The Global Crypto markets are now reaching the red zone, causing stocks and cryptos to trade at the bottom. In fact, Bitcoin (BTC) dropped by 10.30% in 24 hours, down 19% from three days ago. And this plunge has also made more people apprehensive. At the time of writing, BTC is trading around $24,500, with an extended negative run and the decline might continue and breach the lower support. This passage indicates that from the fundamental and technical aspects, BTC still faces challenges to resume the uptrend.

How Bitcoin Responded to the Hike of CPI

The price of bitcoin plummeted on Friday after CPI data from the United States indicated that inflation was far from reducing. CPI, the most generally used measure for inflation in the United States, has now increased by 8.6% year on year in the preceding month, causing a $500 BTC price decline on the New York trading day.

Whereas the recent bearish attitude has kept some crypto purchasers on the sidelines. Furthermore, BTC’s slide from the $33,000 barrier level has increased the possibilities of a Bitcoin rally. Now BTC is currently trading around $24,500, with the possibility of more declines. The coin has declined by more than 10.30% in the last 24 hours.

Bitcoin Prices Strongly Trending Downward

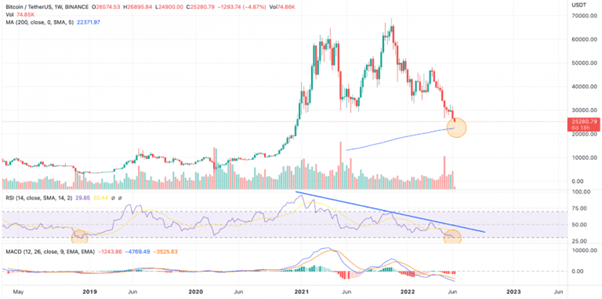

After breaking out of the descending triangle and hitting the pinnacle of the consolidation, the BTC price has now dropped below the support levels at $28,436.

The price has already dropped close to the critical level, and the last support above $20,000 is between $22,500 and $23,800. To keep the price over $20,000, prices must either consolidate within these areas or refrain from falling below them.

In the worst-case scenario, the price might continue to fall and break through the lower support with a prolonged bearish run.

Technical Analysis

Bitcoin price may test one of the main weekly support levels at the 200-day MA at roughly $22,479 if it rejects the major support zone. If these levels are also rejected, the asset may suffer a precipitous plunge, which looks to be impending given the MACD’s severe bearishness.

RSI, on the other hand, is continuing a substantial downward trend line and is testing lower support for the first time since December 2018. The Bitcoin (BTC) price is highly negative across all time horizons and may continue to fall hard to reach the next support zone.

How to “Survive” in the BTC Bear Market?

So with all that, we can foresee that the BTC price will struggle for the rest of 2022 as central bank monetary tightening squeezes assets across the board. In such a large bear market, there are still people who have got an ROI of more than 1000%, and the secret to this is —- 100x leverage. In bear markets, traders can use leverage to maximize their profits in futures markets. Bexplus is a promising Bitcoin-based futures exchange, providing BTC, ETH and ADA, Doge, and XRP perpetual futures contracts with up to 100x leverage. Unlike spot trading which enables you to earn money only when BTC goes up, you can also make profits if the BTC price drops.

For example, if you open a short position with 1 BTC when it prices at $25,000, added 100x leverage. When the price of Bitcoin declines to $20,000. The profit will be ($25,000 – $20,000) * 100 BTC/$20,000 *100% ≈25 BTC, making the ROI 2500%.

Join Bexplus and Profits with Top Traders

Bexplus is a safe platform accredited by U.S. FinCEN MSB (Money Services Business). And the excellent features below also make Bexplus outstanding in the crypto market.

-

Up to 10 BTC FREE Bonus

If you deposit BTC in the Bexplus account, you can earn a 100% BTC bonus, which can also be used to trade futures contracts. That means if you deposit 1 BTC, your account will have 2 BTC. The more deposits, the more bonus you will get. You can get up to 10 BTC as a bonus!

-

Copy Trading

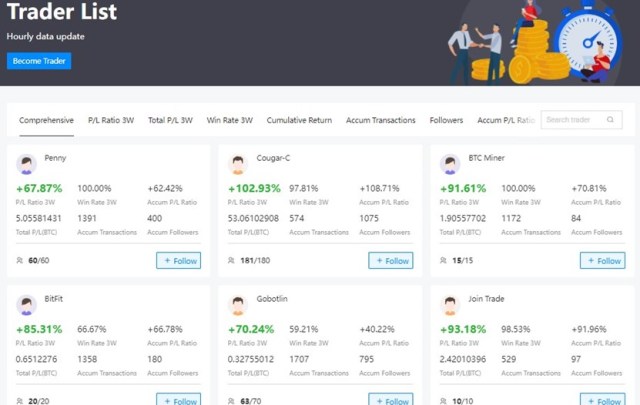

Bexplus’ unique copy trading gives every investor who has just entered the market the opportunity to become a veteran. Users can choose to copy the tradings of top traders who have high profitability and followers. It also allows users to take a profit and stop loss. Traders can also close the copied positions at any time.

-

21% Interests-Bearing BTC Wallet

Bexplus helps users to get gains by storing BTC in the multi-signature wallet and enjoy up to 21% annualized interest without any risks.

- Demo account with 10 BTC to practice trading without risks.

- No KYC requirement, registration with Email within a few minutes.

- Android and iOS App to trade anywhere anytime.

- 7/24 hours 1V1 customer support available.

- Fast withdrawal without any time limit, and no deposit fee.

Bexplus is a good trading platform for both novices and veterans. Click Here to Register an account in Bexplus now and claim up to 10 Free BTC!

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of Bitcoinist. Bitcoinist does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.