On-chain data shows the Bitcoin miner profitability is approaching a level that could end up paving way for volatility in the asset’s price.

Bitcoin Miner Realized Price Is Sitting At $53,700 Right Now

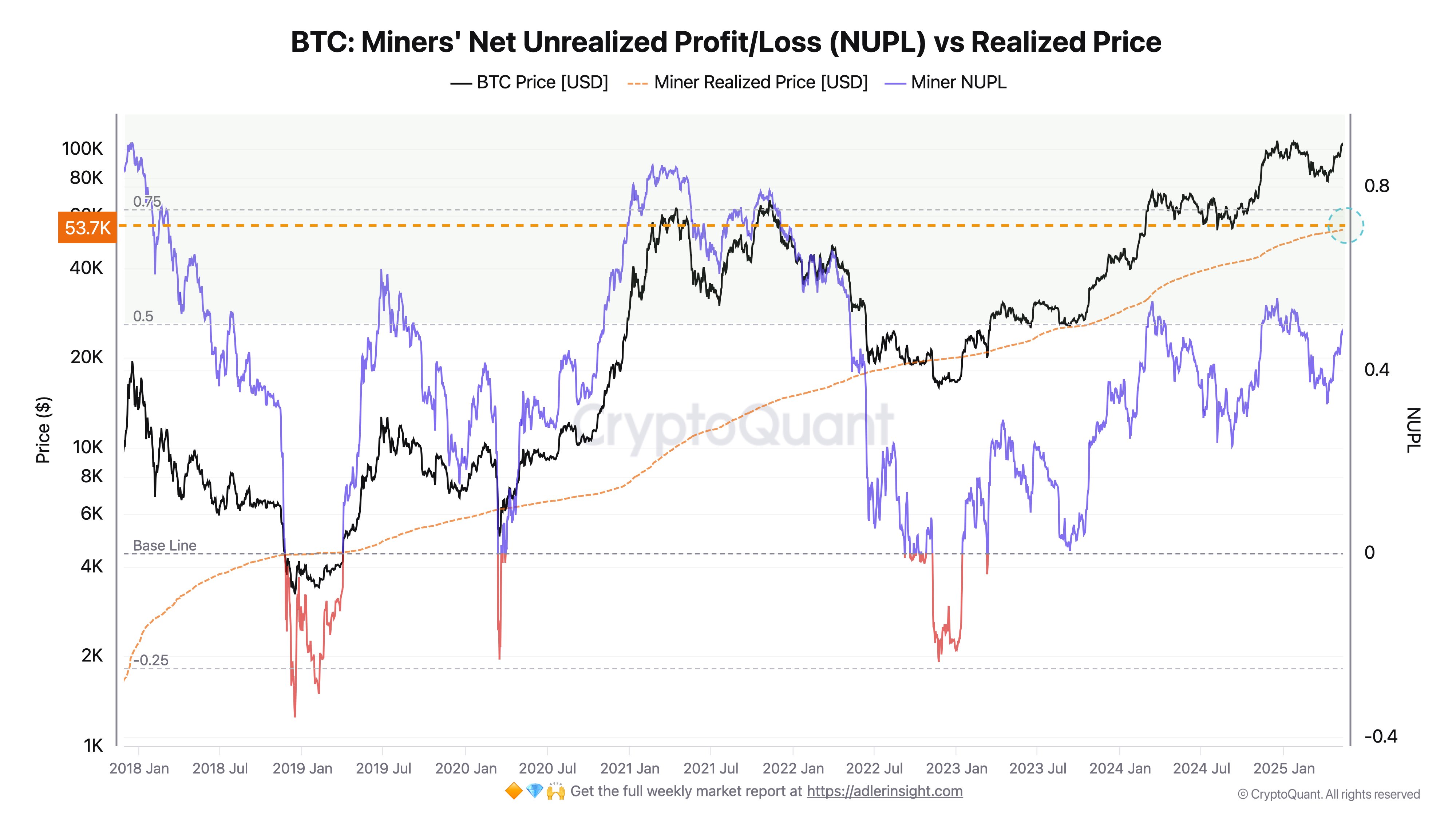

In a new post on X, CryptoQuant author Axel Adler Jr has discussed about the profit-loss situation of the Bitcoin miners. There are two indicators related to these chain validators of relevance here. The first is the “Miner Realized Price,” which keeps track of the cost basis of the average address attached to the BTC miners.

When the value of this metric is below the spot price of the asset, it means the miners as a whole are holding their coins at a net unrealized profit. On the other hand, it being above the cryptocurrency’s value suggests the loss outweighs the profit held by this cohort.

Now, here is the chart shared by the analyst that shows the trend in the Bitcoin Miner Realized Price over the last several years:

The value of the metric appears to be significantly under the asset's price at the moment | Source: @AxelAdlerJr on X

As is visible in the above graph, the Bitcoin Miner Realized Price stands at around $53,700 right now, which puts the miners into a notable amount of profit at the current spot price.

Based on the chart, Adler Jr has noticed a trend in the metric,

Since the beginning of 2023, the spread between the spot price of BTC and the realized price for miners has been actively widening, reflecting enhanced marginal profitability of mining.

The exact gap between the spot price and Miner Realized Price can be obtained from another indicator known as the Miners’ Net Unrealized Profit/Loss (NUPL). Formally, the indicator keeps track of the difference between the unrealized profit and unrealized loss held by the BTC miners.

When this metric has a value equal to zero, it means the Bitcoin miners are just breaking-even on their investment. That is, the spot price is equal to the Miner Realized Price. It being above or below this line implies the dominance of profit or loss.

From the metric’s curve in the chart, the trend talked about by the analyst is clearly visible, as the NUPL has gone through an overall increase since 2023. Today, the Miners’ NUPL is sitting at 0.47.

Adler Jr has noted that this level is close to the 0.5 level, “breaking through which will open the way for increased volatility.” The last two periods in which Bitcoin breached this mark led to it forming a new price all-time high (ATH).

The indicator only sustained briefly above the line in both of these instances, however, with the last proper break occurring way back at the end of 2020. This breakout led into the 2021 bull run.

BTC Price

Bitcoin has made some recovery from its latest pullback as its price is now back at $104,300.

The trend in the BTC price over the last five days | Source: BTCUSDT on TradingView