On-chain data shows both Inscription and monetary-related Bitcoin transactions have neared their all-time highs (ATHs) recently.

Bitcoin Miners Rake In High Revenue As BTC Transfers Spike

As Glassnode’s lead on-chain analyst Checkmate pointed out in a new post on X, the miners have recently been handling more Bitcoin transactions of both types.

The types being referred to here are “Inscriptions” and non-Inscription transfers. The Inscriptions are transactions of Satoshis (where a Satoshi or Sat is the smallest unit on the network) with some data attached.

The data could be of any type: image, text, audio, or video. Thanks to Inscriptions, applications like Non-Fungible Tokens (NFTs) and BRC-20 Tokens have become possible on the Bitcoin blockchain.

Transactions of these Inscriptions are naturally different from the usual transfers of tokens on the blockchain, as the former involves the exchange of tokens and other applications (which may carry their own intrinsic but different value from normal Sats). In contrast, the latter involves a money-based transaction.

From the perspective of the miners, though, both of these transaction types have a commonality: they offer them a transfer fee. Thus, any of these types gaining traction is a positive development for them.

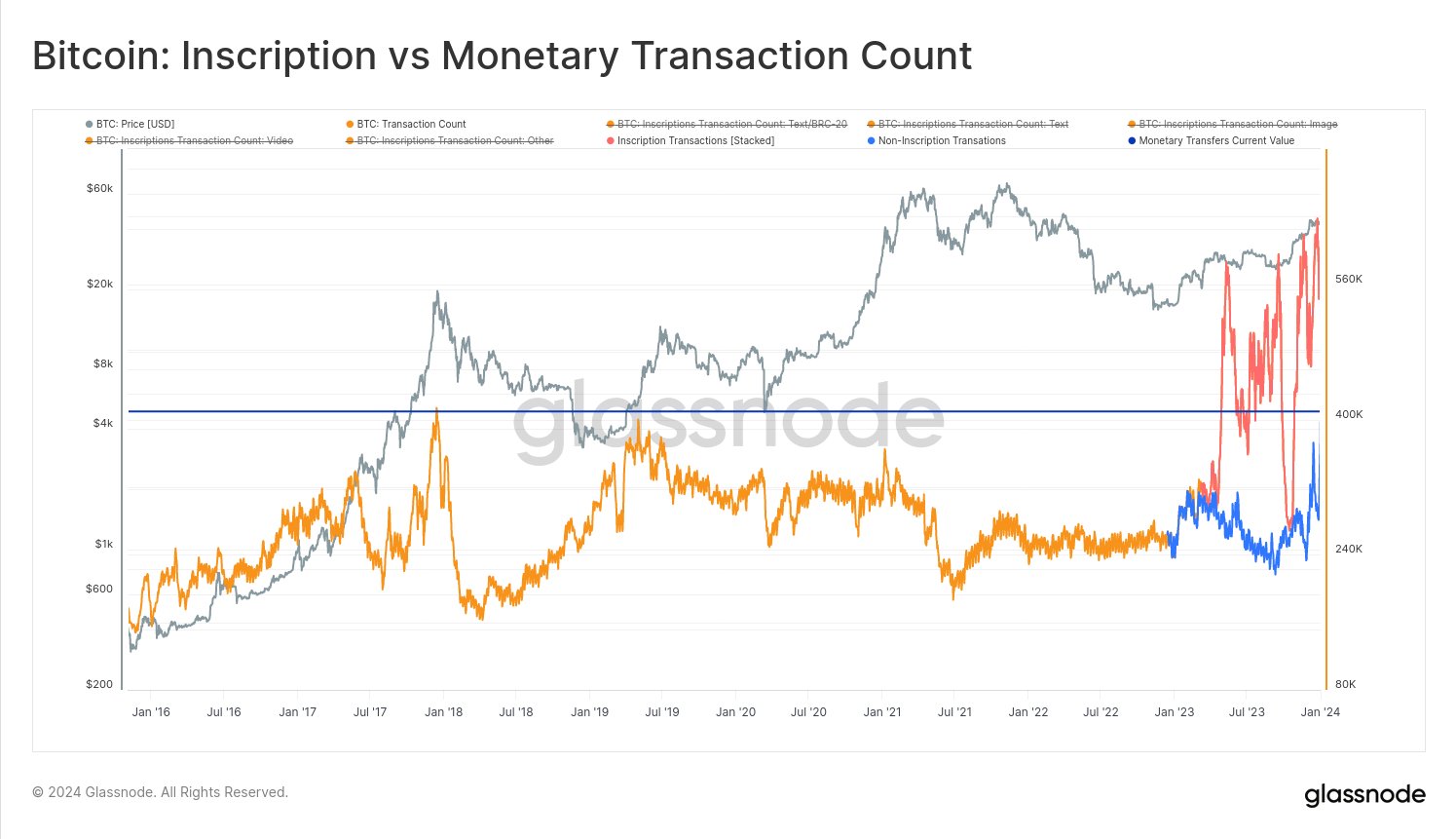

Now, here is a chart that shows the trend in the total number of Bitcoin transactions for both of these types:

Looks like both of the metrics have shot up recently | Source: @_Checkmatey_ on X

As displayed in the above graph, the Bitcoin Inscription transactions have recently observed a sharp surge and have set an ATH of around 200,000 daily transfers. The number of these transfers is floating slightly lower but still near this record high.

The Inscriptions had seemingly lost interest a while back, but it would appear that the users of the blockchain are now once again actively participating in these network applications.

The monetary transactions have also registered some rapid growth recently and are sitting at a level with the ATH of 409,000 daily transactions observed in 2017. These normal transfers have naturally seen a spike in interest because of the latest Bitcoin price rally.

With the transaction count shooting up, it’s also not surprising that the average fee on the network has also blown up. The miners only have a limited capacity to handle transfers, so they prioritize moves attached with the highest fees.

In times of high traffic like right now, those who don’t want their transactions stuck in the mempool for long periods have no choice but to attach a fee competitive with the rest of the network.

For the miners, this transaction fee boom arising out of the interest in Inscriptions and the chain itself could provide some hope for their future, as there will come a day when all of Bitcoin will be mined, and the transaction fees will become their sole income source.

So far in the history of the cryptocurrency, miners have relied on the block rewards as their main revenue stream, as the fees have, more often than not, been relatively low. With the Inscriptions, though, the fee revenue is finally gaining some balance.

BTC Price

Bitcoin has seen a flash crash today, where its price briefly dipped under the $42,000 level but has now bounced back to $42,600.

The price of the coin has seen a sharp plunge recently | Source: BTCUSD on TradingView