On-chain data shows Ethereum has observed a large exchange outflow recently, a sign that buying may be going on in the market.

Ethereum Exchange Supply Hits Lowest In 5.5 Years After $181 Million Outflow

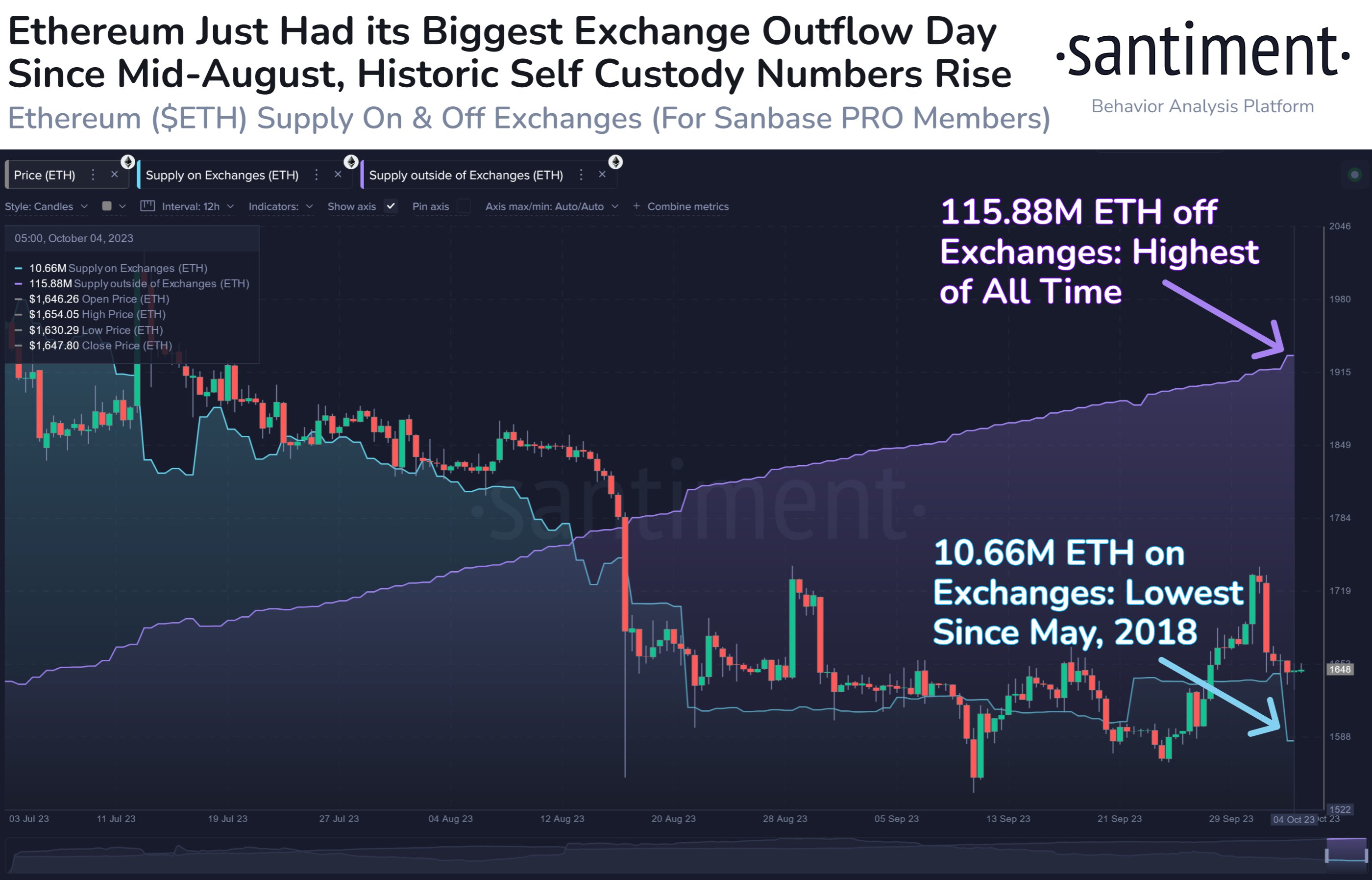

According to data from the on-chain analytics firm Santiment, ETH has just witnessed its largest exchange outflow day since August 21st. The indicator of interest here is the “supply on exchanges,” which keeps track of the total amount of Ethereum that’s currently sitting in the wallets of all centralized exchanges.

When the value of the metric goes down, it means that a net number of coins is exiting these platforms currently. Generally, investors take their coins off these central entities toward self-custodial wallets when they plan to hold onto them for extended periods, so this kind of trend can be a sign that HODLing is happening in the market.

On the other hand, the indicator’s value rising implies deposits are moving toward the exchanges right now. Investors may make such transfers for a variety of purposes, one of which could be selling, so such a trend can sometimes be a signal that a price correction could be coming soon.

There is also a counterpart indicator to the supply on exchanges: the “supply outside of exchanges,” which is pretty self-explanatory; it measures the total amount of supply sitting inside self-custodial wallets.

Now, here is a chart that shows the trend in the Ethereum supply on exchanges, as well as in the supply outside of these platforms, over the past few months:

The value of the two metrics has gone opposite ways in recent days | Source: Santiment on X

As shown in the above graph, the Ethereum supply on exchanges has seen a sharp plunge recently, as a large net outflow has occurred on these platforms. Naturally, a spike in the supply outside of exchanges occurred alongside this plunge, as supply transferred towards that side.

In these latest withdrawals, investors took out 110,000 ETH (worth around $181 million at the current exchange rate) towards self-custodial entities, leading to the supply on exchanges dropping to its lowest point since May 2018.

These outflows have come after the price of the asset has registered a pullback following its recent surge above the $1,700 mark, making it possible that these withdrawals are a sign of a net amount of buying activity taking place at the current prices.

From the chart, it’s visible that the supply outside of exchanges has been on a perpetual uptrend, regardless of whatever behavior the supply on exchanges has been showing.

This is obviously because of the fact that new ETH is constantly being minted in the form of validator rewards, so the total supply is always heading up. Since the newly minted supply counts under self-custody, it makes sense that that the supply outside of exchanges would keep showing overall growth.

ETH Price

Ethereum has been consolidating near the $1,600 level since the failed recovery attempt a few days back.

ETH has been moving sideways since its pullback | Source: ETHUSD on TradingView