Amid the Securities and Exchange Commission’s (SEC) objections to BinanceUS’s attempt to acquire cryptocurrency lender Voyager Digital, rumors have spread throughout the crypto community that Binance has called off the deal.

Binance’s CEO Changpeng Zhao has stated in a Twitter post that the deal is still on and will also help return funds to users as soon as possible.

U.S. Judge Criticized The SEC’s Stance On Binance-Voyager Deal

According to a March 2 Reuters report, a U.S. bankruptcy judge has criticized the Securities and Exchange Commission for “raising doubts” about the proposed sale of crypto brokerage firm Voyager Digital to Binance.US.

U.S. Bankruptcy Judge Michael Wiles, who is assigned to the Southern District Bankruptcy Court in New York, stated that the SEC had essentially asked to “stop everyone in their tracks” during a court hearing on Thursday.

The regulator’s conviction that “everything other than Bitcoin” is a security is still standing, negatively impacting the industry. In that sense, the SEC claims that the Binance-Voyager deal should be halted because it would allegedly constitute an illegal transaction under current regulations.

The alleged “sale of securities” has recently impacted companies such as the crypto exchange Kraken, which was forced to shut down its staking services in the SEC’s jurisdiction due to the regulator’s recent regulatory approach to the crypto industry.

Will Binance Be Able To Complete The Voyager Deal?

U.S. Bankruptcy Judge Michael Wiles appeared skeptical of the Securities and Exchange Commission’s attempt to block a potential purchase of defunct crypto lender Voyager Digital by Binance subsidiary BinanceU.S. in a March 2 hearing in the Southern District of New York.

The SEC’s objection said the deal failed to detail what safeguards were in place to “ensure that customer assets are not transferred off the Binance.US platform,” the SEC said, according to the Reuters report.

A spokesperson told Reuters that the company would:

(…) work with the relevant parties to provide any requested information, as Binance.US customer assets always remain on the platform and are held on a 1:1 basis, fully reserved.

In addition, the New York Department of Financial Services (NYDFS) has stated that Voyager Digital “illegally” operated a virtual currency business within New York without a license.

Voyager filed for bankruptcy in July 2022, caught up in the crypto winter and the development of the crypto crisis. Voyager received initial court approval for its acquisition from Binance.US in February.

The Binance.US and Voyager deal seems to have all the odds against it. The SEC and NYDFS want to prevent the deal between these two companies. The regulators have hinted at the possible intervention by the U.S. national security review, which could delay or completely block the deal for the two crypto firms.

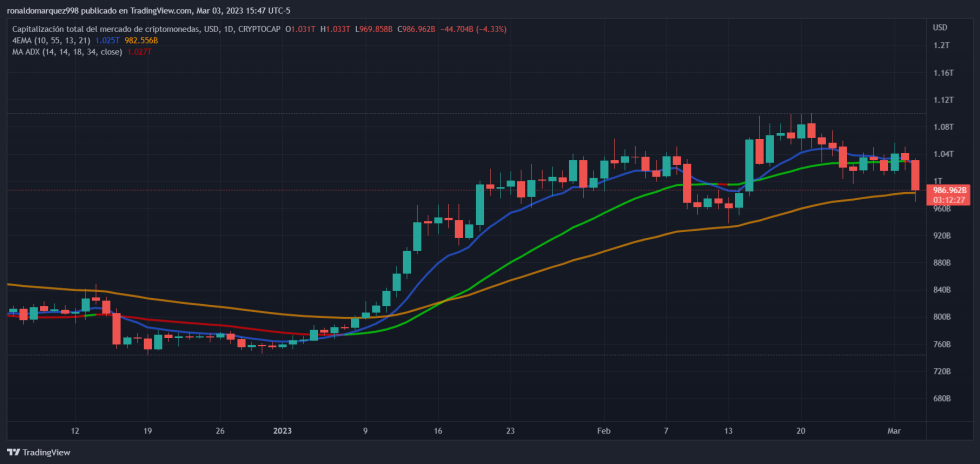

The total crypto market cap has dropped significantly since Thursday to $986 billion. Between the market drop and the possible bankruptcy filing of crypto-friendly bank Silvergate, the market has stumbled and raised investor fears.

The global cryptocurrency market cap has fallen -4.27% in the last 24 hours and -45.22% over the last year. Bitcoin’s market cap has dropped by $5 billion and now stands at $431 billion, representing a dominance of 40.15% in the sector.

Meanwhile, the stablecoins market cap is at $136 billion, with a share of 12.69% of the total cryptocurrency market capitalization.

Featured image from Unsplash, chart from TradingView.com