Bitcoin is holding firmly above the $92,000 level after several days of relief and a stronger-than-expected rebound across the market. Yet despite the positive price action, analysts remain deeply divided. Some interpret this move as a classic relief rally within a broader downtrend, warning that the macro structure still favors a deeper correction.

Others see the recent recovery as the first sign that Bitcoin may be stabilizing and preparing for another bullish phase. The uncertainty reflects the conflicting signals coming from both derivatives and spot markets.

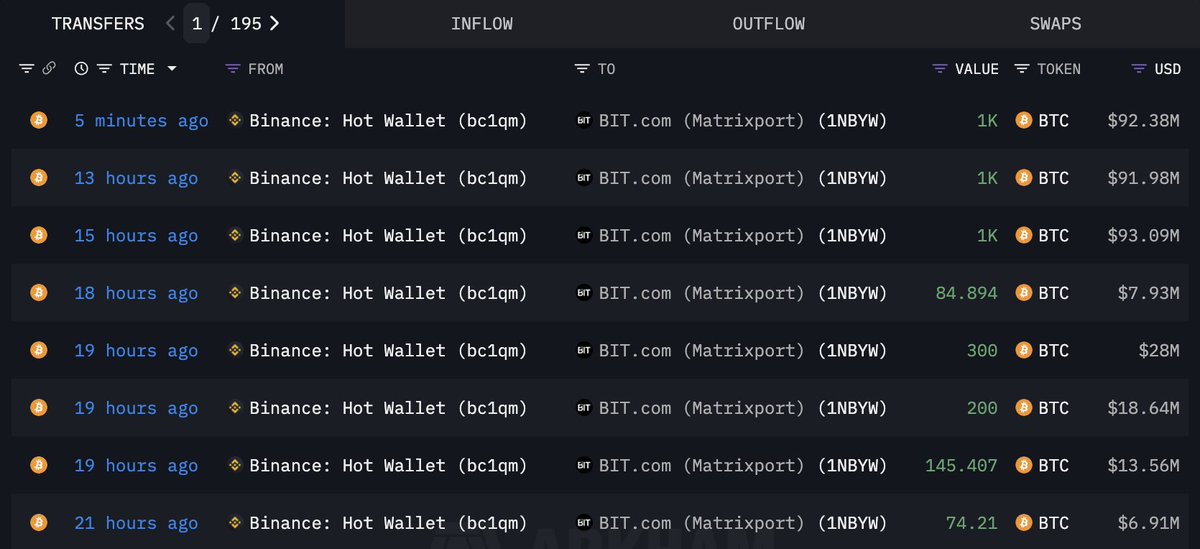

Adding fuel to the discussion, new on-chain data from Arkham shows that Matrixport withdrew 3,805 BTC—worth approximately $352.5 million—from Binance within the last 24 hours. This is a significant development, as Matrixport is one of Asia’s largest crypto financial service platforms, founded by Jihan Wu, the co-founder of Bitmain. The firm provides institutional-grade investment products, lending, trading, and asset management solutions to high-net-worth clients and funds across the region.

Large withdrawals from exchanges by institutions like Matrixport often signal accumulation, reduced selling pressure, or repositioning for custody and long-term holding. Combined with Bitcoin’s stabilization above $92K, this data adds an important layer of complexity to the current market outlook.

Institutional Positioning and a Changing Macro Landscape

Matrixport’s withdrawal of 3,805 BTC from Binance signals a potentially meaningful shift in institutional positioning. Large entities rarely move this size of capital without intention. Such withdrawals typically imply reduced selling pressure and a preference for custody over exchange liquidity, often interpreted as quiet accumulation.

For a firm managing billions in client assets, reallocating Bitcoin off exchanges suggests growing confidence in medium-term price stability or an expectation of improving market conditions.

This move arrives at a pivotal moment in the global macro environment. The Federal Reserve has ended Quantitative Tightening (QT), marking a major transition from liquidity withdrawal to a more accommodative stance. Historically, the end of QT has preceded periods of asset reflation, as systemic liquidity begins to stabilize.

At the same time, Japanese bond yields have surged, signaling stress in one of the world’s most influential funding markets. A spike in Japanese yields often triggers global liquidity adjustments, particularly through the carry trade, which can ultimately redirect capital toward risk assets—including Bitcoin.

Additionally, markets expect the Federal Reserve to cut interest rates soon, further easing financial conditions. Lower rates weaken the dollar, reduce funding costs, and typically stimulate inflows into alternative and high-beta assets.

In this environment of softening monetary policy and rising liquidity, Matrixport’s aggressive Bitcoin accumulation could reflect growing institutional conviction that the worst of the downturn is behind us—and that Bitcoin may be entering a more favorable macro phase.

BTC Price Analysis: Testing Recovery Momentum

Bitcoin’s daily chart shows the market attempting to stabilize after the sharp decline that pushed price toward the mid-$80,000s. The rebound into the $91K–$93K zone marks the first meaningful recovery attempt, but the structure still reflects caution.

BTC remains below the 50-day and 100-day SMAs, which have both started to slope downward, signaling that the broader trend has not yet shifted back in favor of the bulls. Until Bitcoin reclaims these moving averages with strong volume, the market will likely see this move as a relief rally rather than a confirmed reversal.

Price is currently consolidating above the 200-day SMA, a level that often acts as a long-term trend gauge. Holding this region is essential; losing it would risk a deeper drop toward earlier support zones near $82K–$84K. Volume activity during the bounce shows some improvement, yet it remains far below the levels seen during the late-October peak, suggesting that buyers are cautious and large players are not fully engaged.

The chart also shows a clear lower-high structure forming since September, confirming the bearish pressure that has dominated the last several weeks. For sentiment to shift decisively, BTC must break above $95K and rebuild momentum toward the psychological $100K mark. Until then, volatility and hesitation remain the defining features of this recovery.

Featured image from ChatGPT, chart from TradingView.com