Coinbase Global, the largest cryptocurrency exchange in the United States, is confronting a potential setback as JPMorgan Chase & Co. downgraded its rating on the company’s stock.

The downgrade comes amidst concerns over a decline in Bitcoin’s value and fading enthusiasm for exchange-traded funds (ETFs) directly linked to the largest cryptocurrency in the market.

Bitcoin ETF Concerns Trigger Downgrade Of Coinbase Rating

According to a Bloomberg report, JPMorgan analysts, led by Kenneth Worthington, expressed their belief that the anticipated catalyst from Bitcoin ETFs, which had propelled the cryptocurrency ecosystem out of a winter period, would not meet market participants’ expectations.

While acknowledging Coinbase as a dominant player in the crypto industry and a global leader in cryptocurrency trading, JPMorgan downgraded the company’s rating to underweight from neutral.

The news of the downgrade caused Coinbase’s shares to drop by as much as 5.4% during US premarket trading on Tuesday.

Coinbase experienced substantial growth in 2023, with its shares gaining nearly 400% in line with Bitcoin’s surge. However, the recent approval of spot Bitcoin ETFs by US financial regulators has raised concerns about the sustainability of gains for crypto-related stocks.

Coinbase’s shares have declined by 26% since the beginning of the year, while Bitcoin itself has experienced a 7.1% decline, currently trading below $40,000 at $38,900 as of this writing.

JPMorgan Maintains $80 Price Target On COIN Stock

JPMorgan highlighted their concerns regarding the potential deflation of enthusiasm for cryptocurrency ETFs, leading to lower token prices, reduced trading volume, and diminished ancillary revenue opportunities for firms like Coinbase.

The analysts emphasized that disappointment in ETF fund flows could deflate the enthusiasm that had driven the cryptocurrency rally, particularly in the second half of 2023 and since October.

Despite the downgrade, JPMorgan maintained a price target of $80 for Coinbase’s stock, which implies a 38% decline over the next 12 months from the closing price on Monday.

Interestingly, bearish sentiment towards Coinbase has been on the rise, with 12 sell ratings, eight buys, and eight holds, according to Bloomberg data.

Battle Of Bitcoin ETFs

On Monday, Bitcoin ETFs faced a day of contrasting fortunes in what Bloomberg experts have dubbed the “Cointucky Derby.”

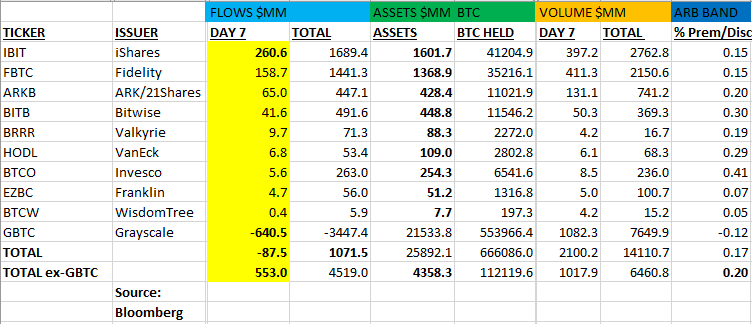

According to Bloomberg expert James Seyffart, the GBTC ETF experienced a challenging day, with over $640 million flowing out. This record outflow suggests a growing trend as the outflows have been steadily increasing. The total outflow for the GBTC ETF has now reached $3.45 billion.

In contrast to Grayscale’s outflows, BlackRock’s IBIT ETF had a positive day, with a notable inflow of $272 million. This marked the third-largest inflow day for the fund.

Despite the overall mixed performance in the Bitcoin ETF space, the IBIT ETF managed to offset some of the industry’s negative sentiment, with only a net outflow of -$76 million for the day.

ETF expert Eric Balchunas of Bloomberg highlighted the ongoing battle between different Bitcoin ETFs. He referred to the “Great GBTC Gouge,” emphasizing the record outflow of -$640 million for Grayscale’s ETF.

However, other ETFs, referred to as “The Nine,” attempted to offset this outflow, but fell short with a $553 million inflow. Despite the challenges, the rolling net flows for Bitcoin ETFs remain healthy, with a positive $1 billion overall. The Nine now hold a 20% share compared to GBTC.

Additionally, new Bitcoin ETF launches have seen high trading volume in their second week. Balchunas specifically mentioned the IBIT ETF’s “impressive” performance, ranking seventh in year-to-date flows among all ETFs.

Blachunas believes that this success is notable considering its relative newness compared to established ETFs known for attracting significant investor capital. Balchunas expressed interest in how long IBIT and other newcomers can sustain their presence on the list.

Featured image from Shutterstock, chart from TradingView.com