Data shows the Bitcoin trader sentiment has turned into that of greed since the rally toward the $35,000 level occurred.

Bitcoin Fear & Greed Index Is Now Pointing At “Greed”

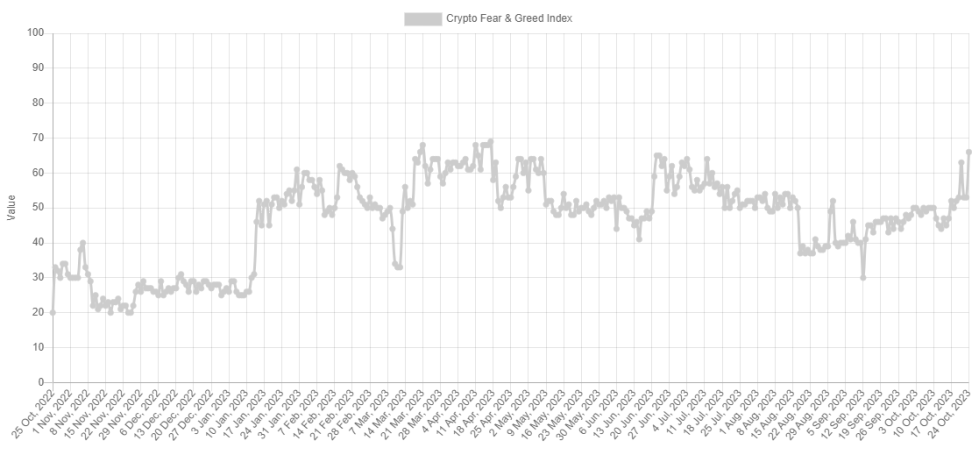

The “Fear & Greed Index” is an indicator that tells us about the sentiment among investors in the Bitcoin and wider cryptocurrency market. The index was created by Alternative and it takes into account the following factors: volatility, volume, social media sentiment, market cap dominance, and Google Trends.

The metric uses a numeric scale that runs from 0-100 to represent the sentiment. When the indicator has a value greater than 54, it means that the investors share a majority sentiment of greed right now.

On the other hand, the metric being less than 46 implies the overall sentiment in the market is that of fear currently. The territory in-between these two regions naturally suggests a neutral mentality.

Now, here is what the Bitcoin Fear & Greed Index looks like at the moment:

The value of the index appears to be 66 right now | Source: Alternative

As displayed above, the Bitcoin Fear & Greed Index has a value of 66, which implies that the market sentiment is firmly inside the greed territory. Just yesterday, the investors had been neutral on the cryptocurrency, as the index had a value of 53.

This sharp change in the mentality has come with the rapid 12% growth that the asset has seen during the past 24 hours. The below chart shows the trend in the indicator.

Looks like the value of the index has shot up over the past day | Source: Alternative

From the graph, it’s visible that the metric is currently the highest it has been since April of this year. High values of the indicator have historically not been a good sign, however, as tops have often formed for BTC when the investors get too greedy.

The major tops in the cryptocurrency, though, have generally formed only when the sentiment has hit the extreme greed territory, which occurs at and above values of 75.

The current value of the metric is, thus, notably under this mark at present. Something to note, however, is that while tops may become significantly more probable to form inside extreme greed, the possibility of a top is still raised inside the normal greed region.

The aforementioned April peak of the Bitcoin Fear & Greed Index, for instance, also coincided with a top for the cryptocurrency. Because of this relationship that seems to exist between the sentiment and the price, some traders follow it to time their moves.

These investors are called “contrarian traders,” as they do the opposite of what the wider market is expecting. Warren Buffet‘s famous quote sums up this idea: “Be fearful when others are greedy, and greedy when others are fearful.”

Based on the current sentiment of greed, perhaps a contrarian investor may now be watching closely to see if the sentiment leans further towards the side in the coming days, or they may even decide to sell right here.

BTC Price

Bitcoin crossed the $35,000 mark yesterday, but the asset has since seen some pullback as it’s now trading at $34,500.

BTC has observed explosive growth in the past day | Source: BTCUSD on TradingView