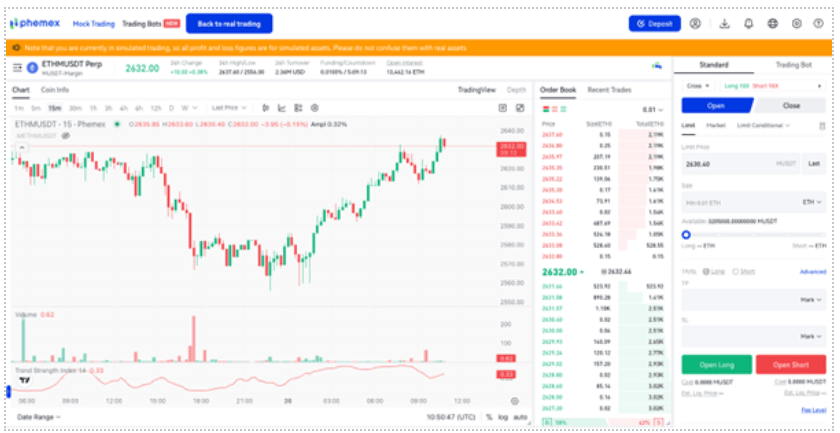

With up to 100x leverage, Phemex is perfect for those looking to maximize their positions with minimal capital. The platform stands out for its user-friendly interface, built on TradingView charts, which allows for detailed market analysis and precise trade execution. While it requires KYC for most of its features, it’s still highly secure, offering cold wallet storage for all deposits.

Constant feedback from users ensures regular updates, making Phemex a platform that evolves with its community. If you’re looking for a versatile and powerful trading experience, Phemex is definitely one to consider.

Key features

- 100x Leverage: Maximize your exposure with up to 100x leverage on BTC/USD, ideal for those who thrive on high-risk, high-reward trading strategies.

- KYC for Basic Features: Trade with ease and good privacy.

- TradingView Integration: Full access to advanced charting tools, multiple timeframes, and custom indicators to perform in-depth technical analysis.

- Sub-Account Isolation: Manage multiple strategies simultaneously by isolating different trades within separate sub-accounts.

- Zero Deposit Fees: Deposit crypto without worrying about fees eating into your capital, making it more cost-effective for frequent traders.

- Cold Wallet Security: Keep your assets secure with Phemex’s Hierarchical Deterministic Cold Wallet System, which aggregates deposits into a multi-signature cold wallet.

- Bonus Programs: Earn up to $4,100 in bonuses for completing tasks like your first deposit and social media shout-outs.

Pros

- High Leverage Options: The ability to trade with up to 100x leverage on major pairs, providing opportunities for experienced traders to maximize gains.

- Fast and Responsive: Built to handle high-frequency trading without lag or system downtime, even in volatile markets.

- User-Driven Updates: Phemex continuously improves its platform based on community feedback, such as adding new trading pairs.

- Comprehensive Risk Management: Advanced tools like stop-loss, take profit, and trailing stops help traders manage risk in real-time.

- Low Trading Fees: Competitive maker and taker fees (-0.025% and 0.075%), making it attractive for active traders.

Cons

- Limited Fiat Support: You can’t directly trade fiat on Phemex—you’ll need to deposit cryptocurrency first.

- Withdrawal Delays: Bitcoin withdrawals can be slower due to the cold wallet system, which processes requests a few times per day.

- No Options Trading: While it excels in perpetual contracts, Phemex currently lacks options trading, which could be a drawback for some traders.

3. BTCC review

BTCC ranks as the third best trading platform in the Netherlands in our list, thanks to its long-standing reputation and a whopping 225x leverage through their futures trading pit making it a great place to trade crypto contracts. Founded in 2011, BTCC is one of the oldest cryptocurrency exchanges in the market, which has helped it build trust and reliability over the years.

Originally based in Shanghai, it now operates from Hong Kong, serving a global audience. BTCC is especially favored by traders who prioritize security and stability, with most user funds stored in cold storage.

While its cryptocurrency selection is more limited than some competitors, its focus on major coins like Bitcoin, Ethereum, and Litecoin, combined with advanced trading tools, makes it a top choice for Dutch traders looking for a reliable platform with strong liquidity.

Additionally, the platform’s USD-centric approach makes it ideal for those who primarily trade in fiat currencies. It also stands as one of the top non-KYC US crypto exchanges.

Overall, BTCC stands as a solid choice for those in the Netherlands who want to access a reliable European crypto exchange with high leverage.

- OCO (One Cancels Other) Orders: Set up two concurrent orders, and when one is fulfilled, the other automatically cancels.

- Multi-Purpose Wallet (Mobi): A wallet supporting multiple currencies with a focus on security and utility.

- High Liquidity: BTCC boasts a large pool of liquidity, especially in Bitcoin and Ethereum markets.

- USD as Primary Fiat: Deposits and withdrawals are mainly handled in USD, making it a go-to platform for USD-based traders.

- Mobile Application: Offers a streamlined mobile app experience, supporting on-the-go trading.

- Cold Storage: User funds are kept in cold storage for enhanced security against online threats.

- Comprehensive KYC Verification: Mandatory KYC ensures regulatory compliance and boosts security for users.

Pros

- Established Trust: Over a decade in the industry, maintaining a clean record with no significant security breaches.

- High Leverage Trading: Offers up to 225x leverage on futures contracts, ideal for high-risk, high-reward traders.

- Seamless EUR Integration: Great for users who prefer or need to trade using EUR as their main fiat currency.

- Advanced Order Types: With OCO and other sophisticated trading tools, the platform caters to experienced traders.

- Consistent Support: Reliable customer service via multiple channels, including email, web form, and FAQs.

Cons

- Limited Cryptocurrency Selection: BTCC only supports around 10 major cryptocurrencies, leaving altcoin enthusiasts looking elsewhere.

- High Withdrawal Fees: A withdrawal fee of 0.0015 BTC, which can add up for users frequently moving funds off-platform.

- Restricted Fiat Options: Heavy reliance on USD, with fewer options for other major fiat currencies.

- China’s Regulatory Influence: Although BTCC is now based out of Hong Kong, its historical ties to China can leave some traders wary of future regulatory disruptions.

4. Binance review

For Dutch traders, Binance stands as one of the best altcoin trading platforms in the Netherlands with over 600 cryptocurrencies supported and 1,200+ trading pair. Its massive liquidity ensures that trades get executed quickly, even during volatile market swings, making it an great exchange for crypto scalping and high-frequency trading strategies according to our crypto specialist Ben.

Founded in 2017 by Changpeng Zhao (CZ), Binance has become a global powerhouse in the crypto exchange space. It offers everything from spot and margin trading to highly leveraged futures contracts—up to 125x—making it an ideal platform for both casual and professional traders.

Binance doesn’t just cater to the experienced trader—it also provides tools and educational resources like Binance Academy, allowing users to sharpen their skills. And with its 0.1% maker/taker fees, along with a 25% discount for BNB holders, you’ll find it hard to beat the cost-effectiveness of this platform. But perhaps the best part? Binance’s vast liquidity ensures you won’t be stuck waiting for your orders to fill, even during the most volatile market swings.

Key features

- Advanced Trading Interface: Supports spot, margin, and futures trading with up to 125x leverage, giving traders a wide range of options to optimize their strategies.

- Over 389 Cryptocurrencies: A massive selection of altcoins for traders looking to go beyond just Bitcoin and Ethereum.

- BNB Fee Discount: Holders of Binance Coin (BNB) get a 25% reduction in trading fees, which is particularly useful for high-frequency traders looking for the fastest crypto trading software.

- TradingView Integration: Full support for TradingView charts, giving traders access to advanced technical analysis tools.

- SAFU Fund: A $1 billion Secure Asset Fund for Users (SAFU) that acts as an insurance policy in case of hacks or security breaches.

- Binance Earn: Staking, dual investment, and mining pools that allow users to earn passive income on their crypto holdings.

- P2P Trading: Peer-to-peer trading with an escrow service, supporting over 100 fiat currencies and 800+ local payment methods.

- Regulatory Compliance: Registered and licensed in key European markets like France and Spain, making it a safer option for Dutch traders.

Pros

- High Liquidity: Binance handles billions in daily trading volume, which means trades get executed fast with minimal slippage—a major advantage for Dutch traders working with altcoins and high-frequency strategies.

- Competitive Fees: The standard 0.1% maker/taker fees are among the lowest in the market, and the BNB discount sweetens the deal.

- Cutting-Edge Security: Beyond standard two-factor authentication (2FA), Binance employs advanced tools like address whitelisting, anti-phishing codes, and machine-learning algorithms to detect unusual activity.

- Educational Resources: Binance Academy offers tutorials, articles, and videos covering everything from basic crypto concepts to advanced trading techniques.

- Multiple Trading Modes: Whether you’re a beginner using the “Simple” trading interface or a pro leveraging futures and options, Binance offers interfaces tailored to all levels of traders.

Cons

- Overwhelming for Beginners: While the platform offers a lot, the sheer volume of features and tools can be intimidating for those just starting in crypto trading. The “Simple” mode helps, but diving into the advanced tools can be daunting.

- Limited Fiat Withdrawal Methods: Certain countries, including the Netherlands, may find the options for withdrawing fiat somewhat restrictive.

- Ongoing Legal Scrutiny: Binance’s legal battles, particularly in the U.S. and other regulatory jurisdictions, can cause uncertainty.

5. MEXC review

If you’re serious about crypto trading in the Netherlands, MEXC is a platform you’ll want to consider. Founded in 2018, it has quickly become one of the go-to exchanges for traders seeking a wide range of assets and advanced trading features. With over 2300 coins and 2800+ trading pairs, MEXC caters to those who want variety and flexibility.

It’s particularly popular for its high leverage in futures trading—up to 200x—and ultra-low fees, with 0% maker fees and just 0.01% taker fees for futures contracts. With its crypto derivatives trading software support, MEXC, can be used at very high levels of trading and at very low rates.

What’s more, MEXC doesn’t require KYC, meaning you can trade anonymously up to 10 BTC in daily withdrawals without verifying your identity. Whether you’re in it for the spot market or looking to trade with leverage, MEXC is built to handle it all with ease.

Key features

- 2300+ cryptocurrencies: Access one of the largest selections of coins on the market, including niche altcoins and tokens.

- Up to 200x leverage: Provides a high-risk, high-reward futures trading environment for advanced traders.

- 0% maker fees: Trade without incurring any maker fees on both spot and futures markets.

- No KYC: Trade anonymously with a 10 BTC daily withdrawal limit, perfect for privacy-focused traders.

- Advanced charting: TradingView integration allows you to analyze the markets with professional-grade tools.

- Cold storage: Most user funds are kept offline to protect against hacks.

- API access: Ideal for developers or traders using automated bots.

Pros

- Deep liquidity pools: MEXC offers excellent liquidity for top trading pairs, which means faster executions and tighter spreads—key for day traders and scalpers.

- Customizable order types: Beyond just basic market and limit orders, MEXC provides advanced order types like trailing stop orders and post-only orders, giving traders more control over execution.

- Detailed market insights: MEXC features granular market data, including real-time order book depth, helping traders make more informed decisions.

- Security layers beyond 2FA: In addition to two-factor authentication, MEXC includes withdrawal address whitelisting and an anti-phishing code, offering multi-layered protection against unauthorized access.

- Token staking and earning: Earn passive income by staking various tokens directly on the platform, with flexible and fixed options.

- Futures bonus programs: Participate in events like Futures M-Day, where you get reduced fees and bonus rewards for high-volume trading.

Cons

- Limited fiat on-ramps: MEXC focuses on crypto-to-crypto trading, with fewer fiat deposit options compared to other major platforms.

- Geographically restricted: Services are unavailable in several regions, including the U.S., due to regulatory concerns.

- No DeFi or Web3 integrations: While powerful in traditional trading, MEXC lacks decentralized finance (DeFi) or NFT trading capabilities.

- Steep learning curve: Its advanced tools are great for experienced traders but could be overwhelming for beginners, and there’s limited educational content available.

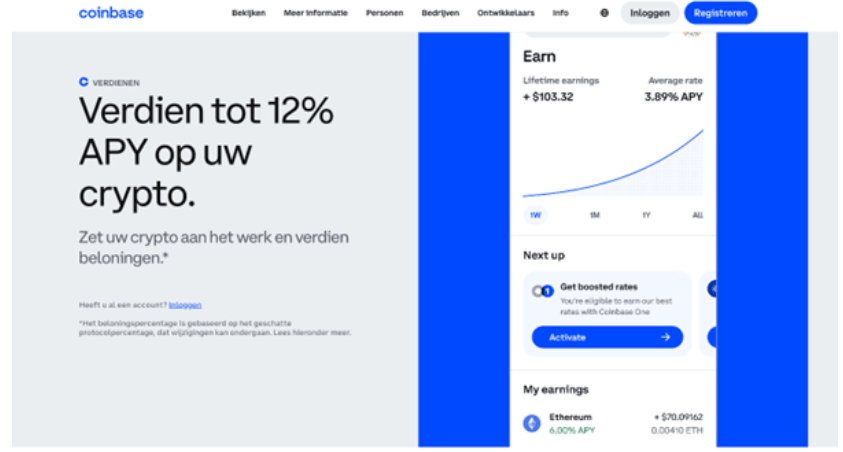

6. Coinbase review

Coinbase is not just the largest U.S.-based cryptocurrency exchange—it’s also one of the best platforms available for Dutch traders. Offering access to over 200 cryptocurrencies, Coinbase combines ease of use with powerful features that cater to both beginners and advanced traders alike. With funds held 98% in cold storage and a robust insurance policy, Coinbase stands out as one of the most safe and secure crypto exchanges available in the Netherlands.

Coinbase is not just the largest U.S.-based cryptocurrency exchange—it’s also one of the best platforms available for Dutch traders. Offering access to over 200 cryptocurrencies, Coinbase combines ease of use with powerful features that cater to both beginners and advanced traders alike. With funds held 98% in cold storage and a robust insurance policy, Coinbase stands out as one of the most safe and secure crypto exchanges available in the Netherlands.

What makes Coinbase stand out in the Netherlands? Two major reasons: its regulatory compliance and industry-leading security. With funds held predominantly in cold storage and a robust insurance policy to protect against cybersecurity threats, Coinbase ensures your assets are kept safe while staying compliant with Dutch and European regulations. If you’re trading from a different region, Coinbase is also a strong platform for those looking to trade crypto in the USA.

It also offers features suitable for traders in Canada, as well as Europe, providing some of the most efficient crypto trading softwares in Canada for traders looking to execute rapid trades and manage their portfolios efficiently.

For more advanced users, Coinbase Advanced Trade offers granular control over orders and comprehensive charting tools, while beginners benefit from the platform’s intuitive interface. Whether you’re executing your first trade or managing a complex portfolio, Coinbase has the features to back you up every step of the way.

Key features

- Advanced Trade Platform: Granular control with limit, market, and stop orders, paired with in-depth order books and TradingView integration.

- Crypto-to-Crypto Trading Pairs: Access to over 400 trading pairs.

- Cold Storage: Approximately 98% of customer funds are stored offline, ensuring maximum protection against hacks.

- Instant Withdrawals: Fiat-to-crypto purchases allow immediate withdrawal of your digital assets.

- Coinbase One: Zero trading fees on up to €10,000 in volume per month, along with premium customer support.

- Staking and Rewards: Earn up to 10% on supported cryptocurrencies through staking directly on the platform.

- Insured Funds: Crime insurance that covers digital assets held in Coinbase’s storage systems in the event of a breach.

- Educational Resources: The “Learn to Earn” program incentivizes users with crypto rewards for completing educational modules.

Pros

- Regulatory Compliance: Fully aligned with Dutch and EU regulations.

- Wide Range of Assets: Access to over 200 cryptocurrencies, with frequent updates and new listings.

- Top-Tier Security: Cold storage, two-factor authentication, and biometric logins.

- Instant Liquidity: Fast crypto withdrawals, with no waiting period for fiat-to-crypto purchases.

- Comprehensive Data: Advanced charting tools and order book transparency provide all the data you need for precise trading strategies.

- Seamless Integration: Coinbase Wallet offers easy connectivity for decentralized finance (DeFi) activities, NFTs, and other blockchain services.

Cons

- High Transaction Fees: Standard trading fees on Coinbase are notably higher than competitors.

- Subscription Model: Coinbase One offers fee reductions but comes at a cost (€30/month).

- Regulatory Scrutiny: Ongoing legal challenges, particularly with the SEC, introduce an element of uncertainty regarding its long-term operations, though Coinbase remains compliant within the Netherlands.

- Limited Control in Staking: While staking is offered, there is limited flexibility in how long assets are staked and under what conditions.

What makes a crypto exchange suited for Dutch traders

When selecting a crypto exchange tailored to the Dutch market, there are several key factors to consider. First and foremost is regulatory compliance—the exchange must adhere to Dutch and EU regulations, ensuring legal trading and protection of assets. Exchanges like Coinbase and Binance, for example, are fully licensed in key European jurisdictions, offering peace of mind.

Next is fiat compatibility. An ideal platform will support easy EUR deposits and withdrawals, which reduces friction when moving funds in and out of the exchange. Additionally, strong liquidity is crucial, especially in volatile markets. Dutch traders benefit from platforms with high trading volumes, ensuring that buy and sell orders are executed quickly, even during market turbulence.

Security features cannot be overlooked—cold storage, multi-signature wallets, and crime insurance are essential. Lastly, ease of use is vital for both beginners and advanced users, with comprehensive charting tools and mobile trading options providing flexibility and control at every level of trading.

How to select a platform and get started

Choosing the right crypto platform isn’t just about picking the one with the lowest fees or the most coins—it’s about finding the best fit for your trading goals, security needs, and user experience. Here’s a step-by-step guide to help you get started:

- Define Your Trading Objectives

Are you focused on day trading with leverage, long-term investing, or exploring altcoins? Knowing this will guide you toward the right platform. - Research Security Features

Look for platforms that offer cold storage, 2FA, and insurance. Binance’s SAFU fund or Coinbase’s insurance policy ensures peace of mind for Dutch traders. - Compare Fees

High-volume traders should focus on platforms with low maker/taker fees like Binance or MEXC. Be aware of extra costs like withdrawal fees, especially if you trade frequently. - Check Fiat Support

If you plan to deposit or withdraw in EUR, make sure the platform supports seamless fiat transactions. BTCC and Coinbase offer good fiat options, while some platforms like MEXC are more crypto-focused. - Compare Fees

High-frequency traders should go for platforms with low maker/taker fees, like Binance or MEXC. Be mindful of hidden costs like withdrawal fees. - Test the Interface

A good UI can make a huge difference. Try demo accounts or tutorials to see if the platform feels intuitive. - Create an Account

Visit the platform’s website and sign up with your email or phone number. Most exchanges will require KYC for full access, so have your ID ready if needed. - Deposit Funds

Add funds via bank transfer, credit card, or crypto deposit. Some platforms, like Coinbase, offer easy fiat-to-crypto conversions, while others may require third-party payment processors. - Start Trading

Explore the platform’s interface—whether you’re using basic buy/sell options or advanced tools like limit and stop-loss orders. Test out smaller trades to get comfortable. - Secure Your Account

Enable 2FA, set up withdrawal whitelisting, and use strong passwords to keep your account secure. - Withdraw Funds

If you’ve completed a successful trade, you can withdraw either in crypto or fiat (depending on the platform), using cold wallet storage for extra security when withdrawing crypto.

By following this list, you’ll have everything in place to start trading crypto confidently on the platform best suited for you.

What are the biggest risks for Dutch crypto traders?

Trading cryptocurrency in the Netherlands presents several risks that every trader should be aware of. From regulatory challenges to technical pitfalls, here’s a detailed breakdown of what you need to watch out for:

- Key regulations: Evolving European regulations, especially MiCA, could impose stricter compliance on exchanges, affecting KYC requirements and asset listings. Sudden changes may lead to asset freezes or withdrawal delays.

- Volatile days: Price swings can trigger margin calls or liquidations, especially in high-leverage positions. Low liquidity can amplify risks through significant slippage on larger orders.

- On platform risks: Despite cold storage, hot wallets remain vulnerable to hacks and phishing attacks. Traders are also at risk from social engineering and malware targeting private keys. Use hardware wallets and MFA for protection.

- Liquidity crunch: Trading smaller altcoins or on lesser-known exchanges can lead to higher spreads and slippage, negatively impacting trade outcomes.

- Network congestion: During peak times, blockchain networks can become congested, leading to delays and higher transaction costs, particularly on Ethereum.

- Exchange solvency risks: Some exchanges lack financial stability. Traders should verify platforms’ Proof of Reserves to ensure solvency during market stress.

- Human error: Mistakes like sending funds to the wrong address or losing private keys can result in permanent losses, with no central authority to recover them.

- Technical failures: Platform outages, wallet bugs, or smart contract issues can prevent access to funds or disrupt trading at crucial moments.

In summary, Dutch crypto traders need to stay vigilant, regularly assess platform risks, and utilize robust risk management strategies, including keeping funds off exchanges whenever possible.

Is crypto legal in the Netherlands?

Yes, cryptocurrency is legal in the Netherlands, but it operates under strict regulation. The Dutch Central Bank (DNB) oversees crypto exchanges and wallet providers, requiring them to register and comply with anti-money laundering (AML) laws and Know Your Customer (KYC) guidelines. While there are no laws banning crypto trading or ownership, platforms must adhere to the Dutch Financial Supervision Act (Wft), which aims to prevent fraud and illegal activities. However, cryptocurrencies are not considered legal tender, and the government does not provide consumer protection for crypto transactions, so it’s essential to trade carefully.

Pros and cons of trading crypto

Pros:

- 24/7 Market Access: Unlike traditional financial markets, crypto never sleeps, allowing traders to capitalize on price movements at any hour, any day.

- Decentralization: Many cryptocurrencies operate on decentralized networks, reducing reliance on central authorities and offering peer-to-peer transactions.

- High Volatility: Crypto markets can experience significant price swings, which provides opportunities for large profits—especially for day traders and scalpers.

- Global Accessibility: With crypto, anyone with internet access can trade, making it more inclusive and accessible than traditional financial systems.

- Innovative Financial Instruments: From staking to yield farming, crypto offers various ways to earn passive income while holding assets.

- Blockchain Transparency: Every transaction is recorded on the blockchain, ensuring transparency and traceability across the network.

- Fractional Ownership: You don’t need to buy a whole Bitcoin or Ethereum—crypto allows for fractional ownership, so you can invest with any amount.

Cons:

- Market Volatility: The same volatility that offers profit potential also brings a high level of risk, with prices often experiencing sharp and sudden declines.

- Regulatory Uncertainty: Regulations around crypto are constantly evolving, and unclear legal frameworks can make it risky for traders, especially in regions like the Netherlands.

- Security Risks: Despite advancements, crypto exchanges remain targets for hackers, and individuals can lose funds if they don’t secure their private keys.

- Limited Consumer Protections: Unlike traditional banks, crypto transactions are irreversible, and there’s no recourse if your funds are lost or stolen.

- Complex Fee Structures: Some exchanges, especially when trading with leverage or specific tokens, have intricate fee models that can eat into profits.

- Liquidity Risks: For lesser-known altcoins, low liquidity can make it difficult to execute large trades without significantly affecting the price.

- Steep Learning Curve: Understanding blockchain technology, market analysis, and different financial instruments can be overwhelming for newcomers, requiring extensive research and education.

FAQs

Do I need to pay taxes on crypto gains in the Netherlands?

Yes, crypto is considered an asset in the Netherlands, and profits must be reported as part of your wealth under Box 3 in the Dutch tax system.

What’s the best crypto exchange for privacy if I don’t want to do KYC?

BYDFi and MEXC offer limited trading without KYC, but keep in mind that full features often require verification for compliance.

Can I trade with leverage on crypto exchanges in the Netherlands?

Yes, several exchanges, like BYDFi and Phemex, offer high leverage trading, with some platforms supporting up to 200x leverage on derivatives.

Which Dutch banks support crypto deposits and withdrawals?

Banks like ING and ABN AMRO generally allow transfers to regulated crypto exchanges, but always check with your bank for specific policies.

How do I pick a crypto exchange with low fees?

Look for exchanges like Binance and MEXC, which offer competitive maker/taker fees, and consider holding platform tokens like BNB for discounts.

Can I stake crypto on Dutch exchanges?

Yes, platforms like Coinbase and Binance offer staking options where you can earn rewards by locking your coins for a set period.

Is it safe to store my crypto on an exchange?

While most exchanges offer cold storage, it’s best to use a hardware wallet for long-term storage to minimize the risk of hacks.

How do I minimize the risks of trading crypto with high leverage?

Always use risk management tools like stop-loss and take-profit orders, and only trade with leverage if you fully understand the risks involved.

Which exchange offers the widest range of altcoins for Dutch traders?

Binance and MEXC offer access to a massive range of altcoins, with thousands of trading pairs available.

Conclusion

If you’re a crypto trader in the Netherlands, finding the right exchange can make all the difference between a smooth trading experience and unnecessary headaches. Whether you’re all about high-stakes day trading with BYDFi’s 200x leverage or prefer a more secure and user-friendly platform like Coinbase, there’s something here tailored for you. If you’re the type who loves diving into a vast pool of altcoins, Binance is your playground with its massive selection and competitive fees. MEXC is by far the most cost-effective platform and has also branched out to different regions and is not one of the go-to crypto platforms in Singapore.

By now, you should have a clearer idea of which platform matches your style, goals, and risk appetite. The key is picking a platform that not only meets your trading needs but also makes you feel confident in the security of your assets. Trading in crypto is fast-paced and ever-changing, but with the right exchange, you’ll be well-equipped to navigate the twists and turns. Ready to take your crypto game to the next level? It’s time to get started on the platform that fits you best.