Ethereum price found a key support level at the ascending trendline, rallying by over 8% to trade above the $2,600 level. If it maintains this momentum, it could retest the 200-day EMA at $2,700 and extend an additional 15% rally above its weekly resistance at $3,236. Notably, the top altcoin will experience more upside if the demand for Layer-2 blockchains grows.

As such, Ethereum based coins like Cutoshi, Dai, and Uniswap could help Ether record new highs as they gain traction from the wide market bullish momentum. This is why crypto whales are showing high interest in these three coins before the next bull market.

Crypto Whales Showing Interest In Cutoshi (CUTO)

Like DAI and UNI, crypto whales are showing interest in CUTO due to the fun back story behind its conception. It draws inspiration from the Chinese Lucky Cat and Satoshi Nakamoto’s core principles of blockchain technology. Cutoshi intends to tokenize good fortunes and bring them into the blockchain. It has adopted the power of decentralization, privacy, and financial freedom to build an ecosystem where decision making powers and control lie in the hands of its users.

Its ecosystem will feature superior tools that will bring DeFi to the masses. These include a multichain decentralized exchange, enabling users to trade and swap crypto assets seamlessly across multiple blockchains. Outside the DEX platform, there is also a learning academy that will offer users educational materials in DeFi and cryptocurrency to help them navigate their way through financial freedom.

The project has also prioritized its community with its farming protocol. Here, users who complete challenges and participate in the project’s events will be rewarded with CUTO tokens. So far, Cutoshi has successfully completed stage one and is in stage two, where CUTO tokens are available at a low-price entry point of $0.022. This marks a 46% leap from its initial offering of $0.015. It has also surpassed the $600K milestone as investors continue to be bullish about the project.

Uniswap Price Analysis: Can UNI Breakout To $20?

The price of UNI has seen a notable increase amid a wide market relief rally. It’s been fluctuating between $7.83 and $8.26, highlighting growing investor interest. This altcoin remains far below its all-time high of $44.97 witnessed in May 2021, roughly an 81.68% drop. On-chain technical indicators indicate that the Uniswap token faces resistance around the $10 level.

With an additional barrier at the $15 and $20 levels, if Uniswap’s price were to breach these resistance zones, it could push it toward the $20 target, a 134% rally from its current value. Additionally, Uniswap’s moving average convergence divergence (MACD) indicates a slight bullish momentum. The MACD line has moved above the signal line, and the histogram indicates green bars, further highlighting a positive sentiment.

Source: TradingView

Notably, Coinglass data reports that UNI derivatives have witnessed an uptick in trading activity. It highlights a strong rise in trading volume and open interest, which reflect heightened investor interest. This further suggests a strong upward potential for the UNI token.

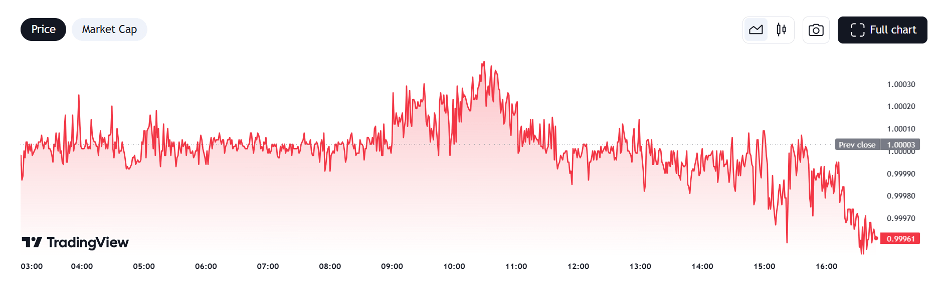

Could DAI Price Breach The $1 Mark?

DAI stablecoin is another Ethereum-based coin that could change Ether’s bearish trends. While its value is pegged to the US Dollar, the DAI token has managed to uphold its worth without a centralized trust, setting it apart from other stablecoins like Tether (USDT) and Paxos (PAX). Its decentralized nature, coupled with a lack of regulating authority, suggests that no government can influence or shut it down.

Additionally, the DAI coin was also created by Maker, an autonomous company with another project known as Makercoin (MKR), which is also an ERC 20 decentralized token. Notably, the stability of the coin is upheld through a lending system based on the Ethereum network. Users will need to deposit their ETH into a collateralized debt position.

Source: TradingView

The Maker offers DAI stablecoins by initiating a series of balancing mechanisms that usually push the price of DAI above the Dollar. On-chain technical indicators from TradingView suggest the stablecoin could breach the $1 mark for the long term as key resistance levels have been identified. Dai’s price is expected to reach $1.2993 by 2030.

Best Token To Buy

As the market prepares for a big surge, these three Ethereum-based altcoins are on the brink of parabolic runs. Cutoshi’s diverse market appeal will foster greater adoption, propelling its value to exponential heights.

For more information on the Cutoshi (CUTO) Presale:

Join and become a community member:

https://twitter.com/CutoshiToken