Data shows the futures side of the crypto market has witnessed liquidations of $221 million as Bitcoin has broken above the $51,500 mark.

Bitcoin Has Continued Its Latest Rally With A Break Above $51,500

Bitcoin had slumped back under the $49,000 mark just yesterday, prompting many to wonder whether the earlier surge above $50,000 was only temporary.

During the past day, however, the coin has sharply moved up and has not only recovered back above $50,000 but has also been exploring new highs for the year, as it has jumped past the $51,500 barrier.

The below chart shows how the original crypto has performed during the last few days.

The price of the asset has shot up over the past couple of days | Source: BTCUSD on TradingView

Only Cardano (ADA) has put together better gains than Bitcoin’s rally during the past day. Following this surge, the asset is at its highest point since December 2021, more than two years ago.

With BTC going through a rollercoaster in the past day, it’s unsurprising that one development has occurred in the market, a mass liquidation event on the futures side.

Crypto Futures Market Has Observed Large Liquidations During Last 24 Hours

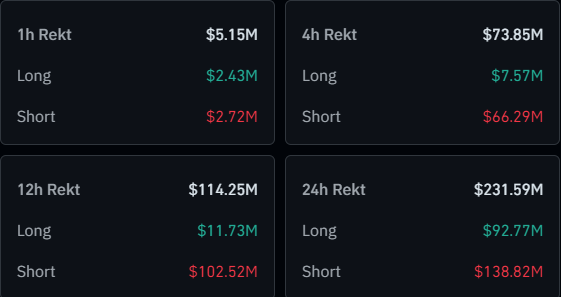

According to data from CoinGlass, more than $231 million in crypto futures contracts have been flushed down during the past 24 hours. The table below shows the breakdown of these liquidations between longs and shorts.

The data for the liquidations in the past day | Source: CoinGlass

It would appear that $138 million of the liquidations involved the short holders. This is equivalent to more than 60% of the total liquidations for the period, meaning that the event was a short-majority one.

This makes sense because cryptocurrency has increased its net amount in the past day. However, as the price action hasn’t been straight up but down and up, a significant amount of longs (almost $93 million) have also been caught in this flush.

Events like these, where many liquidations occur at once, are popularly called “squeezes.” As the shorts made up the latest squeeze, it would be an example of a “short squeeze.”

In a squeeze, liquidations can cascade together like a waterfall, causing an amplification effect on the price swing that triggered them. This may be why Bitcoin’s surge has been so sharp.

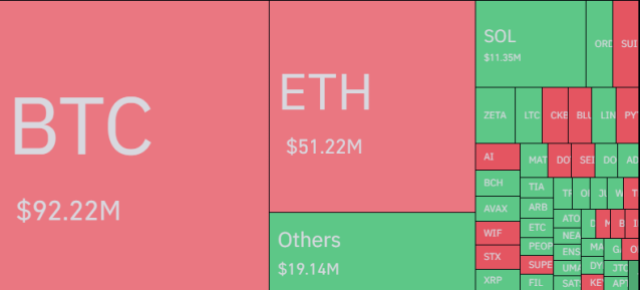

Regarding the individual contribution towards the squeeze by the various symbols, BTC is unsurprisingly at the top with $92 million in liquidations. Ethereum, the second largest crypto, is likewise second with $51 million in liquidations.

The distribution of the liquidation event per symbol | Source: CoinGlass

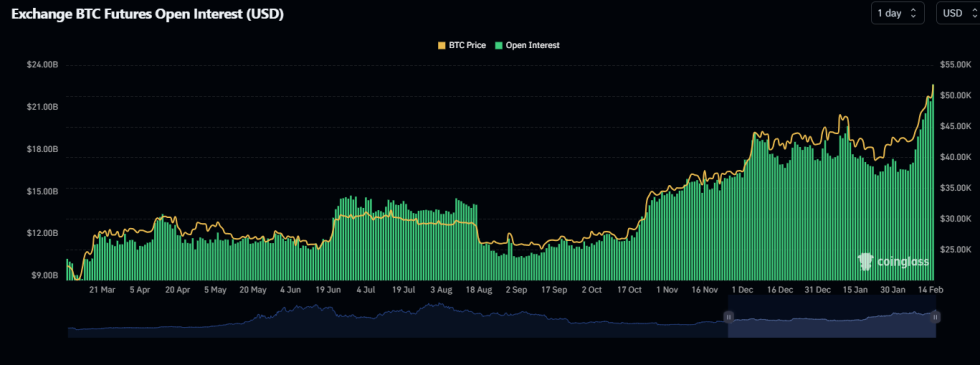

While many liquidations have piled up on the crypto futures market in the past day, the speculators haven’t been dissuaded yet, as the Bitcoin Open Interest has only continued to march upwards.

Looks like the value of the metric has been going up recently | Source: CoinGlass