Bitcoin is at a pivotal moment following weeks of significant volatility and uncertainty. The recent interest rate cut by the Federal Reserve, coupled with geopolitical tensions stemming from the conflict between Iran and Israel, has led to erratic price movements that have left investors on edge.

Despite this turbulence, key metrics from BGeometrics suggest that global central banks are easing their monetary policies, which is expected to boost global liquidity. This shift could create a favorable environment for BTC and other risk assets.

As central banks inject more liquidity into the markets, the potential for a substantial rally in Bitcoin’s price increases. Analysts closely monitor these macroeconomic conditions, as continued easing could ignite renewed investor confidence and drive demand for BTC.

If these trends persist, a significant price surge for BTC could materialize as early as the end of this year. Investors and traders are watching the market closely, looking for signs that Bitcoin can capitalize on these favorable macroeconomic developments and regain its bullish momentum.

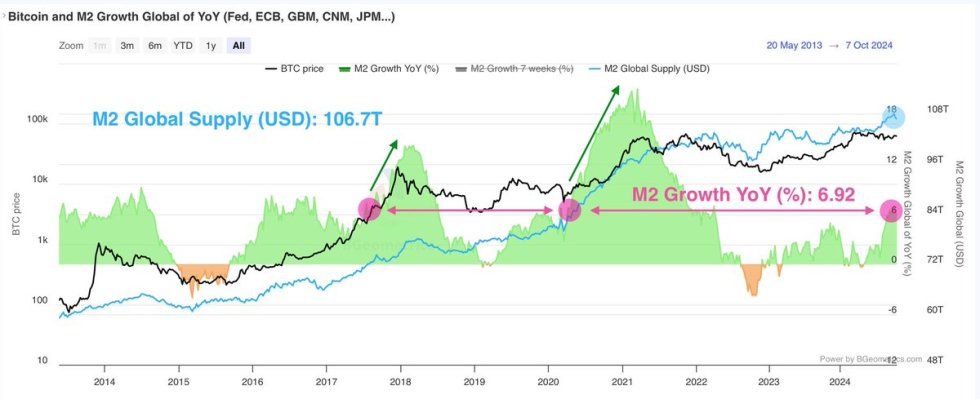

Bitcoin Correlation With M2

The current global trend among central banks to ease their monetary policies and lower interest rates is creating an ideal environment for Bitcoin, cryptocurrencies, gold, and stocks. This shift in policy is boosting liquidity across the markets, which historically correlates with positive price movements in these asset classes.

Key data shared by on-chain analyst Axel Adler reveals that nearly all global central banks, excluding the Bank of Japan, are actively implementing measures to stimulate their economies. This coordinated easing is expected to enhance liquidity, fostering an environment conducive to substantial price appreciation for assets like Bitcoin and gold.

The undeniable correlation between BTC and the M2 global money supply further highlights this dynamic. As the M2 money supply expands, it typically indicates increased liquidity in the market, leading investors and traders to gravitate towards BTC as a promising asset.

The growth in money supply often precedes significant gains in Bitcoin’s price, as more liquidity means more capital available for investment. This creates an atmosphere ripe for rallies, enticing institutional and retail investors.

Furthermore, as traditional investors diversify their portfolios to hedge against potential inflation or currency devaluation, Bitcoin’s appeal as a digital store of value becomes increasingly prominent.

This trend, combined with a favorable macroeconomic environment, positions Bitcoin to potentially outperform other assets in the coming months. Investors closely monitor these developments, anticipating that easing monetary policies and increased liquidity will pave the way for substantial gains in Bitcoin and the broader crypto market.

BTC Testing Liquidity

Bitcoin (BTC) is trading at $61,000 after experiencing a 6% dip from its peak of $64,500 amid significant volatility. The price has recently lost both the 4-hour 200 exponential moving average (EMA) at $61,800 and the 200 moving average (MA) at $61,200, raising concerns among traders.

While this dip could represent a healthy retracement to test key demand levels, a deeper correction may be on the horizon if the price fails to reclaim these indicators in the coming days.

For bulls to regain momentum, BTC must break above the EMA and MA levels, ultimately targeting the $66,000 supply zone. This resistance is crucial for establishing a bullish trend and attracting more buyers.

Conversely, if BTC struggles to reclaim these technical levels, it could trigger increased selling pressure, leading to further declines. Market participants are closely monitoring this situation, as the ability to hold above the current levels will be vital for determining Bitcoin’s short-term trajectory.

Overall, the coming days will be pivotal for BTC as traders seek to confirm strength or potential warning signs of a more significant downturn.

Featured image from Dall-E, chart from TradingView