Bitcoin might have pulled back from near-all-time highs over the last few days, but buyers are not fazed. While traders watch price action, some analysts look at how on-chain data is evolving.

Number Of BTC Wholecoiners Drop To 1.013 Million Addresses

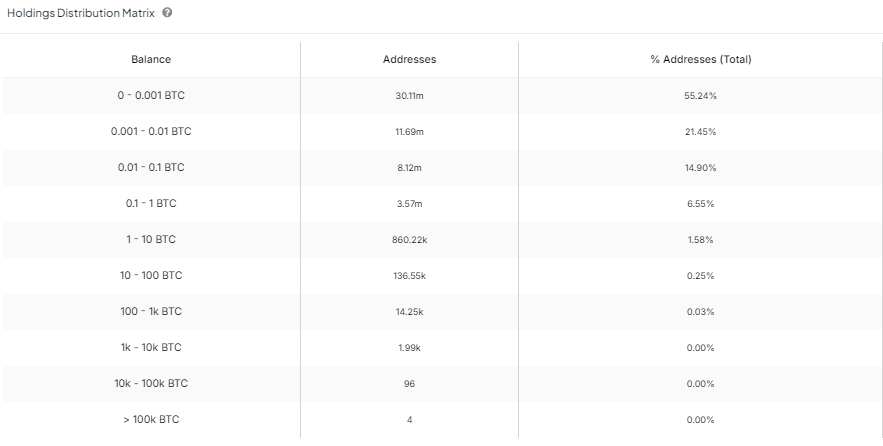

According to IntoTheBlock, the number of Bitcoin addresses has increased. With expanding valuation and adoption levels, they also discovered that as of November 1, the number of unique Bitcoin addresses managing at least 1 BTC is now above 1.013 million.

Interestingly, though the number of holders of BTC controlling over 1 BTC stands at more than 1 million, it is lower than at the start of the year. In early January 2024, more than 1.024 million addresses controlled at least 1 BTC.

Although the drop is subtle, pointing to possible HODLing, it highlights the importance of price as a factor affecting ownership. In January 2024, prices fell to as low as $38,500.

Since then, not only has the coin soared to an all-time high of around $74,000, but it has also crashed to nearly $50,000. After the extension to March highs, the dump in the following months through to August 5, when BTC fell to $49,000, there has been no point when the coin retested $38,000.

Effectively, the January lows marked this year’s lows, while prices continue to chop in between, rising and falling inside the $38,500 and $74,000 range. The bounce from August highs formed a solid base, and buyers are now angling to breach $74,000 in a buy trend continuation formation.

Will Rising Bitcoin Prices Lead To Unhealthy Concentration?

There is a direct correlation between prices and ownership. When BTC is more affordable, there will be a tendency for more addresses to be “wholecoiners.” On the other hand, if BTC soars, like it is at the moment, prices are out of range, mostly for retail, to purchase a whole BTC.

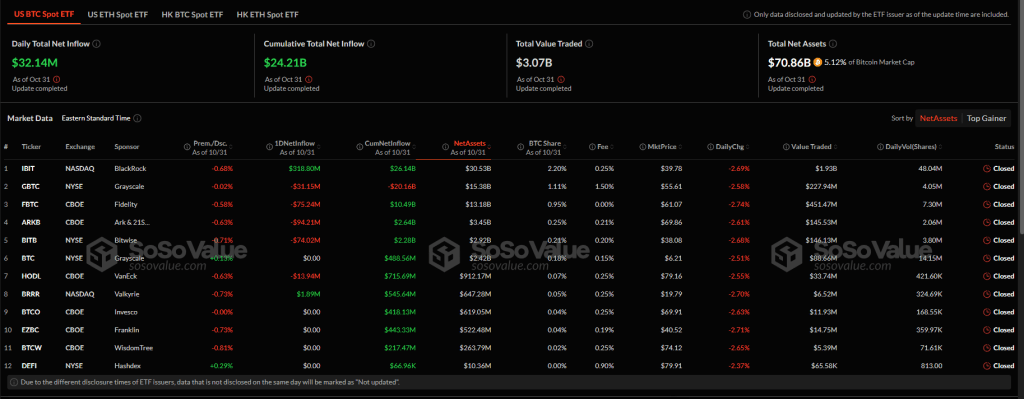

Accordingly, the generally high prices from January lows to spot rates may explain why there are few wholecoiners. The situation is even made worse with the approval of spot Bitcoin ETFs. Through firms like Fidelity and BlackRock, institutions demand BTC, which means a bigger chunk of the circulating supply is concentrated in a few whale wallets.

Analysts predict crypto prices to rally if Donald Trump wins this November election. For this reason, the number of wholecoiners will likely shrink even further as a few whales, mostly spot Bitcoin ETF issuers, tighten their grip.