Here’s what on-chain data says regarding which cryptocurrency exchanges are currently the preferred platform for the Bitcoin whales.

Bitcoin Exchanges Ranked According To Whale Ratios

In a new post on X, CryptoQuant community manager Maartunn discussed which exchange is currently number one in the Bitcoin Exchange Whale Ratio.

The “Exchange Whale Ratio” here refers to an indicator that keeps track of the ratio between the sum of the top 10 exchange inflows and the total exchange inflow for a given platform.

The ten largest inflows to an exchange are generally considered to be coming from the whale entities, so this metric’s value tells us about what part of the total platform inflows these humongous investors are making up for.

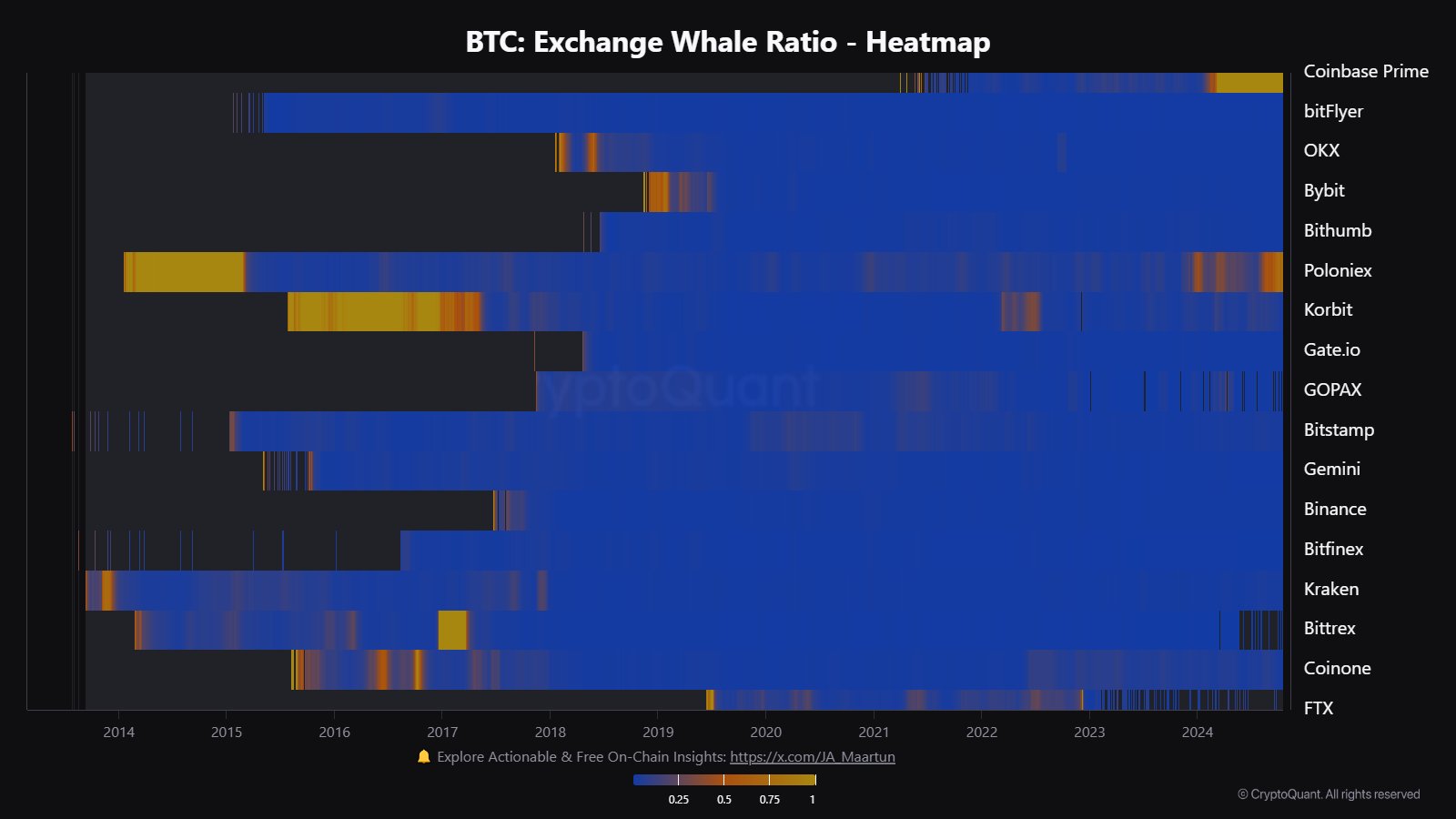

Now, here is the chart shared by Maartunn that shows how the Bitcoin Exchange Whale Ratio has changed for the various exchanges in the sector over the past decade:

Looks like Coinbase currently has this metric at the highest value | Source: @JA_Maartun on X

In the graph, a blue shade corresponds to Bitcoin Exchange Whale Ratio values close to 0, a red one to those around 0.5 and a yellow one to those near 1. It would appear that while most of the exchanges have a shade of blue, Coinbase stands out for having a consistent yellow streak for a while now.

This suggests that the whales make almost all the BTC inflows going to Coinbase. In contrast, the other exchanges have seen a dominance of retail exchange inflows, including Binance, the largest cryptocurrency platform in terms of trading volume.

The chart shows that while Coinbase has been dominating in terms of whale activity this year, it wasn’t always the case. The platform’s growth as the home to the whales can be connected to one event: the launch of the spot exchange-traded funds (ETFs).

The spot ETFs finally gained approval from the US Securities & Exchange Commission (SEC) at the beginning of this year. Since then, these new financial instruments have garnered popularity among investors.

A spot ETF allows investors to gain indirect exposure to BTC’s price movements, which means they don’t have to own any real BTC tokens; the spot ETFs purchase and hold coins on behalf of their users instead.

Now, the spot ETFs must securely store this BTC somehow, and for this purpose, most of them have chosen Coinbase as the custodian. This unique position that the platform has acquired in the sector could explain why the platform’s inflows have been so whale-heavy this year.

BTC Price

Bitcoin had seen a pullback below the $67,000 level earlier in the day, but it appears that the asset has recovered as its price is now trading around $67,200.

The price of the coin seems to have been enjoying bullish momentum recently | Source: BTCUSDT on TradingView