On-chain data shows the Dai sharks and whales have been growing their holdings recently, which could fuel Bitcoin’s rally.

Dai Sharks & Whales Have Bought 6.4% Of The Supply In Last Six Weeks

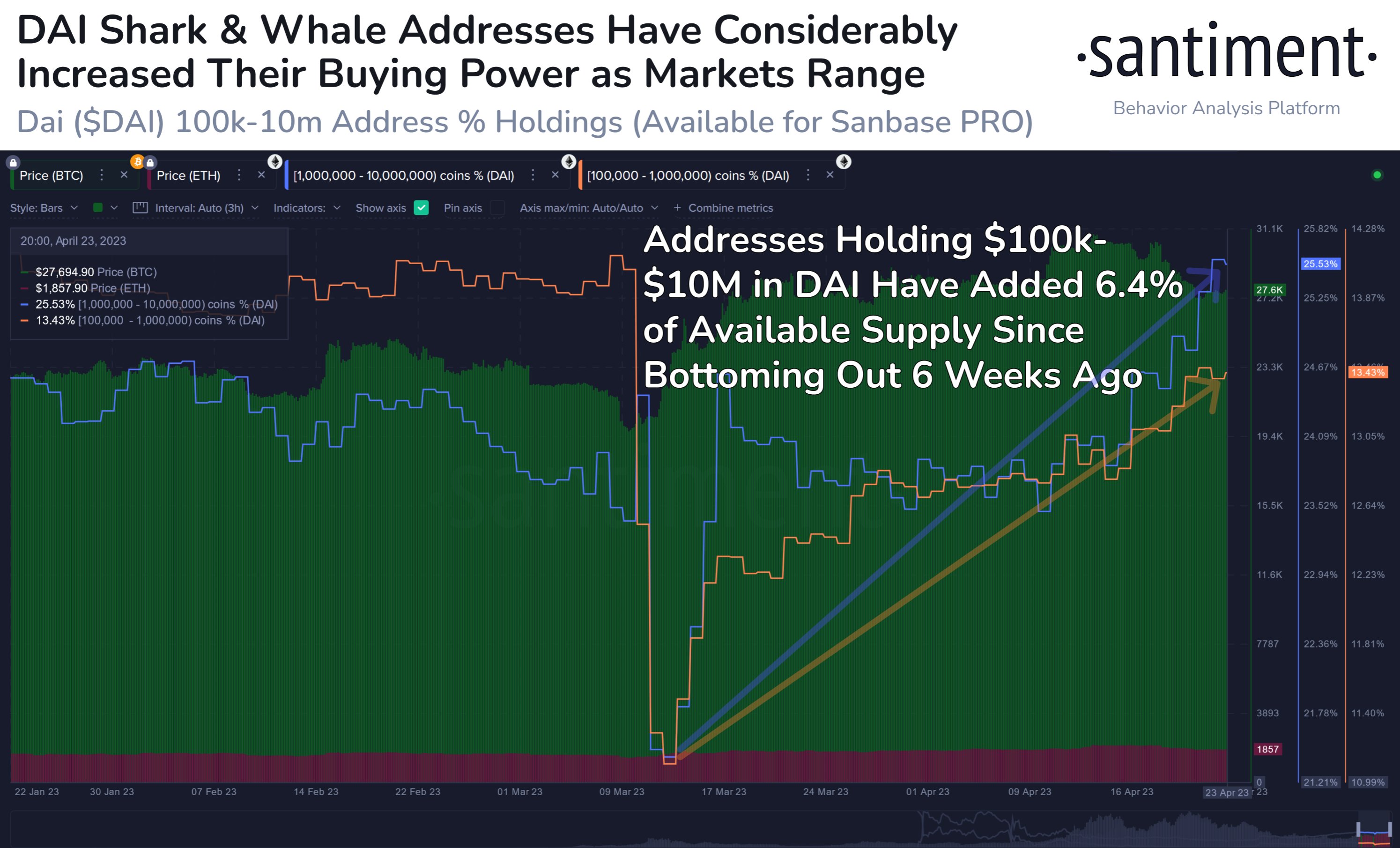

According to data from the on-chain analytics firm Santiment, the holdings of Dai whales and sharks had plunged to a bottom last month. The relevant indicator here is the “DAI Supply Distribution,” which tells us about the percentage of the total circulating supply of the stablecoin that each market wallet group is holding.

Addresses are divided into these wallet groups based on the number of coins they have in their balances. For example, the 100 to 1,000 coins cohort includes all addresses holding at least 100 and 1,000 tokens of the stablecoin.

If the Supply Distribution metric is applied to this group, then it would measure what percentage of the supply the combined balances of wallets satisfying this condition add up to.

In the context of the current topic, the bands of interest are 100,000 to 1 million coins and 1 million to 10 million coins. Here is a chart that shows the trend in the Supply Distribution for these two groups over the last few months:

The values of the two metrics seem to have been rapidly going up in recent days | Source: Santiment on Twitter

The first of these ranges ($100,000 to $1 million) corresponds to a Dai cohort called the “sharks,” while the latter one ($1 million to $10 million) represents the wallets of the “whales.”

These investors’ wallets have such large amounts that they can play an important role in the market. Naturally, the whales’ holdings are bigger than the sharks’, so they are the more powerful group.

Investors usually use stablecoins like DAI to escape the volatility associated with the other assets in the market. Such investors generally hold onto their stables until they feel the timing is right to re-enter volatile coins like Bitcoin and Ethereum. At this point, they convert their stables into them, thus providing a bullish boost to their prices.

The chart shows that the percentage of the total circulating Dai supply held by the sharks and whales plummeted in March when BTC fell below the $20,000 level. Soon after these investors shed their holdings, BTC’s price started climbing again.

This would suggest that the sharks and whales of this stablecoin shifted their coins into BTC while the cryptocurrency was trading around relatively low levels, thus helping it recover.

In the six weeks since then, these humongous investors have again accumulated the stablecoin and added around 6.4% of the circulating supply into their wallets. While the sharks’ holdings are currently less than what they were before the bottom, the whales’ treasuries have gone on to recover and surpass the holdings from earlier completely.

Recently, Bitcoin’s price has plummeted to the low $27,000 level. Whether the Dai sharks and whales convert their saved-up stacks here to take advantage of the dip and help the cryptocurrency recover, just like a month, remains to be seen.

BTC Price

At the time of writing, Bitcoin is trading around $27,300, down 7% in the last week.

BTC has sharply gone down | Source: BTCUSD on TradingView