Bitcoin liquidations have been massive this year. With the swings in price during the course of the year, there have been liquidations along long and shorts that have come out into the billions of dollars. Investors have oftentimes gotten greedy and have had to deal with the consequences of their impatiences given the large number of liquidations in a short period of time.

For 2021 so far, there have been a number of memorable liquidations that have taken place. One was during the September 7th crash that saw liquidations go into the hundreds of millions. This report takes a look at the liquidations of 2021 and what it has amounted to as the year draws to a close.

Related Reading | A Look Inside The Record-Breaking Year Of Bitcoin And Ethereum Futures

Bitcoin Traders Getting Rekt

While things like funding rates, futures basis, and leverage have been hot topics in the space, none have come close to highlighting how much risk traders took in the market this year. The liquidation numbers take care of this as it shows that bitcoin traders have had what had been to be a very risky year, taking some big leaps that have left them burned in its wake.

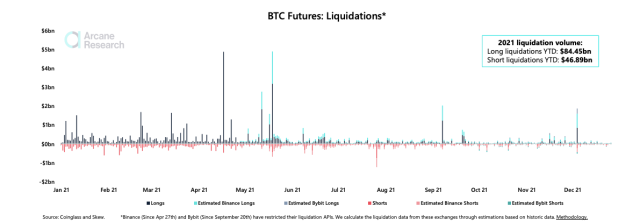

According to a report from Arcane Research, there have been over $100 billion liquidations for the year 2021 alone. This varies across long and short liquidations, with the latter taking most of the hit.

Bitcoin liquidations surpass $100 billion | Source: Arcane Research

Long liquidations for the year came out to a whopping $84.45 billion. A result of various crashes that saw long traders losing massively in the market. Most driven by the bullish trend that the digital asset had maintained for most of the year and believing that bitcoin would continue on this trend.

Short liquidations came out much lesser compared to the long. At $46.89 billion, this is 50% less than the long liquidations. Nevertheless, it is still a significant number that shows that short traders also got burned by the market’s volatility, even if not to the same extent as long traders.

Exchanges With The Most Liquidations

With the bitcoin liquidations that took place in the crypto market, some exchanges suffered more than others. Mostly, it comes down to the fact that these exchanges are bigger and as such attract more traders who place more trades on the platform. Then when liquidations take place, they record the highest volumes compared to others. This is the case with Binance and ByBit.

Related Reading | MicroStrategy Is The Sole Driver Of Bitcoin Corporate Treasury Balance Growth

These two exchanges saw the majority of liquidations across both longs and shorts. Binance, being the largest crypto exchange in the world, saw the largest portion of this, while ByBit came a close second.

These liquidation trends are expected to continue well into 2022. The reason for this is that more traders are developing larger risk appetites and are hoping to make money through trading. With bitcoin’s price continuing to be highly volatile, a good number of these traders will be liquidated regardless of whether they are long or short in the market.

BTC downtrend continues | Source: BTCUSD on TradingView.com

Featured image from CointribuneBitc, charts from Arcane Research and TradingView.com