The stock price of MicroStrategy (NASDAQ: MSTR) surged by a little over 9 percent following its acquisition of hundreds of millions of dollars worth of Bitcoin on Tuesday.

The public-traded firm closed the New York session higher at 155.75, up by 9.21 percent. Its gains came as a part of an all-round bullish session for the Nasdaq Composite. The tech-savvy index added 133.67 points, or 1.21 percent, to close the session at 11,190.32.

MicroStrategy increased its exposure in Bitcoin, an unconventional financial asset that aims to play hedge in times of global economic crisis. The firm’s co-founder, Michael Saylor, confirmed the purchase of $175 million worth of BTC units for their capital reserves.

That marked Microstrategy’s second-largest investment into the cryptocurrency since August 2020. Back then, the firm had reallocated $250 million worth of cash reserves to Bitcoin. It feared that the Federal Reserve’s unprecedented monetary policies would weaken the US dollar.

“This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash,” Mr. Saylor had said.

Depressive Data

A report published by Yahoo Finance earlier in September showcased MicroStrategy as an underperforming software company based on the industry’s average Returns on Capital Employed (ROCE). It is a measure of a firm’s yearly pre-tax profit against the capital employed in the business.

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

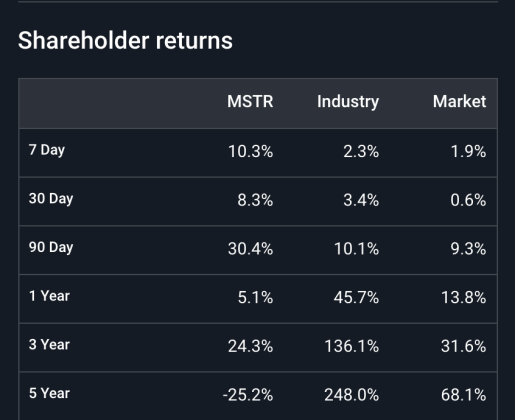

The ROCE of MicroStrategy stood just 3.5 percent. In comparison, the average ROCE of the Software industry average was 8.6 percent. It now stands down by 25 percent on a five-year timeframe. Moreover, the company has been employing additional capital despite showing any credible improvement in sales last year.

Data provided by SimpleWall.st further showed that Microstrategy’s earnings have declined by 34.6 percent in the last five years.

The data aggregator portal raised more red flags about MicroStrategy by calling its stock “overvalued” and highlighting its return on equity as low. Nevertheless, it noted that the firm’s Price to Book ratio is better than the industry’s.

“MSTR is good value based on its PB Ratio (3x) compared to the US Software industry average (6.8x), SimplyWall.st wrote.

Bitcoin as Hedge

MicroStrategy’s dramatic shift to an emerging Bitcoin market signaled its likelihood to use the cryptocurrency as a hedge against its weaker financial health.

While the move validated the cryptocurrency a store-of-value asset among the big firms, it also increased the possibility of major bearish activities should MicroStrategy decide to sell it to offset its losses elsewhere.

The risks increase as the US stock market bubble grows with the monetary support from the Federal Reserve. As it bursts later, it would first impact the stocks of overvalued firms. That poses a severe challenge to MicroStrategy of keeping its bullish bias afloat.

Overall, Bitcoin should have enough demand on the other side should the $425 million BTC whale decide to dump a portion of its holdings. Else, a significant downside correction should ensue.