Data shows the Bitcoin mining hashrate has already rebounded from its latest plunge, suggesting that miners haven’t given up hope just yet.

Bitcoin Mining Hashrate Has Surged Back Towards High Levels

The “mining hashrate” refers to the total amount of computing power that the miners have attached to the Bitcoin blockchain. This metric can tell us about the interest in mining the asset among these chain validators.

If the indicator trends up, it signals that new miners are coming into the blockchain and/or old ones are expanding their facilities, likely because they are finding the network profitable to mine on.

Related Reading: Bitcoin Milestone: BTC Holders Now More Than Population Of Spain

On the other hand, declines in the indicator can naturally imply that at least some of the miners are facing low or no profits on the blockchain, so they are ditching it.

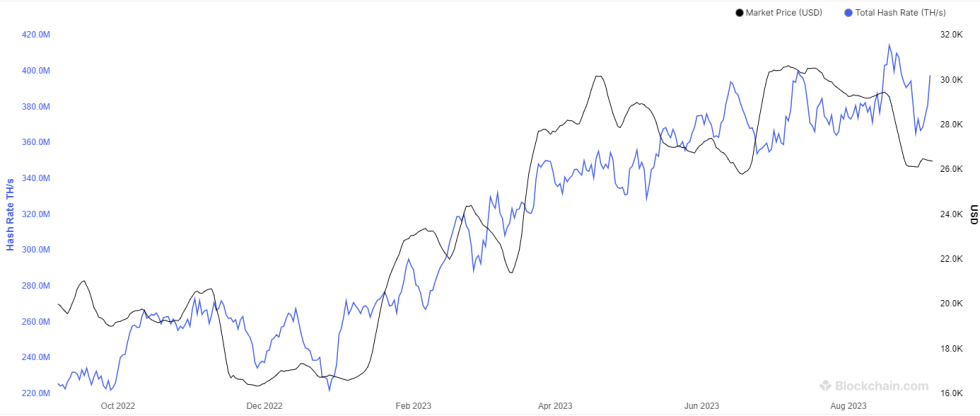

Now, here is a chart that shows the trend in the 7-day average Bitcoin mining hashrate over the past year:

The value of the metric seems to have observed a strong bounce in recent days | Source: Blockchain.com

As displayed in the above graph, the 7-day average Bitcoin mining hashrate had surged to a new all-time high just as the crash in the cryptocurrency’s price from above $29,000 to below $26,000 occurred last month.

The metric had maintained near these levels in the following few days, which was a bit unexpected. The reason it was out of the ordinary is that the miners refer to the USD value of their block rewards as their revenue, which would have naturally plunged when the asset’s price had plummeted.

The indicator did, however, eventually drop down when the mining difficulty surged. The difficulty here refers to a feature on the Bitcoin network that guides how difficult the miners would find it to mine on the network right now.

The hashrate essentially represents the amount of competition present on the chain because the block rewards remain fixed on the network, so whenever the hashrate goes up, the competition rises and everyone involved gets fewer revenues.

Due to the hashrate hitting an all-time high, the difficulty had gone up in response, setting a new record of its own. This difficulty increase might have been the last straw for some of the miners, who had already been under pressure from the crash, so they unplugged from the network, leading to the hashrate’s plunge.

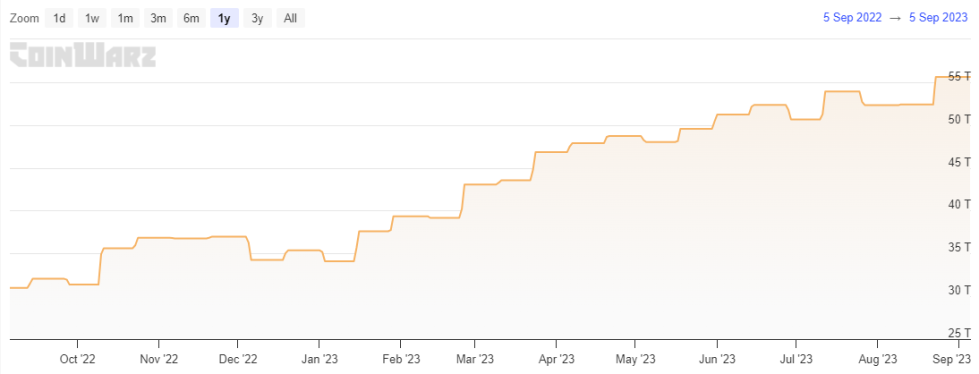

Looks like the metric has set a new ATH recently | Source: CoinWarz

During the last few days, though, the 7-day Bitcoin mining hashrate has registered a strong rebound, as its value is now once again closing in on the ATH. This is despite the fact that the price hasn’t made any recovery at all and the difficulty continues to be at ATH levels.

This could suggest that the miners still believe in the long-term potential of the asset enough that they are willing to add more machines to their facilities while the market is going through a phase of struggle.

BTC Price

Bitcoin has continued to show stagnation recently as its price is still trading around the $25,800 level, registering a drawdown of just 1% in the past week.

BTC continues to be locked in sideways movement | Source: BTCUSD on TradingView