Bumper Finance’s lucrative liquidity program has arrived! From the 14th July, investors wanting to put their stablecoin reserves to work during this time of unprecedented certainty now have a exciting option to support a protocol that promises to make the savage dips of recent crypto history a thing of the past – at least for those involved in the novel DeFi protection protocol.

Bumper Finance is offering early providers of liquidity to the protocol an astonishing 300%+ APR on their stablecoin reserves. Many crypto veterans are currently holding plenty of stablecoins after the recent bull surge and retracement and want to put them to use, and Bumper Finance offers an excellent way to do that.

Concerns about Volatility

There is plenty of talk that the bear market has begun, but equal hope that this is merely a period of reconciliation before the next great surge. Investors who do not want to cash out their portfolio but are worried about sudden price drops face a difficult choice. If they exchange their portfolio for stablecoins, they may miss out on a renewed push to asset ATHs – while also being unable to provide their crypto to DeFi protocols to harvest yields. If they keep their assets, then government regulations and media FUD may continue to push down on portfolio values.

As with all emerging asset classes, crypto is prone to serious volatility. Even the most ardent supporter of the distributed ledgers of the future acknowledge that the heavy swings can make life difficult at times. Seeing patiently harvested yields obliterated by a single piece of news can be disheartening. However, it’s just as disheartening to see the federal government devalue the dollar on the daily. So what’s the solution? Stop-Losses can be useful, but they are cumbersome, finickity, and prone to being triggered by random flash crashes.

How Bumper Protects Assets from Volatility

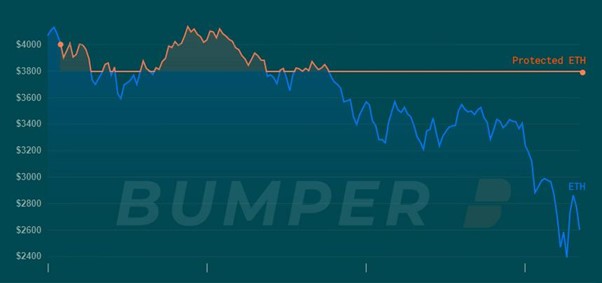

Enter Bumper Finance and its radical Defi protection protocol. Founded alongside development partner Block8, it heralds a new approach to crypto price fluctuations. By using it, holders can protect the price of their assets by paying a small premium. For example, if a user wants to shield 90% of the USDC value of their Ethereum (the first asset available on the protocol), they pay around 3% per annum for a policy. The protection is only locked for 2 weeks, meaning that it’s easy enough for someone to change their mind going forward.

If the worst happens, and the price of Ethereum falls 30%, the user can cash out their policy and keep the 20% difference, minus the premium. It opens the door to tactically cashing out policies too and reinvesting the stablecoin into further crypto assets. Best of all, if Ethereum’s price soars back to its ATH, then policy holders enjoy all the benefits of the rise – as the asset is still theirs to keep, and can even be further reinvested into secondary pools to continue gaining yields.

Where do those premiums go? Well, they go straight to the providers of liquidity – the makers – as a reward for providing the capital protection to the protocol. Yields are paid out in USDC and depositors also receive the protocol’s native $BUMP token for engaging with the protocol. This allows users to orchestrate governance and guide the protocol as it develops. Of course, those tokens can also be sold on the open market for a satisfying return.

How the Liquidity Program Rewards Backers

Bumper Finance’s liquidity program is generous. Day 1 investors who lock their funds for 3 months can expect approximately 100% APR on their stablecoin deposits from the yields of $BUMP generated by policyholders. Throughout the 12 week period, $22 million of $BUMP is available to be farmed.

What’s more, getting in early provides access to a private sale before the public sale goes live. USDC depositors will be able to buy up to 20% of the value of their deposit in $BUMP.

Of course, the unique protection offered by Bumper means that TVL could be far exceeded – and the corresponding value of the token could go higher still. Rewards are sliding, and only early investors will be allowed into the private sale. However, those wishing to support Bumper’s ambitious protocol can do so at any time during the 12 week period by using the Bumper dApp.

Lucrative Protection

The intriguing thing about Bumper Finance and $BUMP is the knock-on effects it could have on the DeFi space. Once the protocol is fully running and is helping holders lock in the price of their crypto assets and reward stablecoin holders with significant yields, it promises to provide a route to confidence for many investors and help buoy the market as a whole.

The team’s marketing calls it “God-mode for crypto”, and it certainly will feel like a miracle to those who have patiently accumulated their assets and want to underline a price floor that they never have to go below. The DeFi space will flourish as a result of protection from sudden price drops and the chance for more assets to be put productively to work. The crypto market is due for a little bump to help it out – and with $BUMP, it has just found it.