Another bearish day in the broader cryptocurrency market has hampered Ethereum’s upward action, as the altcoin’s price remains below the $4,500 level. In the midst of the ongoing bearish performance, a significant portion of Ethereum has been spotted leaving major centralized exchanges at a rapid rate.

Big Money Ethereum Investors Fleeing Binance

Over the past few days, Ethereum, the second-largest digital asset, has been struggling with heightened volatility, which began after reaching a new all-time high. As prices fluctuate, Darkfost, an author and market expert, pointed out a growing shift in investor sentiment and action on Binance, the world’s leading crypto exchange.

The on-chain expert revealed that ETH reserves on Binance continue to shrink, driven by persistent whale outflows. Large ETH holders have been steadily withdrawing their assets from the crypto exchange, a sign of growing trust and interest in the altcoin.

In addition to reducing exchange liquidity, this pattern supports Ethereum’s bullish sentiments because declining supply on significant platforms has always coincided with rising price momentum. Such a development often suggests a long-term holding strategy, as these large investors move their coins to cold storage.

According to the expert, whales are still active and keep accumulating Ethereum as the bullish trend develops. Several notable whale withdrawals on Binance were discovered during the early hours of Thursday, in order to deploy it on Aave for yield.

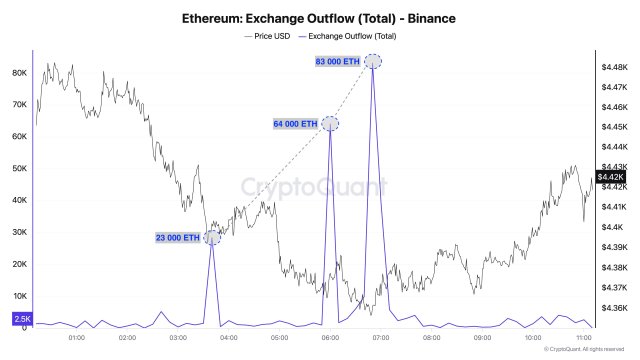

In fact, within a few minutes, Binance saw three significant outflows. Data shared by the on-chain expert shows that the first transaction consists of roughly 23,000 ETH, the second, which was larger, contained 64,000 ETH, while the last and largest transfer contained 83,000 ETH. In total, these transactions are valued at approximately $750 million.

Following the substantial whale outflows, Ethereum reserves have now fallen to 4.2 million ETH. This development implies there is still a high demand for ETH, and Binance is unavoidably one of the most popular platforms for large-scale transactions. Overall, the strong support for ETH from whales is a highly encouraging indicator and is likely one of the factors contributing to its recent outperformance of Bitcoin.

ETH Whales Are On The Move

It is worth noting that Ethereum whale activity extends beyond centralized exchanges. Glassnode, a leading on-chain data analytics firm, has outlined a notable disparity in movement among whale holders. In August, the largest holders of ETH made opposing movements.

Mega whales, particularly wallet addresses holding at least 10,000 ETH, drove the rally with net inflows reaching a peak of +2.2 million ETH over the last 30 days. However, these key investors have now halted their accumulation.

Furthermore, large whales holding 1,000 ETH to 10,000 ETH have been steadily accumulating following weeks of distribution. Within a 30-day period, these investors have amassed more than 411,000 ETH. The massive movement highlights large holders’ interest and conviction in ETH’s long-term prospects.