In this article, we’ll take a close look at the five safest and most secure crypto exchanges on the planet, breaking down their security features and why they stand out in an increasingly risky market. Whether you’re into futures trading platforms for crypto or you’re simply looking for a secure way to manage assets, finding the right platform is essential.

When it comes to trading Bitcoin and other altcoins, ensuring your assets are secure is just as important as finding the right platform for your needs. Unless your account has been hacked before and you have first-hand experience with a lack of safety, choosing a reliable exchange is key to protecting your funds from potential threats. For those who prefer a platform for crypto day trading, balancing speed and other tools together with security is just as important.

Today we’ll cover everything from encryption standards to two-factor authentication and we’ll go into why government regulations even matter. By the end, you’ll have a clear picture of what makes an exchange trustworthy, so you can trade confidently, knowing your assets are well-protected.

High-security crypto exchanges at a glance

- Best Wallet – Best-in-class non-custodial wallet for self-custody users, private keys stay fully user-controlled with advanced encryption.

- MEXC – High-liquidity exchange known for early token listings, fast execution, and strong cold-storage security practices.

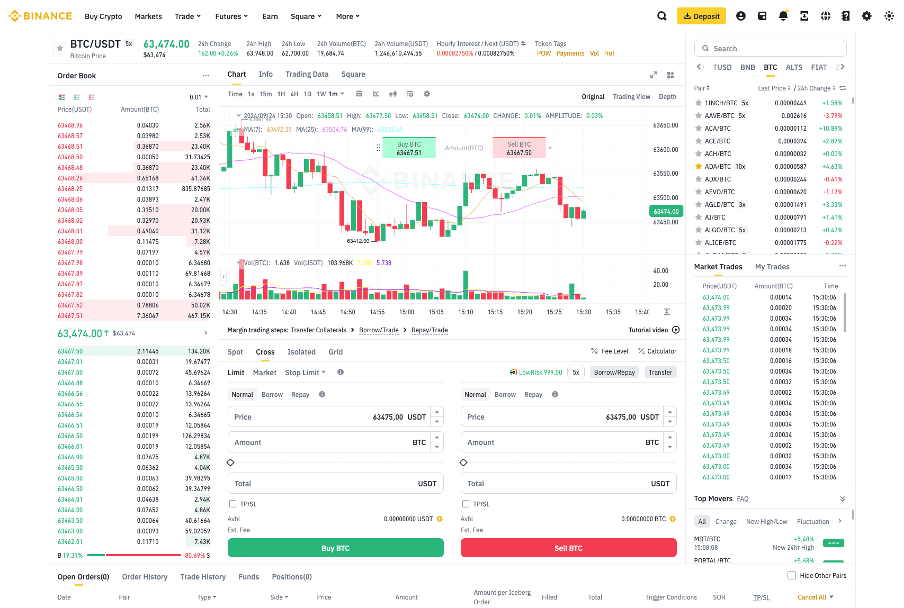

- Binance – Largest global exchange with deep liquidity, massive altcoin coverage, SAFU fund, and enterprise-grade security systems.

- Bitpanda – EU-regulated platform focused on secure, compliant investing with robust custody and transparency standards.

- Margex – Derivatives-focused platform emphasizing fund protection, fair pricing mechanisms, and cold-wallet asset storage.

(This article is not financial advice. Research before investing. Some links are affiliate links, earning us a commission without extra cost for you. Our content remains unbiased regardless of affiliates.)

If you’re into fast trading and need a crypto exchange for scalping, one of these high-security platforms will help you reduce risk while maximizing speed.

Key takeaways TL;DR

- These exchanges implement advanced security measures like multi-signature cold wallets, FIPS 140-2 HSMs, and post-quantum cryptographic signatures to safeguard your funds.

- From 225x leveraged futures on BTCC to Binance’s Secure Enclave-backed altcoin trading, each platform offers highly specialized trading tools tailored for all strategies.

- Best Wallet leads by removing custodial risk altogether through full self-custody and user-controlled private keys, while Binance follows with strict global KYC and AML compliance alongside incident-backed protection mechanisms for platform-wide security events.

Exchange comparison

If you only want to compare each exchange and the security features they offer, I’ve prepared a table below that includes all the features from the review:

| Security Feature | Best Wallet | MEXC | Binance | Bitpanda | Margex |

| Cold Storage | N/A (Self-custody) | Yes | Yes | Yes | Yes |

| Multi-Signature Cold Wallets | N/A | Yes | Yes | Yes | Yes |

| Self-Custody (User Controls Keys) | Yes | No | No | No | No |

| SSL Encryption | Yes | Yes | Yes | Yes | Yes |

| Two-Factor Authentication (2FA) | Yes | Yes | Yes | Yes | Yes |

| Withdrawal Whitelisting | N/A | Yes | Yes | Yes | Yes |

| Anti-Phishing Protection | User-controlled | Yes | Yes | Yes | Yes |

| No KYC for Core Usage | Yes | Yes (limits) | No | No | Yes |

| Regulatory Compliance (KYC/AML) | No | Partial | Yes | Yes | Partial |

| Penetration Testing & Audits | N/A | Yes | Yes | Yes | Yes |

| Advanced Risk Monitoring | N/A | Yes | Yes | Yes | Yes |

| Insurance / Protection Fund | No (Not applicable) | No | Yes (SAFU) | Limited | No |

| Biometric Access Support | Yes (Device-level) | No | Yes | Yes | No |

1. Best Wallet review

Best Wallet is the safest pick on this list for people who want maximum control, because it is a self-custody wallet. That matters, because your private keys stay with you, not a third party. For security-first users, this is the cleanest way to reduce custodial risk while still keeping access to swaps, dApps, and everyday crypto management.

In this review, we’ll break down why Best Wallet is built for users who treat security as the main feature, not an afterthought. We’ll cover the core protection layers you control directly, how to tighten your setup in minutes, and what trade-offs come with self-custody. By the end, you’ll know whether Best Wallet fits your risk tolerance, and how to use it safely without overcomplicating your routine.

Let’s break it down.

Key security features

When it comes to security, Best Wallet focuses on user-controlled protection:

- Self-custody key control: You control the keys and recovery method, so platform-level exchange hacks are not the same threat model.

- App-level encryption: Local device encryption protects sensitive wallet data, especially when paired with a secure device passcode.

- Biometric and device security support: Using biometrics and OS-level protections adds friction against unauthorized access.

- Transaction review flow: Clear signing and confirmation steps help reduce blind approvals and accidental sends.

- Phishing awareness fundamentals: Self-custody still depends on you avoiding fake sites, fake apps, and malicious approvals.

Pros

- True self-custody: You are not exposed to the same custodial failure risks as centralized platforms.

- Fast everyday usability: Designed for holding, sending, swapping, and connecting to Web3 tools.

- Security is user-configurable: You decide how strict your setup is, based on your own threat model.

- Works well for long-term holding: Especially if you separate a spending wallet from a cold storage strategy.

- No exchange account required: You can manage assets without opening a trading account on a centralized venue.

Cons

- You are the last line of defense: If you lose recovery access, there is no support desk that can reverse it.

Other features

Getting started is straightforward, but security depends on how you set it up. The smart move is to lock the device, enable biometric access, and store your recovery details offline. If you use the wallet for daily activity, keep only what you need in your “hot” balance and separate the rest into a long-term storage plan.

Best Wallet is also practical for managing multiple assets without needing an exchange login. That said, it is not a “set it and forget it” tool. If you click random links, sign unknown approvals, or install unofficial apps, you can still get wrecked. Used properly, though, it is one of the strongest security-first options available for mainstream users.

2. MEXC review

MEXC is a strong security-focused exchange for traders who care about liquidity and access to a wide range of listed assets. It is widely used for spotting new listings early and executing quickly, but the security story still comes down to fundamentals, account protection, custody practices, and user habits.

In this review, we’ll focus on the practical security layers that matter day to day. That includes account hardening, withdrawal protection, and safe operating habits that reduce the most common loss scenarios. If you want a platform where you can trade actively, but still want a tight security posture, this section will show you what to prioritize.

Key security features

- 2FA for account access: Enabling 2FA is the minimum baseline for exchange security.

- Anti-phishing protections: Email or message verification features help users spot fake communications.

- Withdrawal protection settings: Address controls and withdrawal confirmations reduce damage if credentials leak.

- Cold storage custody model: Exchanges typically keep a significant portion of user funds offline to reduce hot wallet exposure.

- Operational monitoring: Real-time monitoring and risk controls help flag suspicious logins and withdrawals.

Pros

- Strong liquidity for active trading: Easier execution when markets move fast.

- Broad asset coverage: Useful for traders who want access to many markets in one place.

- Security tools are there: 2FA, withdrawal controls, and anti-phishing features matter when configured correctly.

- Fast onboarding: Account setup is typically quick, but you should still harden security immediately.

Cons

- Custodial risk still exists: On any exchange, you are trusting the platform to custody funds safely.

- User misconfiguration is common: People skip 2FA and get drained, it is that simple.

Other features

MEXC is built for trading pace. You can run spot strategies, rotate into new listings, and manage multiple markets from one interface. The platform experience is the “speed plus variety” combo, but none of that matters if you treat security casually. The correct setup is 2FA on day 1, unique passwords, and withdrawal protections turned on before you fund the account.

If you want maximum safety, keep a working balance on the exchange and store the rest in self-custody, ideally Best Wallet or a hardware wallet. That single habit reduces the biggest risk profile most traders carry.

3. Binance review

If you want a platform that blends massive liquidity with a mature security stack, Binance remains one of the strongest options. It is used globally, supports a huge range of assets, and has built multiple safety layers around custody, account access, and suspicious activity detection.

This review focuses on why Binance is frequently chosen by users who want altcoin variety without ignoring safety. We’ll cover the security features that actually matter, plus the practical steps that reduce your risk the most. Because even on a top-tier platform, weak user security is still the easiest way to get compromised.

Key security features

- Two-Factor Authentication (2FA): Adds a critical barrier for logins and withdrawals.

- Cold wallet storage: A large portion of funds is typically kept offline to reduce hot wallet exposure.

- Withdrawal whitelists: Lets users restrict withdrawals to trusted addresses.

- Real-time risk controls: Monitoring systems help detect suspicious activity patterns.

- SAFU fund: A dedicated reserve designed to protect users in specific incident scenarios.

Pros

- Huge selection of cryptocurrencies: Strong coverage across majors and altcoins.

- Deep liquidity: Helpful during volatility when spreads can widen elsewhere.

- Solid user-side security controls: Whitelists, 2FA, and device protections improve safety when enabled.

- Advanced trading options: Spot, margin, futures, and tooling for active users.

Cons

- Feature-heavy interface: Beginners can feel overwhelmed at first.

- Still custodial: Keeping large balances on any exchange increases platform exposure.

Other features

Binance is packed with products, so you can trade, convert, earn, and manage positions without leaving the ecosystem. That convenience is real, but it can also cause sloppy behavior, like leaving more funds online than needed. The safest approach is to keep an active trading balance only, then move profits or long-term holdings to Best Wallet or cold storage.

If you configure 2FA, whitelist withdrawals, and treat email security seriously, Binance can be a strong “main exchange” option. If you skip those steps, the platform cannot save you from yourself.

4. Bitpanda review

Bitpanda is the cleanest security pick here for users who want a regulated, EU-first platform with a long-term investing mindset. It is built for people who prioritize compliance, straightforward usability, and a more traditional finance-style experience, rather than chasing maximum leverage or the newest listings.

In this review, we’ll focus on why Bitpanda works as a security-led on-ramp and portfolio hub. We’ll look at the account protection standards you should expect, the custody approach typical of regulated platforms, and the practical reasons this can be a safer fit for conservative users compared to high-risk trading venues.

Key security features

- Regulation-led operating model: A compliance-first approach generally means tighter controls and stronger internal processes.

- 2FA and login protection: Essential for preventing basic credential-based attacks.

- Custody safeguards: Platforms built for long-term investors typically focus heavily on secure custody operations.

- Secure data handling: Encryption and access controls help protect user information and transactions.

- Fraud and account monitoring: Detection systems help identify suspicious behavior early.

Pros

- Investor-first environment: Better fit for buying, holding, and managing a portfolio.

- Regulated, EU-focused positioning: Appeals to users who value compliance and transparency.

- Simple interface: Easier to use than many trader-heavy platforms.

- Good for fiat flows: Typically positioned as a smoother fiat on-ramp and off-ramp experience.

Cons

- Not built for high-risk trading: Active derivatives traders may prefer a different platform.

- Custodial by design: Like any custodial platform, it is not the same as self-custody security.

Other features

Bitpanda is best used as a secure, regulated base for building positions over time. It fits users who want clarity, smoother fiat support, and a more traditional investing flow. The security posture is strongest when you still apply the basics: 2FA, unique passwords, and strict device security.

For maximum protection, some users combine Bitpanda for fiat and portfolio tracking, then self-custody long-term holdings in Best Wallet. That split reduces exchange exposure while keeping the convenience of a regulated platform.

5. Margex review

Margex is a derivatives-first platform aimed at traders who want a clean futures experience without a bloated interface. From a security perspective, the fundamentals matter more than anything else: account hardening, withdrawal protections, and keeping only your working balance on-platform.

In this review, we’ll look at Margex from a practical safety angle. We’ll highlight what you should enable immediately, how to reduce the most common loss scenarios, and how to use the platform without taking unnecessary custodial risk. If you trade futures, security is not optional, because one compromise can wipe out your margin in minutes.

Key security features

- 2FA and secure login: The basic requirement for any trading account.

- Withdrawal confirmation controls: Reduces the risk of fast drains after account compromise.

- Cold storage custody model: Exchanges generally rely on offline storage to reduce hot wallet vulnerability.

- Risk controls and monitoring: Helps detect suspicious account behavior and unusual access patterns.

- Operational security practices: Security is also about process, access control, and incident response readiness.

Pros

- Futures-focused experience: Cleaner workflow for active derivatives traders.

- Security depends on user controls: 2FA and withdrawal protections make a real difference.

- Good for active risk-managed trading: Works best when you treat it like a trading venue, not a bank.

Cons

- Custodial exposure: Futures trading still requires keeping funds on the platform.

- High-risk product category: Derivatives amplify mistakes, including security mistakes.

Other features

Margex is best used with strict discipline: deposit what you need, trade, then withdraw profits to Best Wallet or another self-custody solution. The platform can offer a smooth futures workflow, but you should not treat it as long-term storage. Derivatives platforms are for execution, not safekeeping.

If you combine proper account security, strict device hygiene, and small on-platform balances, Margex can fit a futures strategy without exposing your entire stack.

What are the biggest security risks with crypto?

When it comes to crypto, security risks can come at you from all angles. Here’s a breakdown of the most common and serious threats:

- Exchange hacks: Cybercriminals exploit vulnerabilities in exchanges to steal funds. The Mt. Gox hack in 2014 saw 850,000 BTC stolen, worth over $450 million.

- Phishing attacks: Hackers create fake websites or emails to trick users into providing login credentials. In 2022, phishing accounted for 22% of all crypto scams.

- Hot wallet vulnerabilities: Hot wallets, which are connected to the internet, are much more susceptible to hacking compared to offline cold wallets.

- Insider threats: Bad actors within exchanges can misuse access to sensitive information, like the $530 million Coincheck hack in 2018.

- Smart contract vulnerabilities: Poorly written code can lead to exploits, as seen in the $60 million DAO hack in 2016.

- Rug pulls: Developers abandon projects after collecting investor funds, leaving users with nothing.

- Man-in-the-middle attacks: Hackers intercept communications between users and exchanges, compromising transaction data.

- Lack of regulatory oversight: Some exchanges may not follow stringent security protocols, exposing users to fraud and theft.

If you choose any of the platforms listed above and you also follow basic safety habits, you can materially reduce your exposure to phishing, hot wallet hacks, exchange compromise, and weak account security.

What are the biggest security risks with crypto?

When it comes to crypto, security risks can come at you from all angles. Here’s a breakdown of the most common and serious threats:

- Exchange hacks: Cybercriminals exploit vulnerabilities in exchanges to steal funds. The Mt. Gox hack in 2014 saw 850,000 BTC stolen, worth over $450 million.

- Phishing attacks: Hackers create fake websites or emails to trick users into providing login credentials. In 2022, phishing accounted for 22% of all crypto scams.

- Hot wallet vulnerabilities: Hot wallets, which are connected to the internet, are much more susceptible to hacking compared to offline cold wallets.

- Insider threats: Bad actors within exchanges can misuse access to sensitive information, like the $530 million Coincheck hack in 2018.

- Smart contract vulnerabilities: Poorly written code can lead to exploits, as seen in the $60 million DAO hack in 2016.

- Rug pulls: Developers abandon projects after collecting investor funds, leaving users with nothing.

- Man-in-the-middle attacks: Hackers intercept communications between users and exchanges, compromising transaction data.

- Lack of regulatory oversight: Some exchanges may not follow stringent security protocols, exposing users to fraud and theft.

If you choose any of the above exchanges that we have listed, you can be sure to avoid some of the most common risks such as smart contract vulnerabilities, hot wallet hacks, insider threats, phishing attacks, exchange hacks, rug pulls, and the lack of exchange regulation.

What makes a crypto exchange secure?

A secure crypto exchange is built on a foundation of multiple security features, ensuring protection against various threats. Beyond encryption and 2FA, advanced measures such as multi-signature wallets come into play. These wallets require multiple private keys to authorize transactions, significantly reducing the risk of unauthorized access. For example, BitGo uses multi-signature technology to enhance security.

Next, we have withdrawal whitelist features. This allows users to specify trusted wallet addresses for withdrawals, preventing unauthorized transfers even if an account is compromised. Exchanges like BYDFi and Binance offer this feature, adding another layer of protection.

Anti-phishing mechanisms are also critical. Many platforms provide unique anti-phishing codes to help users identify official communications and avoid scams. Additionally, regular security audits by third-party firms ensure that reputable exchanges maintain up-to-date defenses against vulnerabilities.

Finally, self-custody solutions like Best Wallet reduce exposure to exchange-level breaches by keeping private keys under user control, while insurance policies on some centralized exchanges can protect user funds in unlikely breach scenarios.

How does government regulation play a role in safety?

Government regulation plays a vital role in protecting traders by enforcing strict compliance standards on centralized platforms. If you are using a regulated exchange like Binance or Bitpanda, KYC and AML requirements ensure users are verified, which significantly reduces fake accounts and fraud. In contrast, self-custody solutions like Best Wallet enhance security by removing platform-level control entirely, meaning users retain full authority over their assets without relying on an intermediary to safeguard funds.

And here’s where the distinction really matters. In the event of a hack, regulated exchanges may rely on insurance or protection funds to cover certain platform-wide incidents. By contrast, self-custody solutions like Best Wallet avoid this risk altogether by ensuring users retain full control over their private keys. Since assets are not held by a centralized platform, there is no pooled fund to breach, reducing exposure to large-scale exchange hacks that have historically impacted custodial platforms.

So, while privacy is important to some, regulation gives you that added layer of security and peace of mind that your assets are protected.

Security breaches in the history of crypto: Lessons learned

Crypto’s history is filled with security breaches that taught the industry hard lessons. I’ve added some of the most memorable lessons learned below:

Mt. Gox Hack (2014):

One of the largest breaches in crypto history, Mt. Gox lost 850,000 BTC, worth around $450 million at the time. The hack exposed major vulnerabilities in hot wallet management and the lack of internal controls. The incident led to the eventual collapse of the exchange, underscoring the importance of secure cold storage and proper auditing practices.

Bitfinex Hack (2016):

Bitfinex, a popular exchange, lost 119,756 BTC—worth about $72 million at the time—due to a vulnerability in their multi-signature wallets. The funds were never fully recovered, but the exchange introduced a robust security overhaul, including improved multisig wallets and a comprehensive insurance program.

Binance Hack (2019):

Binance lost 7,000 BTC in a coordinated attack exploiting API keys and bypassing 2FA. Binance responded swiftly, compensating users through its SAFU (Secure Asset Fund for Users) and implementing stronger security protocols like AI-based threat detection.

KuCoin Hack (2020):

Hackers stole over $275 million in tokens from KuCoin due to compromised private keys. Quick action by the team recovered most of the funds, but it highlighted the need for better key management and instant user alerts.

How to choose an exchange

Choosing a secure crypto exchange is all about paying attention to the right details. Two-factor authentication (2FA) is one of the most critical security features to look for when choosing an exchange. It adds an additional step to the login process beyond just your password.

For example, platforms like Binance use time-based one-time passwords, typically through apps such as Google Authenticator or Authy. When logging in or confirming sensitive actions, users must enter a rotating code that refreshes every 30 seconds, making unauthorized access far more difficult even if a password is compromised. In contrast, self-custody solutions like Best Wallet rely on device-level security, biometrics, and user-controlled signing rather than account logins, reducing exposure to credential-based attacks altogether.

Encryption is equally important. It ensures that all your sensitive data—personal information, transaction details, and private keys—is protected both in transit and at rest. For example, Kraken uses advanced 256-bit encryption, one of the highest standards available, to secure user data. This type of encryption scrambles your information into unreadable code, preventing unauthorized access by hackers or third parties.

Additionally, check if the exchange has a track record of transparency. Regular security audits, proof of reserves, and public disclosures show that they take security seriously. Finally, regulatory compliance adds an extra layer of trust.

Benefits and drawbacks of trading crypto

Trading cryptocurrency comes with a mix of exciting benefits and important drawbacks, and understanding them is key to avoiding misunderstandings. Let’s dive into the details.

Benefits:

- High returns: Crypto’s volatility can lead to significant profits. For example, Bitcoin surged over 300% in 2020.

- Decentralization: With no central authority, crypto transactions are peer-to-peer, giving you full control of your assets.

- 24/7 trading: Unlike traditional markets, crypto never sleeps. You can trade anytime, even on weekends.

- Liquidity: Coins like Bitcoin and Ethereum have huge trading volumes. Binance sees an average daily volume of over $30 billion, making it easy to trade quickly.

- Low fees: Exchanges, especially decentralized ones like Uniswap, often offer much lower transaction fees than traditional markets.

- Ownership of digital assets: You own your crypto through private keys, bypassing intermediaries. Using a cold wallet like a Ledger Nano S enhances security.

Drawbacks:

- Volatility: While high volatility can bring profit, it can also lead to losses. Ethereum, for example, has dropped as much as 30% in a day.

- Security risks: Crypto exchanges are frequent targets for hackers, putting your assets at risk without proper precautions.

- Lack of regulation: Inconsistent laws across countries can make compliance tricky, leaving traders exposed to sudden regulatory changes.

- Market manipulation: Smaller coins are particularly vulnerable to pump-and-dump schemes, leading to unpredictable price crashes.

- Scalability issues: Networks like Ethereum can get congested, driving transaction fees as high as $200 during peak usage.

- Technical complexity: Managing wallets and private keys, or even engaging in DeFi protocols, can be overwhelming. Mistakes here can result in permanent loss of funds.

Balancing these factors will help you trade smarter and minimize risks when trading on your newly chosen exchange.

FAQs

Which exchange is the safest for beginners?

Best Wallet is widely considered the safest for beginners, thanks to its regulatory compliance, strong security features, and easy-to-use interface.

Do these exchanges offer insurance in case of hacks?

Binance offers incident-backed protection mechanisms for specific breach scenarios, while Best Wallet reduces platform-wide breach exposure by keeping users in control of their private keys through self-custody.

Can I trade without KYC on these exchanges?

Yes, exchanges like BYDFi and BTCC allow trading without KYC for smaller withdrawals, but larger transactions typically require verification.

What’s the difference between cold and hot wallets?

Cold wallets are offline and more secure, while hot wallets are connected to the internet and easier to access but more vulnerable to hacks.

Do these exchanges support staking?

Most of these exchanges, except BYDFi and BTCC, offer staking options for earning rewards on supported cryptocurrencies.

Is Binance good for altcoin trading?

Yes, Binance offers one of the largest selections of altcoins, making it ideal for altcoin traders.

How do I enable two-factor authentication (2FA)?

You can enable 2FA in the account settings of each exchange by linking it to an app like Google Authenticator or Authy.

Can I trade from my phone on these exchanges?

Yes, all of these exchanges offer mobile apps for trading on the go, although features may be limited compared to the desktop versions.

What’s the best exchange for high-leverage trading?

BTCC offers the highest leverage at 225x, making it a great option for experienced traders.

Which exchange has the lowest fees?

BYDFi stands out for its ultra-low fees of only 0.02%, especially for perpetual contract trading.

Conclusion

Choosing a secure crypto platform is crucial to protecting your assets and trading with confidence in an increasingly risky market. The five platforms covered here, Best Wallet, MEXC, Binance, Bitpanda, and Margex, each approach security from a different angle, ranging from self-custody control and regulated custody to cold storage, two-factor authentication, and withdrawal protections, giving users multiple ways to safeguard their funds depending on how they trade and hold crypto.

Whether you’re looking for an exchange with low fees, high leverage, or a wide range of altcoins, there’s a platform here to meet your needs. Remember, security is key, so make sure to consider the protective measures these exchanges offer when making your choice. For traders based in the Netherlands, finding a Dutch crypto exchange with strong security and regulation compliance is critical, and many of the exchanges listed above meet these requirements.