A growing trend that I’ve noticed many clients asking about is fixed income on crypto investments. So it comes as no surprise that a company called BlockFi just announced they’re willing to pay a hefty interest for deposits in crypto.

Some crypto thought leaders have already expressed skepticism, including the blockchain lawyer Jake Chervinsky, who seems to be wondering where the money will come from.

Don’t get me wrong, 6.2% is a pretty good rate for fixed income. However, at this point, I’m not sure it’s worth the risk. Mexican 10 year bonds are currently paying 8%, which comes out to an annual return of about 6% after adjusting for inflation.

As crypto startups go, BlockFi is well backed. Hosted by Gemini, a regulated crypto exchange, and funded by the likes of Morgan Creek and Galaxy Digital, they’re certainly well connected within the industry.

Though this isn’t something that I would personally jump right into, I do hope that they succeed and will be keeping an eye on it from the side.

eToro, Senior Market Analyst

Today’s Highlights

European Trade War

SBI on Ripple

Crypto Markets today

Please note: All data, figures & graphs are valid as of March 6th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

As the US and China inch closer to a possible deal by the end of the month, a new dimension of the trade war will come into focus today.

European Trade Commissioner Cecilia Malmstrom will meet US Trade Rep Robert Lighthizer in Washington to see if they can settle some of their differences. Talks are still in early stages at this point so we don’t expect any significant breakthrough, but at least after today, we should get a good picture of the key issues and the direction these talks may take.

Stocks are largely mixed today and volumes remain thin, no doubt due to a lack of major news.

SBI on Ripple

In this market, it isn’t uncommon to hear people with rather aggressive and sometimes seemingly impossible targets. We have seen some digital assets experience 10,000%+ growth within a short timespan, so somehow this kind of targets can seem kind of normal.

The latest one that I found intriguing came from Yoshitaka Kitao, the President and Representative Director of SBI Holdings who is reportedly expecting to see XRP at $10 sometime this year.

Now, we know that SBI has big plans through their partnership with Ripple Labs, and recently announced a partnership with R3 Corda, who is also a partner with Ripple and Swift. However, the extent that these companies will actually utilize the Ripple token is still in question. So to hear this price call from a guy like Kitao, it fairly reassuring.

Questions about XRP and its standing in my personal portfolio did come up yesterday in our monthly webcast for eToro Platinum and Professional clients. You can catch the recording here. We did also talk about the rest of the macro markets and current trends too.

Mr. Mojo Rising

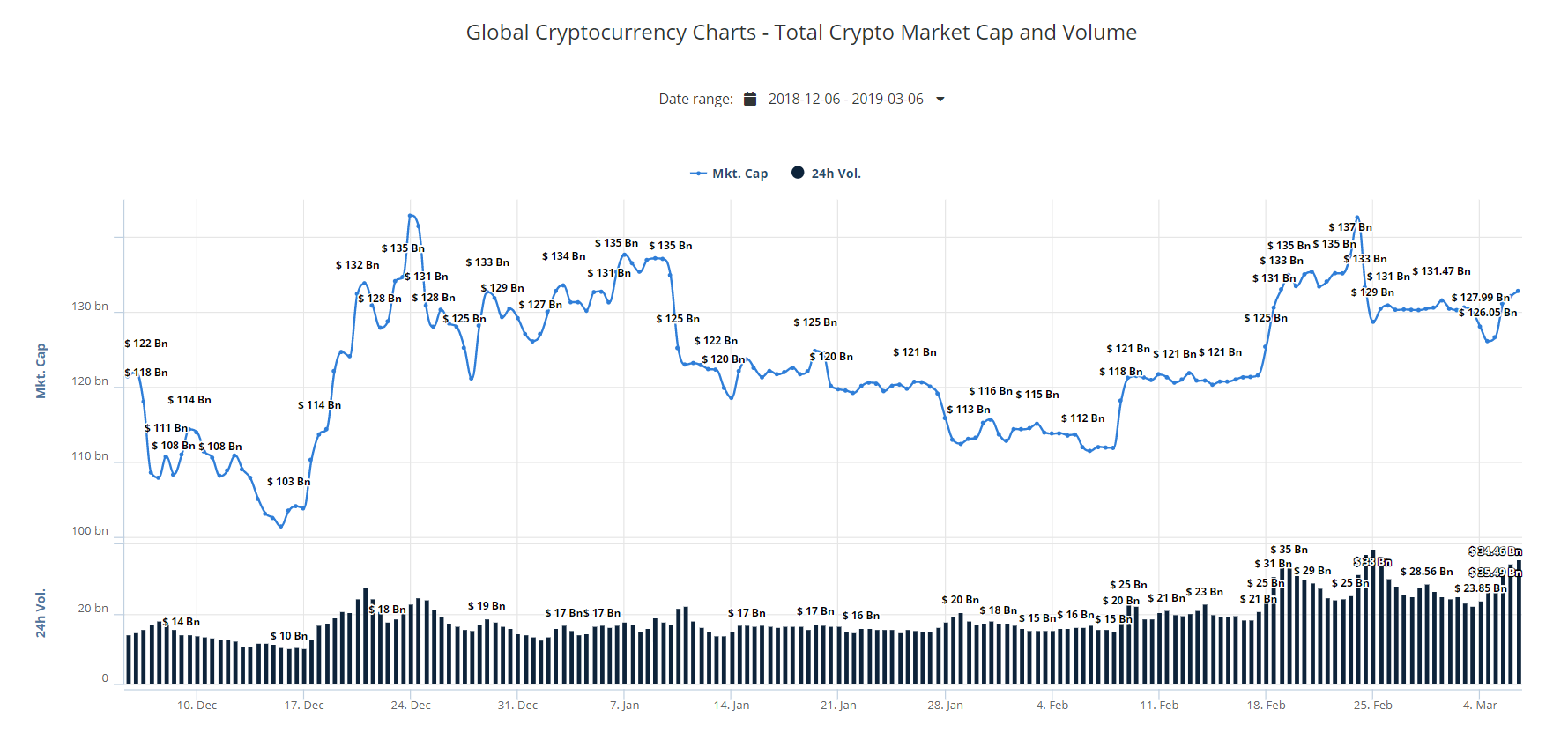

This morning we saw another big leap in the crypto markets, once again with Liteceoin, EOS, and Binance Coin leading the way.

The reasons that these three coins are leading have been discussed in previous updates enough that we shouldn’t have to reiterate them today. However, we can reiterate the fact that volumes on the bitcoin blockchain and volumes across global crypto exchanges are rising steadily and sustaining these higher levels.

Much like the song LA Woman, crypto rallies can sometimes get out of hand but lasting momentum usually builds up gradually.

Let’s have an awesome day!

Best regards,

Mati Greenspan

Senior Market Analyst

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared to utilize publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.