Data shows Bitcoin exchange inflows and outflows have reached a stalemate as netflows aren’t leaning in any particular direction.

Bitcoin Demand Possibly Slowing Down As Netflows Become Neutral

According to the latest weekly report from Glassnode, only around $20 million in net outflows are taking place in the BTC market right now. There are three relevant indicators here: the exchange inflow, the outflow, and the netflow.

The exchange inflow measures the total amount of Bitcoin being deposited to centralized exchanges, while the outflow keeps track of just the opposite: the number of coins leaving exchanges.

The “exchange netflow” is simply calculated by taking the difference between the inflows and the outflows. Naturally, the significance of the metric’s value is that it’s the net amount of BTC flowing into or out of the exchange wallets.

When the value of this metric is positive, it means inflows are overwhelming the outflows right now. As one of the main reasons why investors deposit to exchanges is for selling purposes, this kind of trend can have bearish implications for the price.

On the other hand, negative values imply outflows are more dominant in the market at the moment. Prolonged net outflows can be bullish for the price, as they may be a sign that investors are accumulating.

Now, here is a chart that shows the trend in the Bitcoin monthly exchange netflow over the last few months:

The value of the metric seems to have been near the zero mark recently | Source: Glassnode's The Week Onchain - Week 5, 2023

As displayed in the above graph, the Bitcoin monthly exchange netflow was at deep negative values during the November-December period following the collapse of the crypto exchange FTX.

The largest outflows in the history of the crypto took place in this period, as a net amount of BTC was being withdrawn at the rate of $200,000 coins per month then. One of the contributing factors behind these large outflows was that many investors were taking their coins off centralized platforms out of fear because of what went down with a known exchange like FTX.

Recently, however, the netflow has retreaded to almost neutral values, suggesting that the inflows are balancing out the outflows now. This means that as the price of the crypto has rallied, the buying demand in the market (which the outflows kind of represent) has dropped off relative to the fresh selling (the inflows) that’s taking place now.

The below chart shows the data for the Bitcoin inflow and outflow volumes separately during the past few years.

Looks like both the metrics are at even values now | Source: Glassnode's The Week Onchain - Week 5, 2023

From the chart, it’s apparent that in pure numbers, both these volumes have increased in this rally, but they are almost perfectly balancing each other (which the netflow already revealed) as a measly $20 million in outflows are taking place right now.

BTC Price

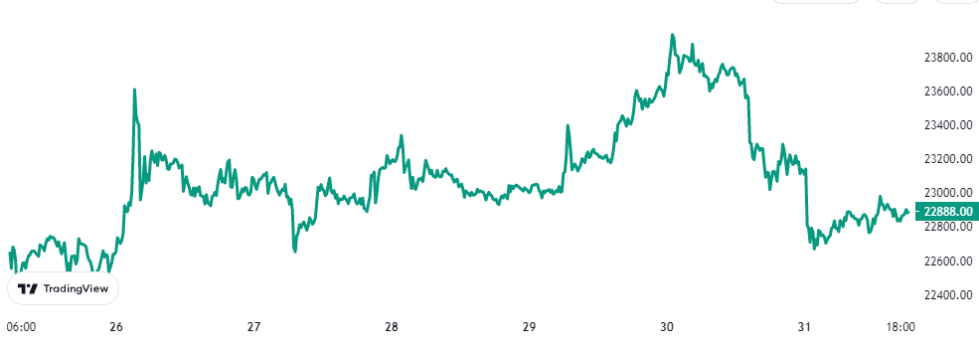

At the time of writing, Bitcoin is trading around $22,800, down 1% in the last week.

BTC has declined over the past day | Source: BTCUSD on TradingView