Despite the ongoing bearish action in the price of Bitcoin, major investors remain unshaken by the downward trend, as they exhibit steady interest in the flagship cryptocurrency asset. In a market where sentiment is heavily negative, these key players seem to be doubling down and banking on BTC, scooping up the asset at a rapid rate.

Big Investors Keep Buying Bitcoin Amid Bearish Conditions

The buying pressure around Bitcoin, the largest cryptocurrency asset, is sharply picking up pace, rising to key levels not seen in months. On-chain data shows that BTC whale holders have reached a key accumulation benchmark even with the market experiencing persistent fluctuations.

This steady accumulation trend in the midst of waning price actions points to a sustained conviction among investors. With long-term holders and key institutional entities increasing their holdings, BTC’s supply is tightening, which reinforces the asset’s fundamental strength.

In the Quick-take post on the CryptoQuant platform, a market expert and investor known as Caueconomy highlighted that BTC is witnessing one of its largest whale accumulations in 2025. Such steady buying pressure indicates that trust in Bitcoin’s long-term value proposition is still growing, possibly paving the way for the next significant development in the cryptocurrency sector.

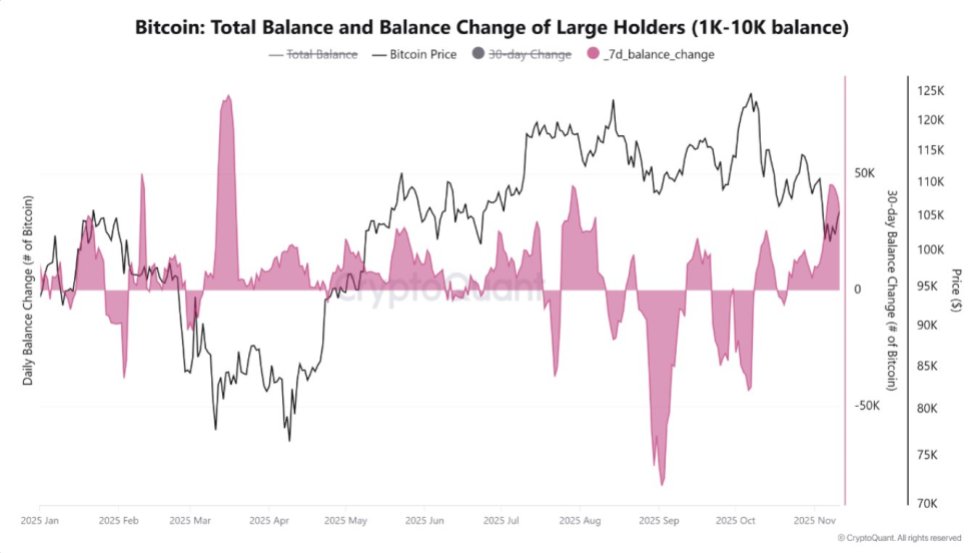

Caueconomy outlined that a large buying volume emerged back in March 2025 despite the decline of Bitcoin and high levels of market anxiety. This heightened acquisition marks the largest weekly accumulation in large-scale wallet addresses.

However, data from the Bitcoin Total balance and Balance Charge of Large Holders reveal that whales have amassed almost 45,000 Bitcoin in the past week. According to the market expert, this represents the second-largest weekly accumulation process among big investors. In the meantime, these large players are once again taking advantage of the capitulation of small holders to absorb coins.

BTC In A Structural Maturity Phase

While Bitcoin’s price may be declining, Axel Adler Jr., a researcher and author at CryptoQuant, declares that the flagship asset is in a phase of structural maturity, not weakness. This phase was determined after examining the BTC Power of Trend (ADX) metric, which has declined.

Adler stated that the drop in peak ADX scores was from 32% to 78%. The development represents a shift from a speculative-impulsive paradigm to an institutionally balanced one rather than market capitulation.

BTC’s ongoing cycle appears to be shifting away from its 4-year cycle pattern. “In the ETF era, the dominance of traditional four-year cycles is fading,” Adler stated. As seen in this cycle, consolidation periods are getting longer, severe impulses are lessening, and price movements are becoming more stable yet less erratic.

A look at the chart shows a market structure where price is hovering between $100,000 and $110,000, with ADX at 32%. This positioning suggests that an internal catalyst is anticipated. It also hints at a rise in futures market volatility and a weakening of long-term holder distribution pressure.