The hype around meme-inspired cryptocurrency has caused a spike in the price of Ethereum gas in recent days. The rising demand for transactions on the Ethereum network is a direct effect of the rising value of these tokens.

There was a 10-month spike in Ethereum’s gas prices. According to data provided by Glassnode, the median price of ETH gas on a seven-day moving average has risen to 43.641 gwei, a level not seen since June 30 last year.

The network utilizes a measurement system based on the gwei. To perform a transaction or launch a smart contract on the Ethereum network, a certain amount of gas is required.

📈 #Ethereum $ETH Median Gas Price (7d MA) just reached a 10-month high of 43.641 GWEI

Previous 10-month high of 43.620 GWEI was observed on 30 June 2022

View metric:https://t.co/6QGDfZoULY pic.twitter.com/n9qDcd6NqD

— glassnode alerts (@glassnodealerts) April 21, 2023

Gas is a unit of computing effort that is used on the Ethereum network to carry out a certain operation. Gwei is the currency used to denote the cost of the gas needed to perform an action on the network.

One Gwei is equal to 0.000000001 Ether (ETH), which means that if the gas price is 20 Gwei, it would cost 0.00000002 ETH to execute the operation. The price of gas can vary depending on network congestion and demand.

Since miners are driven by higher gas prices to include transactions with higher gas costs in the blocks they mine, higher gas prices usually result in faster transaction processing times.

ETH market cap at $229.8 billion on the daily chart at TradingView.com

Ethereum Gas Fees Up 35%

The median gas price across a 7DMA peaked at 150 gwei in May 2022 and has since decreased significantly to the low-to-mid-teens. Then, beginning in March 2022, it began to settle at roughly 20 gwei, where it remained until the Merge went live in September of that year.

As of April 20, 2023, the average gas price for Ethereum transactions was 81.94 gwei, up from 60.82 gwei on April 19 and 44.42 gwei in 2022, representing a rise of 34.74% and 84.46%, respectively.

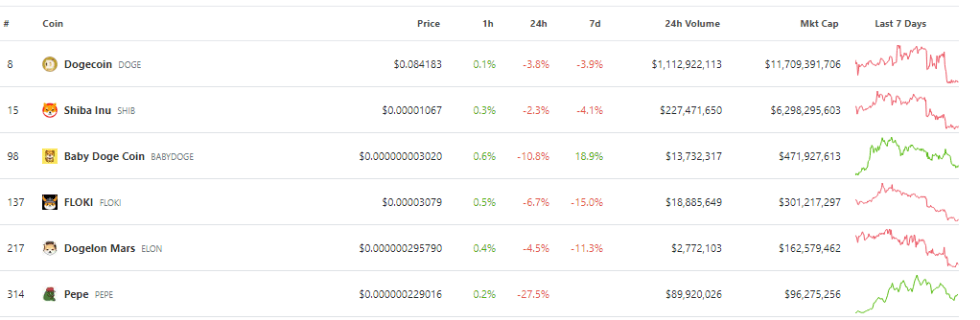

Memecoins are the buzz of the town right now, and Pepe The Frog is spearheading the charge. According to market analysis platform Santiment, recently deployed memecoins such as $TROLL, $APED, and $BOBO have surpassed the top gas-burning altcoins.

In particular, PEPE’s market cap has increased to little over $89 million in just a few days, making it the sixth largest memecoin.

Source: Coingecko

Ethereum Edges Bitcoin In Daily Fees

Meanwhile, independent Ethereum educator Anthony Sassano stated that the second-largest blockchain, Ethereum, had generated 28 times the revenue of Bitcoin through its daily fee structure.

Additionally, he mentioned layer-2 Ethereum platforms that have exceeded the BTC network in terms of daily revenue, such as Arbitrum One.

Image shows the daily and weekly revenue of various blockchains. Source: Twitter

The findings also showed Ethereum’s rising prominence in the dynamic cryptocurrency market.

Within the Ethereum community, gas fees have been a topic of conversation. Certain activities, such as small transactions or interacting with smart contracts of low value, can become prohibitively costly due to the network’s high gas fees.

-Featured image from Zipmex