Canadian regulators have advised putting in place a coordinated oversight regime for all crypto trading platforms. Crypto platforms that are seeking registration will need to sign an undertaking to adhere to investor protections before they fall under formal regulatory surveillance.

This move follows the enormous fall of the global cryptocurrency platform FTX. This is among the new guidelines that have been set by the Canadian Securities Administrators (CSA), which is an umbrella body for securities regulators in the Canadian region.

According to the Canadian Securities Administrators, crypto oversight has been strengthened. The CSA said:

Following recent events in the crypto market, the CSA is strengthening its approach to oversight of crypto trading platforms by expanding existing requirements for platforms operating in Canada.

The CSA is a body that comprises securities regulators from 10 different provinces and three territories in Canada. From now on, the CSA aims at expanding the current requirements for crypto platforms that are presently operating within the country.

Not only will the regulatory grip within the country be tightened, but licensing will also be tightened, including firms based outside the country but still accessible to Canadian citizens.

The ‘Undertaking’ For The Crypto Platforms

The pre-registration “undertaking” as determined by the CSA has to include a pledge that the Canadian client’s assets shall be held with a proper custodian, alongside, these assets have to be kept separate from the platform’s proprietary business. These platforms will not be allowed to offer margin or leverage for Canadian clients in particular.

In case the pre-registration undertaking is not offered by the principal regulator within a deadline to be determined or if the platform has not shut all its operations in Canada, then, “all applicable regulatory options to bring the platform into compliance with securities law, including enforcement action, will be considered,” as stated by the CSA.

Preliminary Plans To Tighten Oversight On Crypto Were Announced Earlier

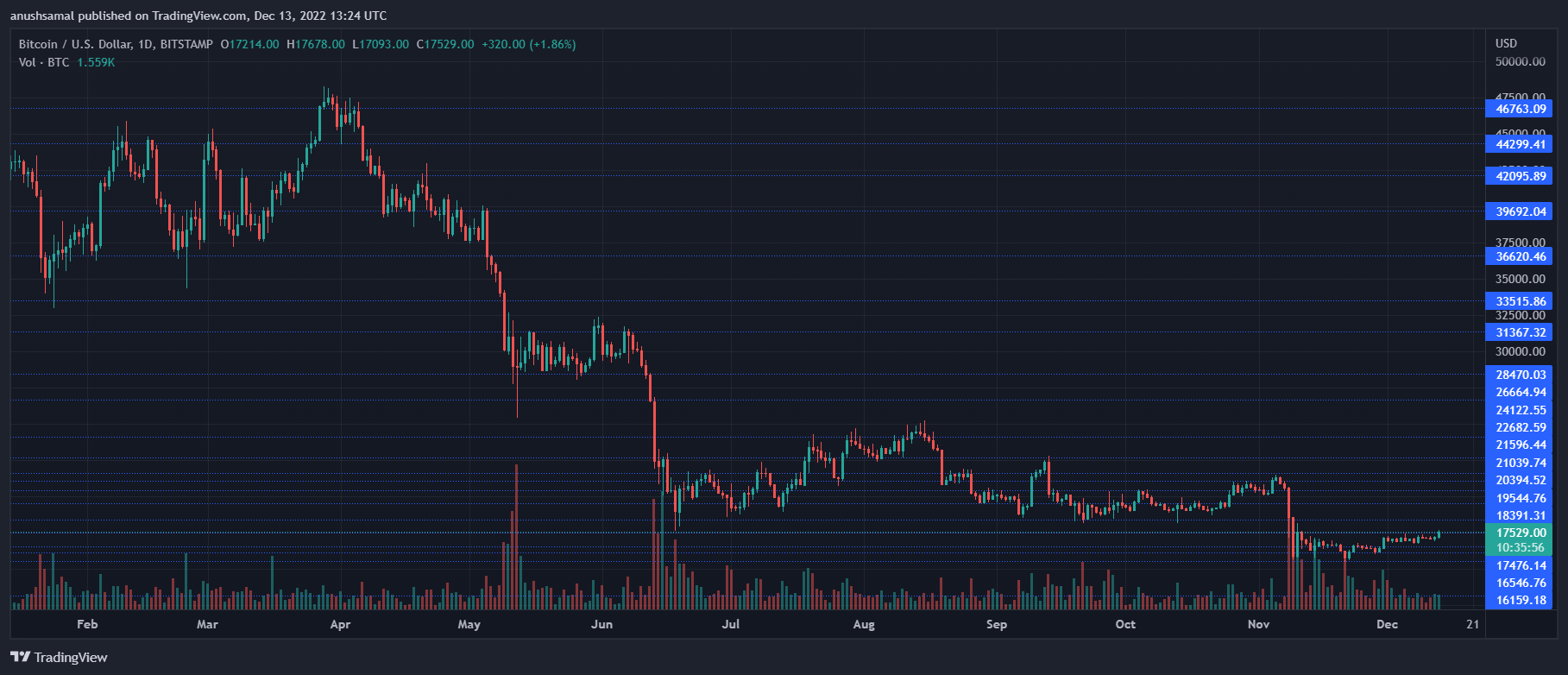

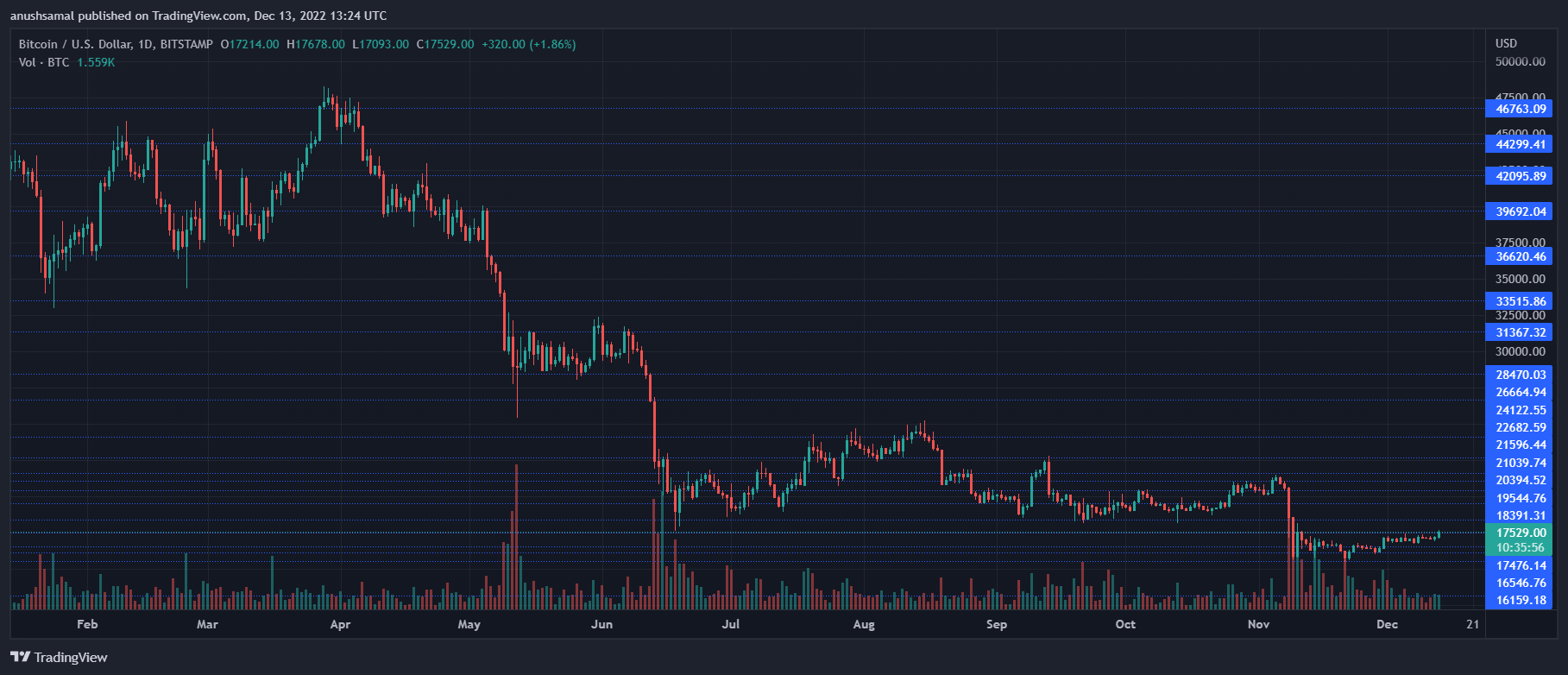

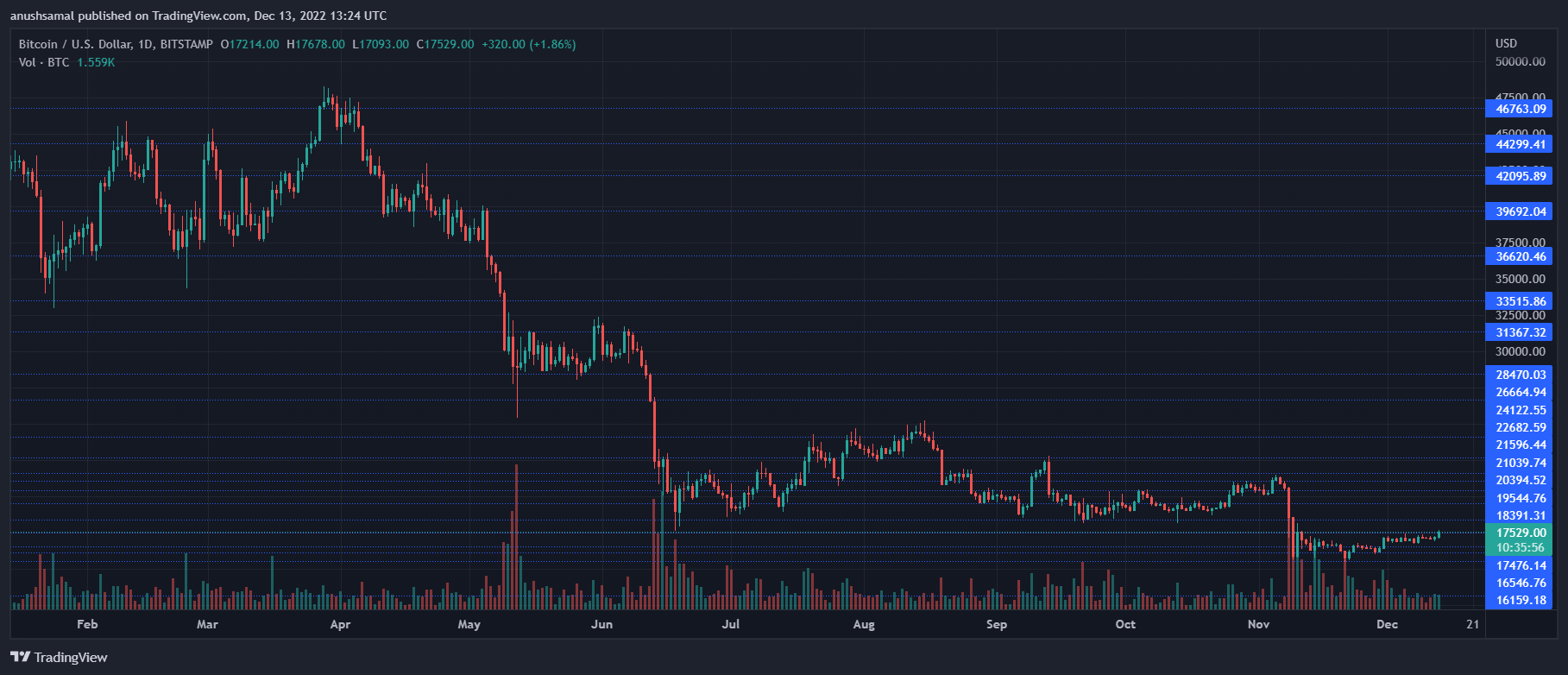

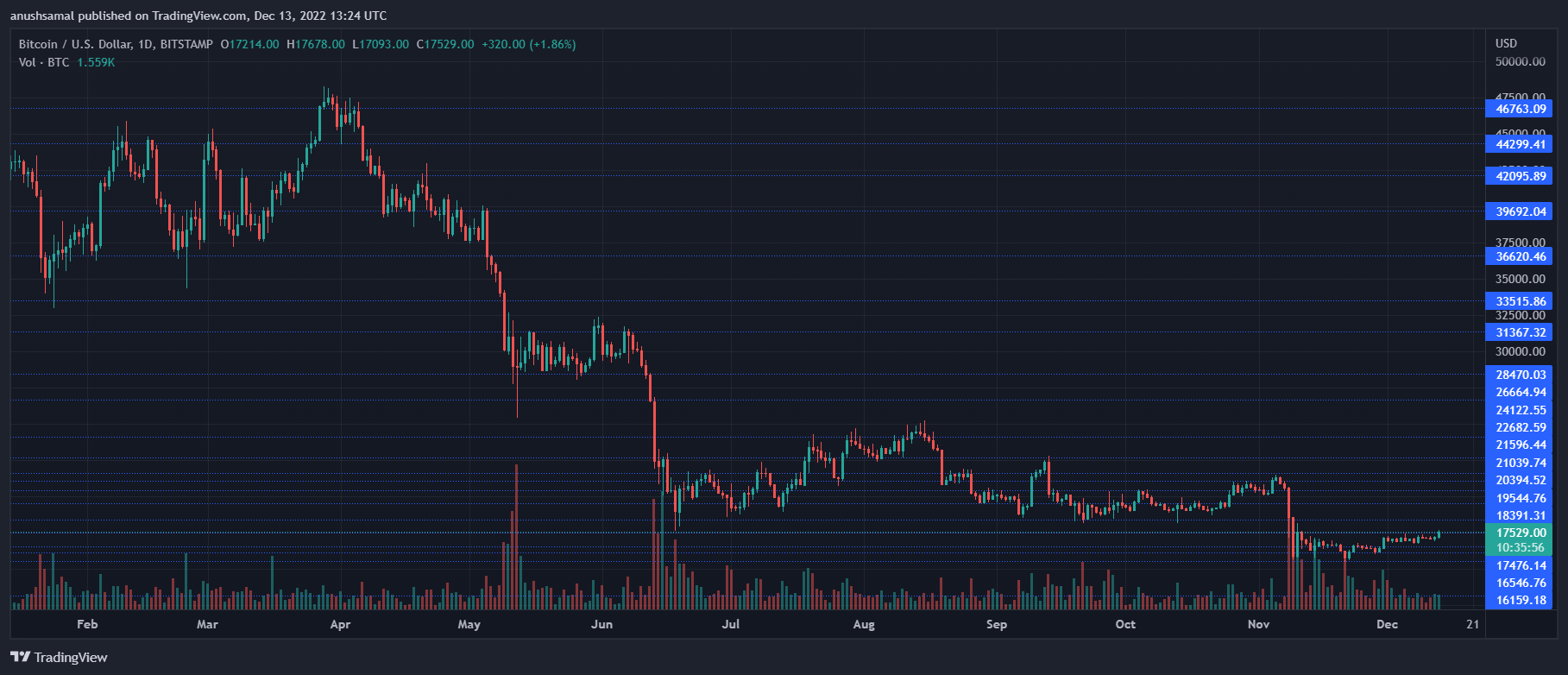

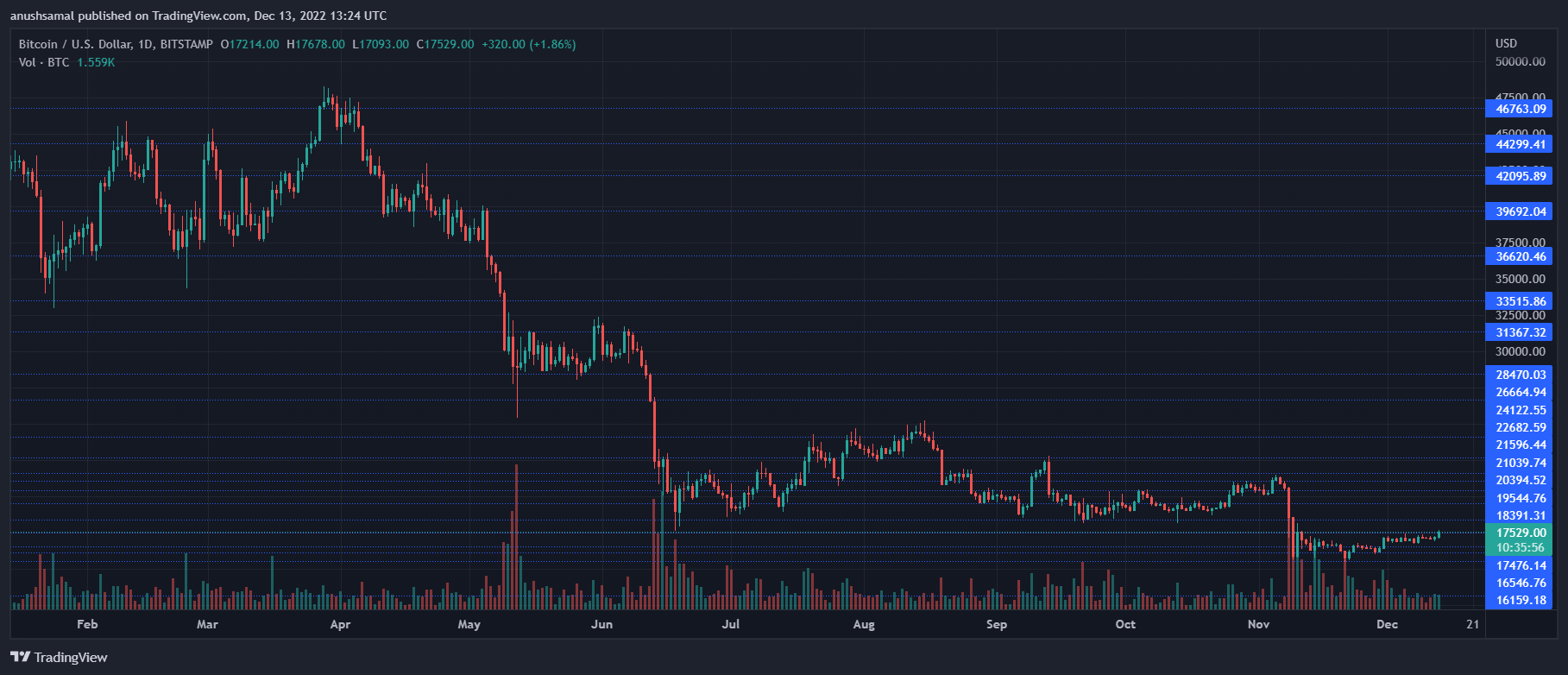

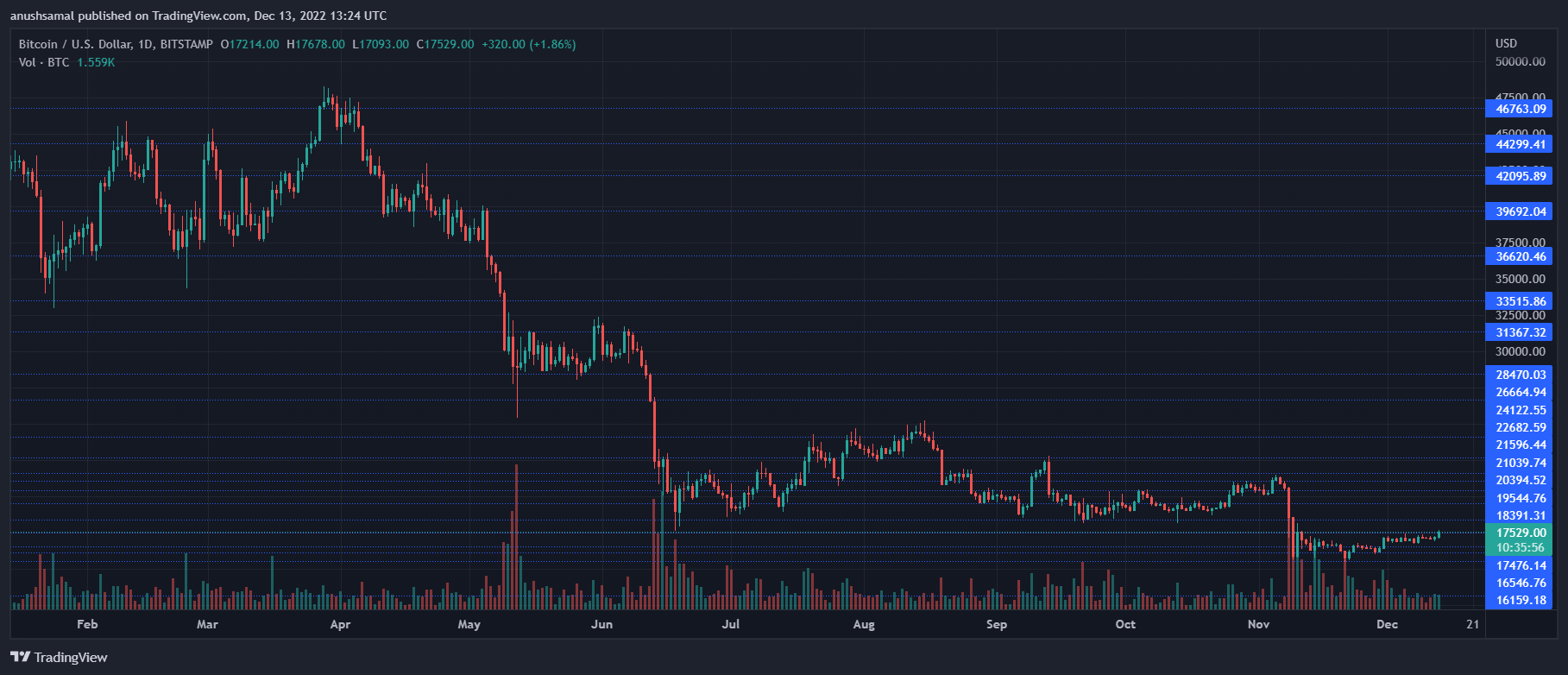

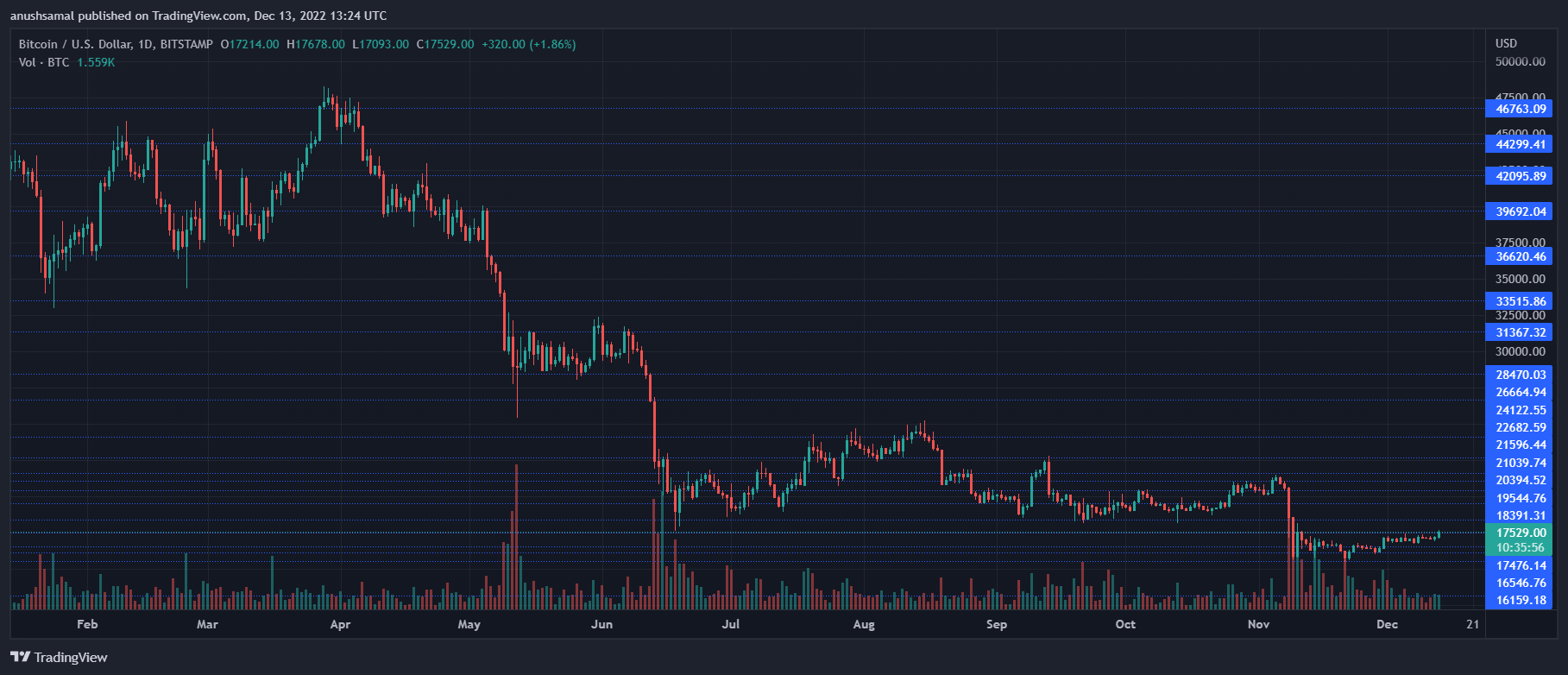

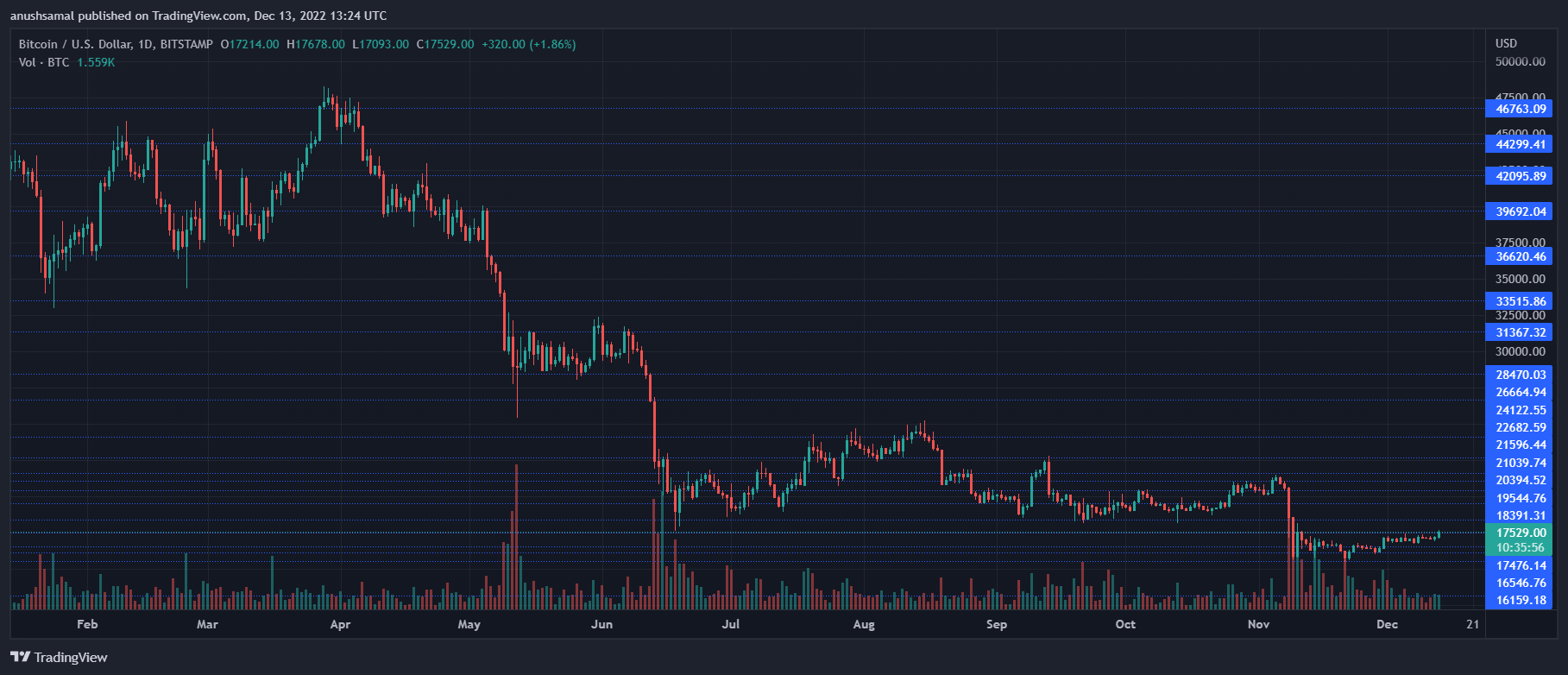

Bitcoin was priced at $17,500 on the one-day chart | Source: BTCUSD on TradingView

The CSA additionally stated:

Canadian investors are urged to exercise caution and consider seeking advice from a registered investment advisor before investing in crypto.

The watchdog further remarked that it considers stablecoins “securities and/or derivatives,” which are also prohibited. Canadian traders shall not be allowed to trade or even be exposed to such crypto assets on either registered or pre-registered platforms.

Canadian regulators have advised putting in place a coordinated oversight regime for all crypto trading platforms. Crypto platforms that are seeking registration will need to sign an undertaking to adhere to investor protections before they fall under formal regulatory surveillance.

This move follows the enormous fall of the global cryptocurrency platform FTX. This is among the new guidelines that have been set by the Canadian Securities Administrators (CSA), which is an umbrella body for securities regulators in the Canadian region.

According to the Canadian Securities Administrators, crypto oversight has been strengthened. The CSA said:

Following recent events in the crypto market, the CSA is strengthening its approach to oversight of crypto trading platforms by expanding existing requirements for platforms operating in Canada.

The CSA is a body that comprises securities regulators from 10 different provinces and three territories in Canada. From now on, the CSA aims at expanding the current requirements for crypto platforms that are presently operating within the country.

Not only will the regulatory grip within the country be tightened, but licensing will also be tightened, including firms based outside the country but still accessible to Canadian citizens.

The ‘Undertaking’ For The Crypto Platforms

The pre-registration “undertaking” as determined by the CSA has to include a pledge that the Canadian client’s assets shall be held with a proper custodian, alongside, these assets have to be kept separate from the platform’s proprietary business. These platforms will not be allowed to offer margin or leverage for Canadian clients in particular.

In case the pre-registration undertaking is not offered by the principal regulator within a deadline to be determined or if the platform has not shut all its operations in Canada, then, “all applicable regulatory options to bring the platform into compliance with securities law, including enforcement action, will be considered,” as stated by the CSA.

Preliminary Plans To Tighten Oversight On Crypto Were Announced Earlier

Bitcoin was priced at $17,500 on the one-day chart | Source: BTCUSD on TradingView

The CSA additionally stated:

Canadian investors are urged to exercise caution and consider seeking advice from a registered investment advisor before investing in crypto.

The watchdog further remarked that it considers stablecoins “securities and/or derivatives,” which are also prohibited. Canadian traders shall not be allowed to trade or even be exposed to such crypto assets on either registered or pre-registered platforms.

Canadian regulators have advised putting in place a coordinated oversight regime for all crypto trading platforms. Crypto platforms that are seeking registration will need to sign an undertaking to adhere to investor protections before they fall under formal regulatory surveillance.

This move follows the enormous fall of the global cryptocurrency platform FTX. This is among the new guidelines that have been set by the Canadian Securities Administrators (CSA), which is an umbrella body for securities regulators in the Canadian region.

According to the Canadian Securities Administrators, crypto oversight has been strengthened. The CSA said:

Following recent events in the crypto market, the CSA is strengthening its approach to oversight of crypto trading platforms by expanding existing requirements for platforms operating in Canada.

The CSA is a body that comprises securities regulators from 10 different provinces and three territories in Canada. From now on, the CSA aims at expanding the current requirements for crypto platforms that are presently operating within the country.

Not only will the regulatory grip within the country be tightened, but licensing will also be tightened, including firms based outside the country but still accessible to Canadian citizens.

The ‘Undertaking’ For The Crypto Platforms

The pre-registration “undertaking” as determined by the CSA has to include a pledge that the Canadian client’s assets shall be held with a proper custodian, alongside, these assets have to be kept separate from the platform’s proprietary business. These platforms will not be allowed to offer margin or leverage for Canadian clients in particular.

In case the pre-registration undertaking is not offered by the principal regulator within a deadline to be determined or if the platform has not shut all its operations in Canada, then, “all applicable regulatory options to bring the platform into compliance with securities law, including enforcement action, will be considered,” as stated by the CSA.

Preliminary Plans To Tighten Oversight On Crypto Were Announced Earlier

Bitcoin was priced at $17,500 on the one-day chart | Source: BTCUSD on TradingView

The CSA additionally stated:

Canadian investors are urged to exercise caution and consider seeking advice from a registered investment advisor before investing in crypto.

The watchdog further remarked that it considers stablecoins “securities and/or derivatives,” which are also prohibited. Canadian traders shall not be allowed to trade or even be exposed to such crypto assets on either registered or pre-registered platforms.

Canadian regulators have advised putting in place a coordinated oversight regime for all crypto trading platforms. Crypto platforms that are seeking registration will need to sign an undertaking to adhere to investor protections before they fall under formal regulatory surveillance.

This move follows the enormous fall of the global cryptocurrency platform FTX. This is among the new guidelines that have been set by the Canadian Securities Administrators (CSA), which is an umbrella body for securities regulators in the Canadian region.

According to the Canadian Securities Administrators, crypto oversight has been strengthened. The CSA said:

Following recent events in the crypto market, the CSA is strengthening its approach to oversight of crypto trading platforms by expanding existing requirements for platforms operating in Canada.

The CSA is a body that comprises securities regulators from 10 different provinces and three territories in Canada. From now on, the CSA aims at expanding the current requirements for crypto platforms that are presently operating within the country.

Not only will the regulatory grip within the country be tightened, but licensing will also be tightened, including firms based outside the country but still accessible to Canadian citizens.

The ‘Undertaking’ For The Crypto Platforms

The pre-registration “undertaking” as determined by the CSA has to include a pledge that the Canadian client’s assets shall be held with a proper custodian, alongside, these assets have to be kept separate from the platform’s proprietary business. These platforms will not be allowed to offer margin or leverage for Canadian clients in particular.

In case the pre-registration undertaking is not offered by the principal regulator within a deadline to be determined or if the platform has not shut all its operations in Canada, then, “all applicable regulatory options to bring the platform into compliance with securities law, including enforcement action, will be considered,” as stated by the CSA.

Preliminary Plans To Tighten Oversight On Crypto Were Announced Earlier

Bitcoin was priced at $17,500 on the one-day chart | Source: BTCUSD on TradingView

The CSA additionally stated:

Canadian investors are urged to exercise caution and consider seeking advice from a registered investment advisor before investing in crypto.

The watchdog further remarked that it considers stablecoins “securities and/or derivatives,” which are also prohibited. Canadian traders shall not be allowed to trade or even be exposed to such crypto assets on either registered or pre-registered platforms.

Canadian regulators have advised putting in place a coordinated oversight regime for all crypto trading platforms. Crypto platforms that are seeking registration will need to sign an undertaking to adhere to investor protections before they fall under formal regulatory surveillance.

This move follows the enormous fall of the global cryptocurrency platform FTX. This is among the new guidelines that have been set by the Canadian Securities Administrators (CSA), which is an umbrella body for securities regulators in the Canadian region.

According to the Canadian Securities Administrators, crypto oversight has been strengthened. The CSA said:

Following recent events in the crypto market, the CSA is strengthening its approach to oversight of crypto trading platforms by expanding existing requirements for platforms operating in Canada.

The CSA is a body that comprises securities regulators from 10 different provinces and three territories in Canada. From now on, the CSA aims at expanding the current requirements for crypto platforms that are presently operating within the country.

Not only will the regulatory grip within the country be tightened, but licensing will also be tightened, including firms based outside the country but still accessible to Canadian citizens.

The ‘Undertaking’ For The Crypto Platforms

The pre-registration “undertaking” as determined by the CSA has to include a pledge that the Canadian client’s assets shall be held with a proper custodian, alongside, these assets have to be kept separate from the platform’s proprietary business. These platforms will not be allowed to offer margin or leverage for Canadian clients in particular.

In case the pre-registration undertaking is not offered by the principal regulator within a deadline to be determined or if the platform has not shut all its operations in Canada, then, “all applicable regulatory options to bring the platform into compliance with securities law, including enforcement action, will be considered,” as stated by the CSA.

Preliminary Plans To Tighten Oversight On Crypto Were Announced Earlier

Bitcoin was priced at $17,500 on the one-day chart | Source: BTCUSD on TradingView

The CSA additionally stated:

Canadian investors are urged to exercise caution and consider seeking advice from a registered investment advisor before investing in crypto.

The watchdog further remarked that it considers stablecoins “securities and/or derivatives,” which are also prohibited. Canadian traders shall not be allowed to trade or even be exposed to such crypto assets on either registered or pre-registered platforms.

Canadian regulators have advised putting in place a coordinated oversight regime for all crypto trading platforms. Crypto platforms that are seeking registration will need to sign an undertaking to adhere to investor protections before they fall under formal regulatory surveillance.

This move follows the enormous fall of the global cryptocurrency platform FTX. This is among the new guidelines that have been set by the Canadian Securities Administrators (CSA), which is an umbrella body for securities regulators in the Canadian region.

According to the Canadian Securities Administrators, crypto oversight has been strengthened. The CSA said:

Following recent events in the crypto market, the CSA is strengthening its approach to oversight of crypto trading platforms by expanding existing requirements for platforms operating in Canada.

The CSA is a body that comprises securities regulators from 10 different provinces and three territories in Canada. From now on, the CSA aims at expanding the current requirements for crypto platforms that are presently operating within the country.

Not only will the regulatory grip within the country be tightened, but licensing will also be tightened, including firms based outside the country but still accessible to Canadian citizens.

The ‘Undertaking’ For The Crypto Platforms

The pre-registration “undertaking” as determined by the CSA has to include a pledge that the Canadian client’s assets shall be held with a proper custodian, alongside, these assets have to be kept separate from the platform’s proprietary business. These platforms will not be allowed to offer margin or leverage for Canadian clients in particular.

In case the pre-registration undertaking is not offered by the principal regulator within a deadline to be determined or if the platform has not shut all its operations in Canada, then, “all applicable regulatory options to bring the platform into compliance with securities law, including enforcement action, will be considered,” as stated by the CSA.

Preliminary Plans To Tighten Oversight On Crypto Were Announced Earlier

Bitcoin was priced at $17,500 on the one-day chart | Source: BTCUSD on TradingView

The CSA additionally stated:

Canadian investors are urged to exercise caution and consider seeking advice from a registered investment advisor before investing in crypto.

The watchdog further remarked that it considers stablecoins “securities and/or derivatives,” which are also prohibited. Canadian traders shall not be allowed to trade or even be exposed to such crypto assets on either registered or pre-registered platforms.

Canadian regulators have advised putting in place a coordinated oversight regime for all crypto trading platforms. Crypto platforms that are seeking registration will need to sign an undertaking to adhere to investor protections before they fall under formal regulatory surveillance.

This move follows the enormous fall of the global cryptocurrency platform FTX. This is among the new guidelines that have been set by the Canadian Securities Administrators (CSA), which is an umbrella body for securities regulators in the Canadian region.

According to the Canadian Securities Administrators, crypto oversight has been strengthened. The CSA said:

Following recent events in the crypto market, the CSA is strengthening its approach to oversight of crypto trading platforms by expanding existing requirements for platforms operating in Canada.

The CSA is a body that comprises securities regulators from 10 different provinces and three territories in Canada. From now on, the CSA aims at expanding the current requirements for crypto platforms that are presently operating within the country.

Not only will the regulatory grip within the country be tightened, but licensing will also be tightened, including firms based outside the country but still accessible to Canadian citizens.

The ‘Undertaking’ For The Crypto Platforms

The pre-registration “undertaking” as determined by the CSA has to include a pledge that the Canadian client’s assets shall be held with a proper custodian, alongside, these assets have to be kept separate from the platform’s proprietary business. These platforms will not be allowed to offer margin or leverage for Canadian clients in particular.

In case the pre-registration undertaking is not offered by the principal regulator within a deadline to be determined or if the platform has not shut all its operations in Canada, then, “all applicable regulatory options to bring the platform into compliance with securities law, including enforcement action, will be considered,” as stated by the CSA.

Preliminary Plans To Tighten Oversight On Crypto Were Announced Earlier

Bitcoin was priced at $17,500 on the one-day chart | Source: BTCUSD on TradingView

The CSA additionally stated:

Canadian investors are urged to exercise caution and consider seeking advice from a registered investment advisor before investing in crypto.

The watchdog further remarked that it considers stablecoins “securities and/or derivatives,” which are also prohibited. Canadian traders shall not be allowed to trade or even be exposed to such crypto assets on either registered or pre-registered platforms.

Canadian regulators have advised putting in place a coordinated oversight regime for all crypto trading platforms. Crypto platforms that are seeking registration will need to sign an undertaking to adhere to investor protections before they fall under formal regulatory surveillance.

This move follows the enormous fall of the global cryptocurrency platform FTX. This is among the new guidelines that have been set by the Canadian Securities Administrators (CSA), which is an umbrella body for securities regulators in the Canadian region.

According to the Canadian Securities Administrators, crypto oversight has been strengthened. The CSA said:

Following recent events in the crypto market, the CSA is strengthening its approach to oversight of crypto trading platforms by expanding existing requirements for platforms operating in Canada.

The CSA is a body that comprises securities regulators from 10 different provinces and three territories in Canada. From now on, the CSA aims at expanding the current requirements for crypto platforms that are presently operating within the country.

Not only will the regulatory grip within the country be tightened, but licensing will also be tightened, including firms based outside the country but still accessible to Canadian citizens.

The ‘Undertaking’ For The Crypto Platforms

The pre-registration “undertaking” as determined by the CSA has to include a pledge that the Canadian client’s assets shall be held with a proper custodian, alongside, these assets have to be kept separate from the platform’s proprietary business. These platforms will not be allowed to offer margin or leverage for Canadian clients in particular.

In case the pre-registration undertaking is not offered by the principal regulator within a deadline to be determined or if the platform has not shut all its operations in Canada, then, “all applicable regulatory options to bring the platform into compliance with securities law, including enforcement action, will be considered,” as stated by the CSA.

Preliminary Plans To Tighten Oversight On Crypto Were Announced Earlier

Bitcoin was priced at $17,500 on the one-day chart | Source: BTCUSD on TradingView

The CSA additionally stated:

Canadian investors are urged to exercise caution and consider seeking advice from a registered investment advisor before investing in crypto.

The watchdog further remarked that it considers stablecoins “securities and/or derivatives,” which are also prohibited. Canadian traders shall not be allowed to trade or even be exposed to such crypto assets on either registered or pre-registered platforms.