Bitcoin has dropped below $27,000 as short-term holders have locked in the highest profits since the November 2021 all-time high.

Bitcoin Short-Term Holder Realized Profit Has Spiked Recently

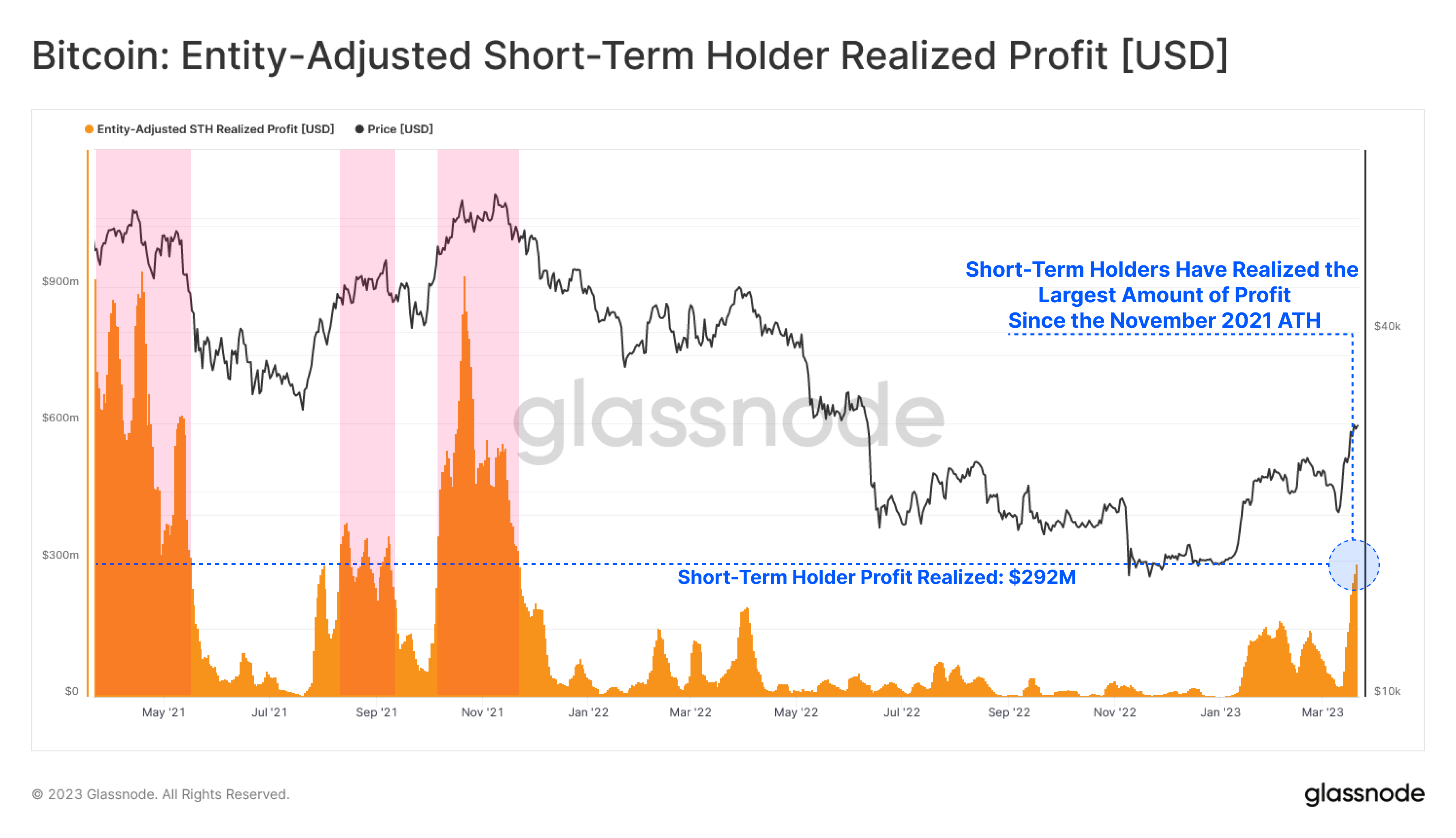

According to data from the on-chain analytics firm Glassnode, the short-term holders have recently realized around $292 million in profits. The relevant indicator here is the “realized profit,” which measures the total amount of profits (in USD) that investors across the Bitcoin network are locking in currently.

This metric works by going through the on-chain history of each coin being sold to see its last transacted price. If this previous selling price for any coin was less than the price at which it is now being moved, then it is being sold at a profit.

The realized profit indicator then adds this amount of profit to its value and then repeats the process for all transactions on the BTC blockchain.

This indicator can also be applied to a specific market section, like an investor group. The entire Bitcoin sector can be divided into two main investor groups: the short-term holders (STHs) and the long-term holders (LTHs).

Here, the relevant group is the former, including all investors holding onto their coins since less than 155 days ago. Naturally, holders carrying their coins for longer than that fall under the LTHs.

Below is a chart that displays the data for the Bitcoin STH realized profit over the last couple of years.

The value of the metric seems to have spiked pretty high in recent days | Source: CryptoQuant

The Bitcoin STH realized profit metric used in the graph is the “entity-adjusted” one, meaning that transactions between the wallets owned by the same entity have been excluded from the data (an entity can be both a single investor and a group of holders).

From the graph, it’s apparent that the indicator had been at pretty low values during the bear market, which makes sense as the prices covered in the 155-day duration would either be greater or close to the same price as the current one, so there wouldn’t be many opportunities for STHs to harvest any significant profits.

However, this trend changed once the rally kicked off in January, as the STHs who bought at the low bear market prices now suddenly got into some immense profits.

The metric dropped in value when the BTC price plunged below the $20,000 mark earlier this month, but with the fresh sharp uptrend in the past week, the STHs have again started realizing some significant profits.

The metric’s current value suggests that STHs had recently realized around $292 million in gains, the highest value since November 2021, when Bitcoin registered its all-time high price.

Such profit-taking from these investors can hurt the price, and it may appear that the asset has already experienced the bearish effect from this, as BTC has now plunged below the $27,000 mark.

BTC Price

At the time of writing, Bitcoin is trading around $26,800, up 10% in the last week.

BTC has plummeted on the daily chart | Source: BTCUSD on TradingView