According to a Bloomberg report, crypto exchange Binance is considering ending relationships with U.S. business partners.

Allegedly the largest cryptocurrency exchange in the market is weighing the option of delisting tokens from any firms based in the U.S. jurisdiction due to a tightening in regulatory policies by the Securities Exchange Commission (SEC).

After the allegations by the SEC that BUSD, a stablecoin pegged to the US dollar, is a security and suing the crypto firm Paxos, the climate between exchanges and the U.S. watchdog has escalated to concern and uncertainty.

In addition, the report said that Binance is reassessing investments in the United States. The regulators do not license Binance to operate in the U.S., but it has been conducting business in the U.S. jurisdiction through its subdiary Binance.US.

Binance CEO Inmediately Responded To The Allegations

Binance’s CEO Changpeng Zao (CZ) denied the allegations in a Twitter post. The exchange’s CEO responded to a commentary on Twitter, saying:

4. False. https://t.co/qjqLrx3TGF

— CZ 🔶 Binance (@cz_binance) February 17, 2023

Binance’s CEO has been embroiled in controversy lately. According to a report from Reuters, the crypto exchange moved $400 million from a “secret” account paired with the exchange’s subsidiary Binance.US, involving crypto-friendly bank Silvergate.

Allegedly, the funds were sent to a trading firm owned by CZ. The trading firm is Merit Peak, incorporated in the British Virgin Islands in 2019. At the time, the firm invested over $1 million into the Binance subsidiary Binance.US.

Binance.U.S spokesperson, Kimberly Soward, told Reuters that Merit Peak is neither trading nor providing services on the Binance.US platform, and only Binance’s subsidiary in the US employees have access to the platform.

Amid the intense scrutiny from the U.S. regulators, the crypto space has had a rough Q1; despite recording a crypto bull run that is barely starting to take shape.

This causes many questions and uncertainties among crypto investors. The regulator is pushing the industry on all fronts, including which companies can have custody of its customers’ assets; the outlook for the exchanges in the near term needs to be clarified in the U.S. jurisdiction.

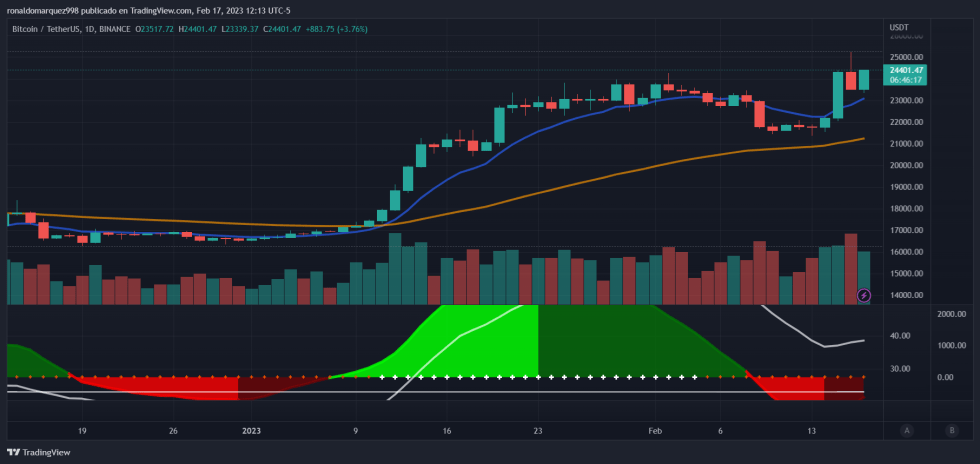

Bitcoin is currently trading at the $24,400 level after a retest of the $23,500 support line. It has gained 10.8% in the last seven days but still has land to cover for a full recovery in the 24-hour time frame, with a current loss of 2.8% since yesterday.