Rising stablecoins in Sub-Saharan Africa are transforming the financial landscape, providing a lifeline to millions of desperate individuals struggling against instability in their economies.

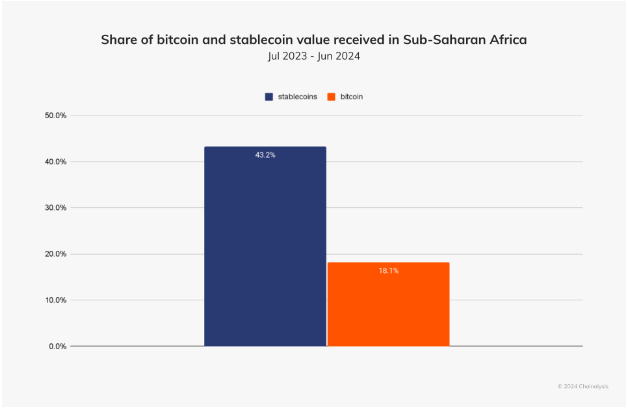

According to recent reports, stablecoins now make up 43% of total cryptocurrency transactions in this region. These are closely associated with currency devaluation and inflation that has driven most individuals and businesses to seek such an alternative that is potentially less volatile for the fulfillment of their financial needs.

A Change In Financial Policymaking

Stablecoins have been adopted massively in countries such as Nigeria and Ethiopia, even with inflation biting at the traditional currencies whereby the citizens have resorted to using digital money such as USDT and USDC to help preserve their savings.

In Nigeria, for instance, stablecoin transactions under $1 million approached $3 billion early this year, showcasing their importance for small to medium-sized transfers. Many Nigerians use cryptocurrencies to pay bills and other transactions, said Moyo Sodipo, COO of the Nigerian crypto exchange Busha. “It has now become practical for everyday transactions,” he said.

Source: Chainalysis

This is in line with a more general Sub-Saharan tendency. Comprising 2.7% of world transaction volume, the area raised on-chain value by $7.5 billion from July 2023 to June 2024. Countries like Kenya and South Africa are equally ascending in crypto adoption, with Kenya ranked 11th and South Africa 31st in Chainalysis’ Global Crypto Adoption Index.

Stablecoins As Economic Stabilizers

Stablecoins are proving central in stabilizing economies that otherwise tend to be easily disrupted because of currency fluctuations. According to Chris Maurice, the chief executive at Yellow Card, the digital currencies become a practical substitute for businesses involved in international trade in view of the foreign exchange shortages in Nigeria. “The banks don’t have dollars, the government doesn’t have dollars,” he noted, underscoring the urgent need for alternatives.

As of Oct. 3, 2014, the market cap of cryptocurrencies stood at $2.08 trillion. Chart: TradingView.com

Ethiopia is another nation seeing significant rise in stablecoin use; retail-sized transfers of the stablecoin rise by 180% year over year. This rise followed the government’s drastic devaluation of the birr currency by restricting the local currency to reduce borrowing from foreign financial institutions. These trends are best represented by how stablecoins can serve as a cushion to an economy seeking to increase its resilience to financial stress within economically unstable regions of Sub-Saharan Africa.

Source: Chainalysis

Future For Crypto In Sub-Saharan Africa

The possibility for economic development is clearer as Sub-Saharan Africa keeps embracing cryptocurrencies—especially stablecoins. As of 2021, the World Bank projects that just 49% of the region’s people had access to a bank account. For many who are unbanked or underbanked, cryptocurrencies show promise as a result of their lack of access.

Clearer regulatory regimes in various jurisdictions also help support growth within the crypto space. South Africa sets the lead with a well-rounded proactive regulating framework that gives power to cryptocurrency entities without putting consumers at risk. As more and more people seek out improved access and stability through digital currency, Sub-Saharan Africa is set to drive global crypto adoption.

Featured image from SEGURA Consulting LLC, chart from TradingView