Data shows that cryptocurrency traders on social media are still bullish about the market, something that could actually be negative for Bitcoin’s price.

Bullish Terms Related To Crypto Are Still Circulating On Social Media

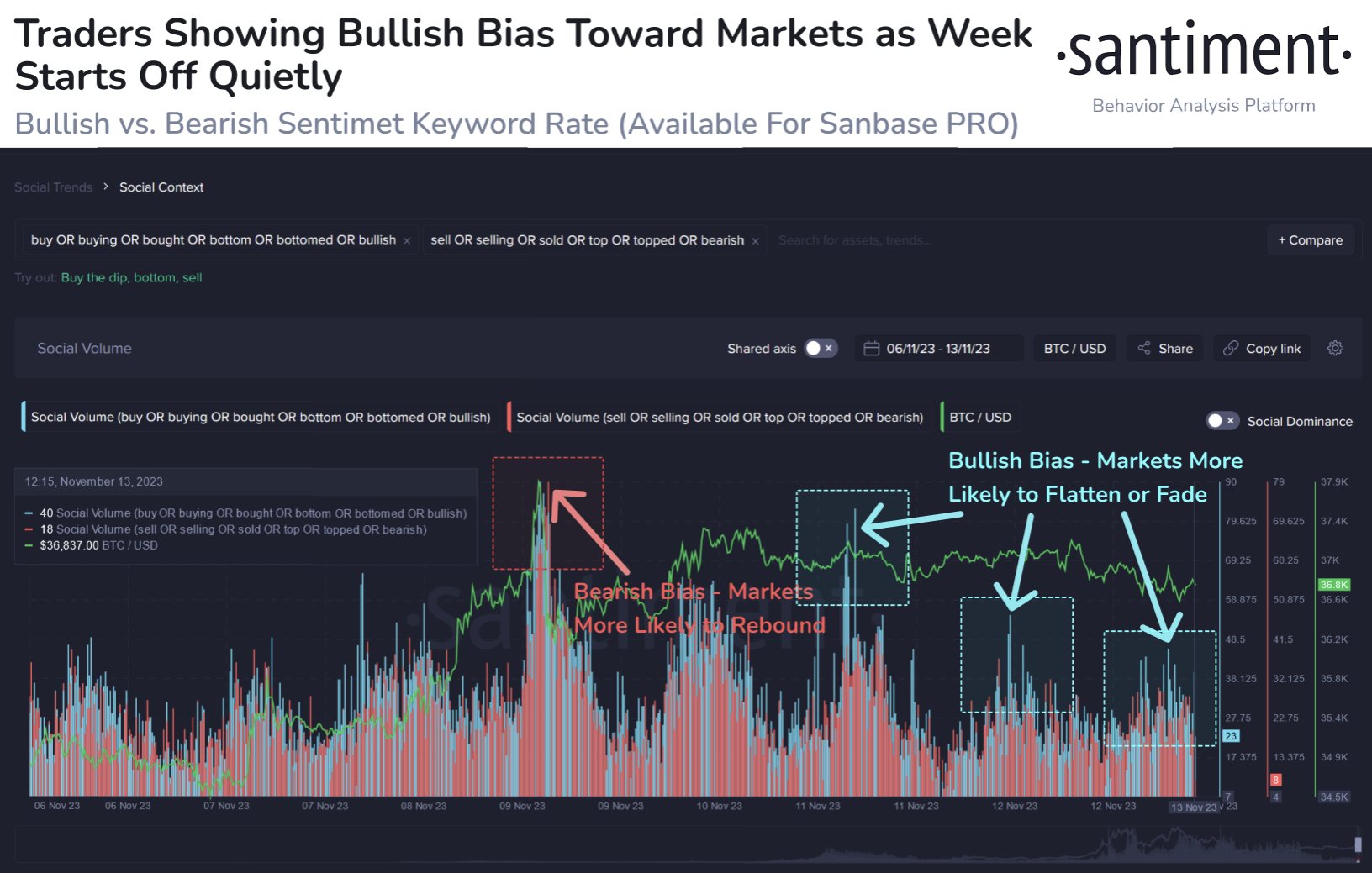

According to data from the on-chain analytics firm Santiment, social media users are still optimistic about cryptocurrency right now. The relevant indicator here is the “social volume,” which keeps track of the total number of unique social media posts/threads/messages that are making mentions of a given term.

By “unique,” what’s meant here is that the metric puts the same weight on all posts that talk about the term, regardless of how many times it mentions the topic. Because of this restriction, the indicator can provide insight into the social media behavior throughout the major platforms.

If the metric has a high value, it means that a large amount of users across the internet are talking about the term. The discussion isn’t limited to just a few threads (which could have been the case, had the indicator only counted the pure number of mentions, rather than the posts themselves).

In the context of the current discussion, Santiment has assembled the data from social media posts talking about Bitcoin and cryptocurrency and has then calculated the social volume of sentiment-related terms by going through it. These terms are ones such as buy or bought in the case of bullish and sell or bottom in the case of bearish sentiment.

The below chart shows the trend in the social volume for these terms for the cryptocurrency sector over the past week:

Looks like the market is holding a bullish majority mentality right now | Source: Santiment on X

As displayed in the above graph, the social volume of bearish-related terms has been lesser than the bullish ones recently, implying that the majority of social media users have been optimistic about Bitcoin and the wider sector recently.

Historically, such market conditions have actually not been ideal for price rises to take place, as the assets have rather moved sideways or declined during periods like these.

In the chart, the analytics firm has also pointed out recent occurrences of this pattern. This time, too, as social media users show FOMO, BTC and others have been either going down or moving flat.

Generally, a bearish sentiment being dominant has the opposite effect on the market, and rebounds can become more probable to take place for the cryptocurrencies.

This effect was in action when Bitcoin had initially observed its surge above the $37,000 mark recently. The coin had seen a pullback from near $38,000 to below $36,000, which had made social media users panic. This bearish bias, however, only worked to the benefit of the market, as the coin quickly rebounded.

As long as social media users remain hyped about the sector, a move up for BTC and others is unlikely currently. It now remains to be seen whether the sentiment will calm down in the coming days, potentially allowing space for a further rally, or if the sector will see some FOMO-induced pain.

Bitcoin Price

Bitcoin has seen a pullback towards the $36,200 level in the past day, as the chart below displays.

The value of the coin appears to have declined recently | Source: BTCUSD on TradingView