In an extraordinary run, Bitcoin has managed to go as high as $64,000, but is this rally justified? Here’s what on-chain data suggests.

Bitcoin On-Chain Activity-Related Metrics Are All Up Right Now

In a new post on X, the on-chain analytics firm Santiment has discussed how the on-chain activity has been looking like for Bitcoin as its latest rally has taken place.

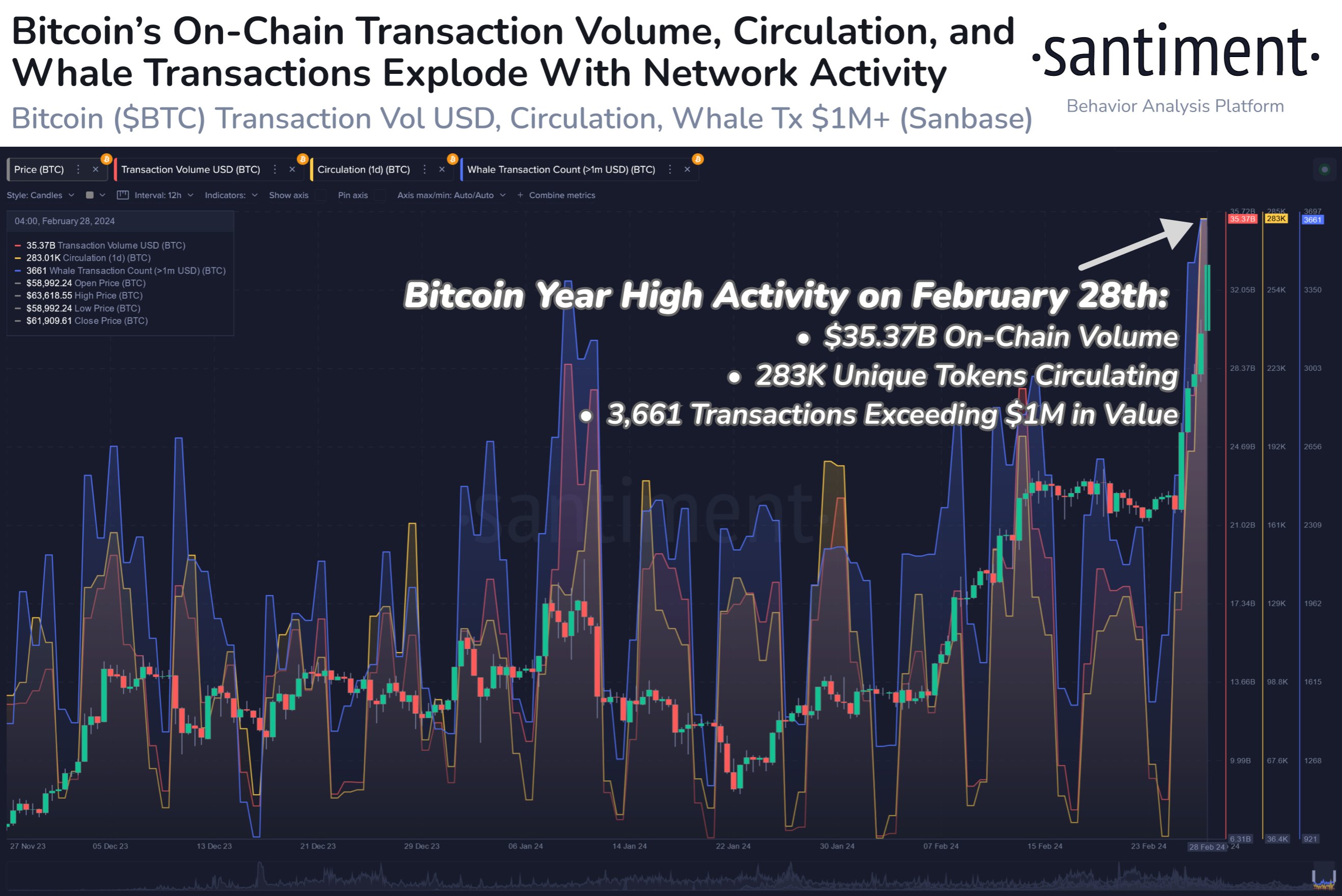

Below is the chart shared by the analytics firm that reveals the trend taking place in three different BTC indicators: Transaction Volume, Circulation, and Whale Transaction Count.

All of these metrics appear to have seen a sharp rise in recent days | Source: Santiment on X

The “Transaction Volume,” the first metric of relevance here, measures the total amount of Bitcoin (in USD) that’s getting involved in transfers on the blockchain every day.

When the value of this metric is high, it means that interest in the asset is high among the investors right now, as they are moving around large amounts on the network.

Historically, sustainable rallies have usually accompanied a rising trend in the volume. Sharp price action like this is naturally attractive to investors, so they start becoming more active in such periods.

More active participants then, in turn, help provide the fuel a move like this needs to go on, so a rally actually needs the volume to go up if it has to be sustainable.

Moves that start sharply but fail to amass enough attention can’t establish this feedback cycle and, therefore, usually end up running out of steam before too long.

From the chart, it’s visible that the Transaction Volume has spiked to pretty high levels alongside this rally, suggesting that user activity has been sharply climbing.

The “Circulation,” the second metric of interest here, has also spiked alongside the volume. This indicator keeps track of the number of unique tokens that are being involved in transfers on the network.

What this spike in the indicator means is that the current high volume isn’t artificially coming from a limited portion of the supply churning back and forth in repeat trades but rather from unique investors making organic moves.

Lastly, the “Whale Transaction Count,” which checks for the number of transfers happening on the blockchain that exceed $1 million in value, has also jumped alongside the rally, implying that not just the smaller investors but also the humongous whales have become highly active.

“Justifying Bitcoin’s historic run to a $64K high today, onchain activity on crypto’s top network has already exceeded levels not matched since 2022,” notes Santiment.

Something to keep in mind is that while high on-chain activity means that volatility should continue, it’s not entirely set in stone that it will only be on the upside. Activity is also high during a selloff, so if the investors, especially the whales, switch to selling, these metrics would still stay up.

BTC Price

Bitcoin has gone through some intense price action in the past day, going as high as $64,000. At present, though, the coin is trading around the $62,700 level.

Looks like the price of the asset has been sharply going up recently | Source: BTCUSD on TradingView