The on-chain analytics firm Santiment has revealed that the altcoins have been showing a recent divergence in network growth.

Altcoins Are Observing Polarization When It Comes To Network Growth

In a new post on X, Santiment has explained how the altcoins have been separating from each other following the big Bitcoin spot ETF news last week. The indicator of interest here is the “network growth,” which keeps track of the number of new addresses joining any cryptocurrency’s network.

The new addresses are defined as those coming online on the blockchain for the first time (that is, they are making their very first transaction). New addresses might pop up on any network for many reasons.

Some cryptocurrency users like to make a new address whenever they want to participate in fresh trades to maintain their privacy. Such users would naturally contribute to growth in this metric.

This new address type wouldn’t be relevant for the more comprehensive network. Something that can be very relevant (and is often, in fact, the main driver of network growth), on the other hand, is adoption.

New users joining the blockchain would create their fresh addresses, thus increasing the network growth indicator. Adoption is usually a positive development for any asset, as it provides a more solid foundation for sustainable moves to occur in the future.

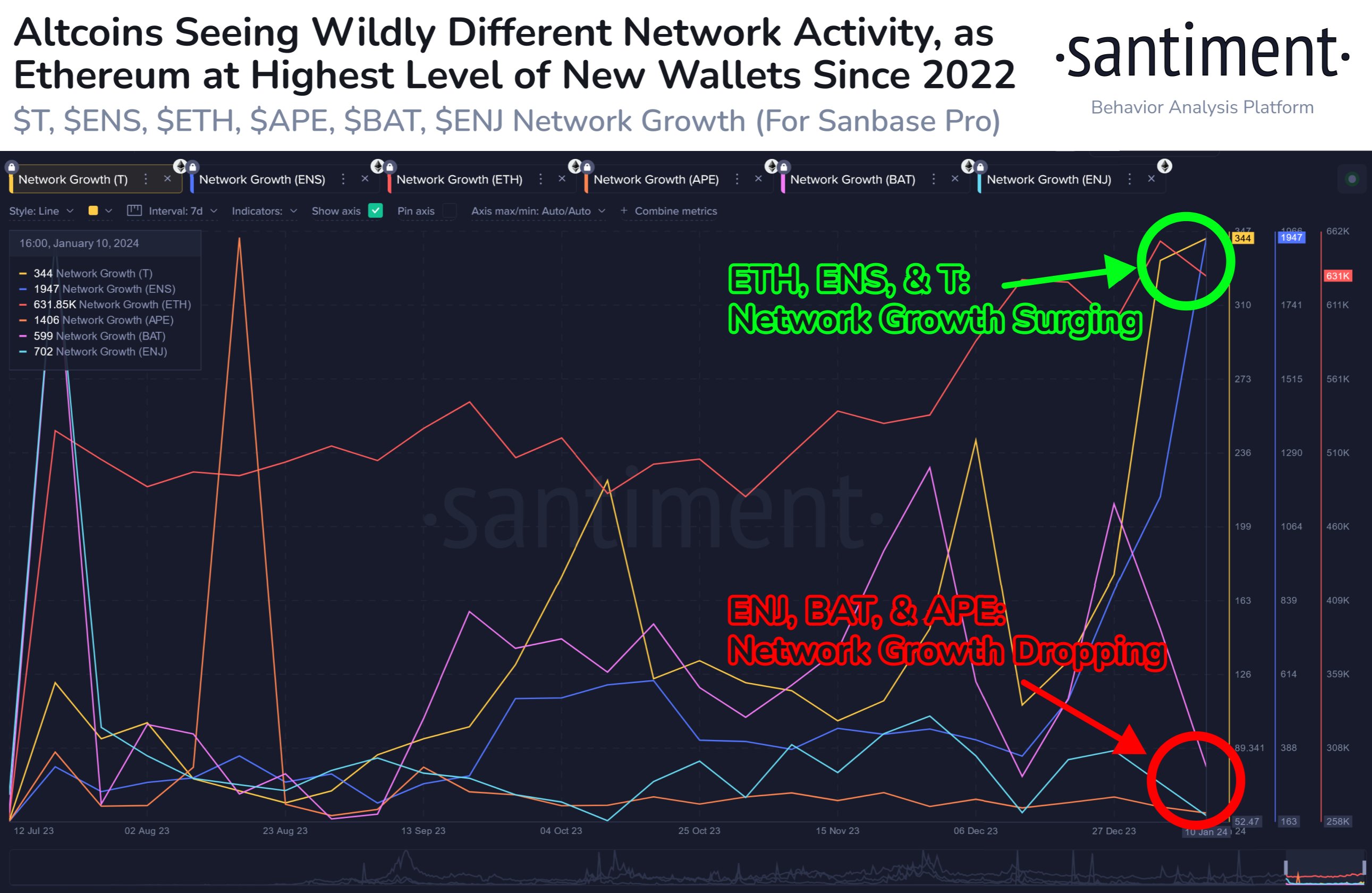

Now, here is the chart shared by Santiment that shows the trend in the network growth for six different altcoins, showcasing the two different sides the alts have separated into recently:

Looks like half of these coins have seen the metric shoot up, while the other half have observed a decline | Source: Santiment on X

As displayed in the above graph, Ethereum (ETH), Ethereum Name Service (ENS), and Threshold (T) have enjoyed a surge in their respective network growths recently.

The latter two assets have seen the metric increase by about 124% and 195%, respectively, which are much larger than ETH’s rise of just 6%. However, this disparity is only restricted to the indicator’s growth, not its pure value.

ENS and T are much smaller altcoins than ETH, the second largest cryptocurrency by market cap, so they observe fewer new addresses in absolute terms.

To put things into perspective, Ethereum is currently observing over 631,850 new addresses coming up on the network, while the metric’s value for the two smaller alts is just 1,947 and 344, respectively.

On the other side of the spectrum are ApeCoin (APE), Basic Attention Token (BAT), and Enjin Coin (ENJ), which have seen their network growths decline by 23%, 42%, and 32%, respectively.

According to Santiment, altcoins have become polarized like this across the sector. This divergence has been forming for some time but has only deepened following the Bitcoin spot ETF approvals.

The Alts observing more adoption would naturally be better set for long-term growth than the other side, although whether they would live up to this potential remains to be seen.

ETH Price

Whereas Bitcoin has struggled recently, Ethereum has managed to shine a bit as its price has been able to break above the $2,500 level.

ETH has gone through some rise in the last ten days or so | Source: ETHUSD on TradingView