On Monday, December 18, 2017, the first day that Chicago Mercantile Exchange Group (CME) started trading Bitcoin futures, volume was unexpectedly light. Nevertheless, CME exchanged Bitcoin future contracts for about $100 million USD.

CME Bitcoin Futures Debut with New Indexes

One week after Cboe launched Bitcoin futures, CME, the largest futures exchange operator, followed suit. In effect, CME launched Bitcoin futures contracts, under the symbol BTC, on Sunday, December 17, 2017, for a trade dated December 18.

The Bitcoin futures opening price for January delivery was $20,650 USD at 6 p.m. ET, on Sunday. According to observers, the CME Bitcoin futures debut was rather “tepid.” And, as The Wall Street Journal detailed:

CME bitcoin futures for January expiration settled at $19,100 on Monday, down 2.1% from the level CME had deemed the opening price ahead of the contract’s launch on Sunday evening. The January contract spiked as high as $20,650 initially, before falling to $18,345 within several hours of trading.

The value of a single CME futures contract is five times the value of the Bitcoin Reference Rate Index, which is quoted in US dollars per one bitcoin.

CME uses two Bitcoin pricing products, Bitcoin Reference Rate (BRR), and Bitcoin Real-Time Index (BRTI).

The BRR is a daily reference rate of the US dollar value of one Bitcoin as of 4:00 PM GMT. The BRR aggregates Bitcoin trading activity across the main Bitcoin spot exchanges between 3:00 p.m. and 4:00 p.m. GMT.

On the other hand, the BRTI is a real-time index of the US dollar of one bitcoin. The BRTI price is continuously published once per second. According to the CME, the BRTI provides real-time transparency to the US price of Bitcoin.

As of this writing, the Bitcoin Reference Rate (BRR), and the Bitcoin Real-Time Index (BRTI) values are as follows:

CME Bitcoin Futures Started with Light Volume but Significant Value

For the first few hours, on the first day of trading, the volume of CME Bitcoin futures was lower than Cboe’s, as Bloomberg explains:

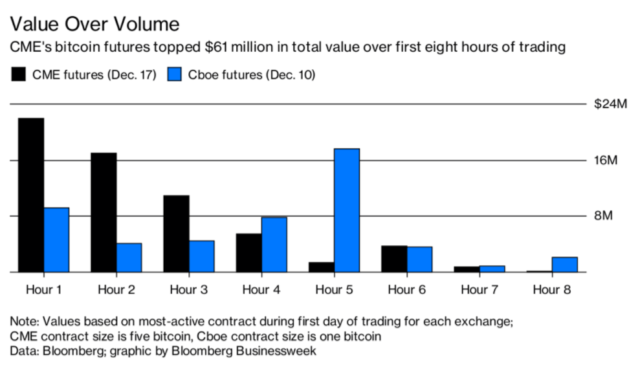

Trading volume for the CME futures has been light, with less than 650 contracts changing hands in the first eight hours of trading, compared with almost 2,500 over the same time frame during CBOE’s debut.

However, in the first eight hours, CME traded $61 million USD. That is about $12 million USD more than CBOE on the same time frame.

Granted, nothing spectacular happened regarding price volatility and volume on the first day of CME futures trading. However, this event further solidified Bitcoin’s status as a mainstream financial asset. Hence, it opened the door even wider for the many financial institutions that want to participate in the cryptocurrency ecosystem.

Granted, nothing spectacular happened regarding price volatility and volume on the first day of CME futures trading. However, this event further solidified Bitcoin’s status as a mainstream financial asset. Hence, it opened the door even wider for the many financial institutions that want to participate in the cryptocurrency ecosystem.

Do you think Bitcoin futures trading volumes will soon increase? Let us know in the comments below.

Images courtesy of Pixabay, CME Group