Bitcoin, Ethereum, Litecoin and all the other cryptocurrencies are great for online payments simply because of their sophisticated use of the Blockchain to facilitate easy transactions. Their transparency is currently unmatched by any fiat equivalent. But can we really bank on them for day to day transfers considering their high volatility? The fact that these currencies are not pegged to any economy worries many.

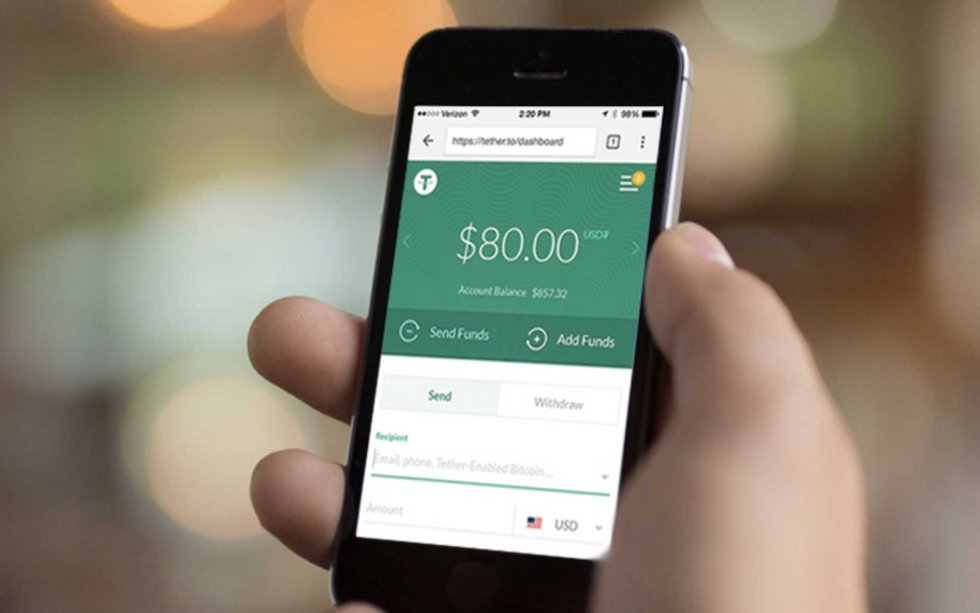

Here’s where Tether comes in – a project that makes fiat currencies easy to trade by converting them to crypto-coins. Tether is an unregulated cryptocurrency issued on the Bitcoin blockchain before making a transition to the Litecoin blockchain through the Omni Layer Protocol. It is a project that is backed by major cryptocurrency exchanges and is ranked #15 in the rankings for the highest market cap (around $2 billion USD).

Essentially a Virtual Dollar?

Tether is an unusual cryptocurrency that was designed as a cryptographically protected equivalent of all regular currencies, with the dollar in mind. With this said there are some major advantages to using Tether over other cryptocurrencies.

- Transit Cryptocurrency: Essentially, Tether can transfer regular currencies to contractors cheaper and faster than bank payments. Also due to the use of the blockchain, securing the payments it makes it an advantageous way to trade regular and cryptocurrencies.

- Accepted: Numerous platforms that work with cryptocurrencies accepted and enhanced their platforms after the integration of Tether. Platforms that could not use the US Dollar were able to use Tether instead thus growing their platforms.

- Good Backup: Tether is a backup fund that ensures the market stability of the coins. The backup funds make up to the equivalent amount of tether in circulation.

Risks Regarding Tether Limited

There are doubts that Tether Limited, the company behind Tether, does not have the reserves to back up all the funds currently in circulation. Claims that it does not hold the dollars to back it up need to scrutinize, for in case they do come out to be true, it could have a catastrophic impact on the trust people impart in the holding company. However, Tether Limited has undergone extreme lengths to be transparent and this is new territory. There are no preexisting processes or benchmarks to measure success.

Tether has remained consistent and will continue to do so. Tether is a verifiable cryptocurrency and while uncertainty around this Tether controversy does not stand well for cryptocurrencies in general, trust has remained high from the very beginning.

So What’s the Verdict?

It would be ignorant to disregard Tether as an up and coming cryptocurrency that could find many use cases in the future. Even right now, freelancers can use Tether to hold some of their earning in a secured digital vault that does not suffer from sudden price fluctuations. These funds can be withdrawn at any given moment by exchanging them at the Tether website.

However, like always, it is recommended that you do not invest any more in Tether than you can afford to lose, for the technology is still at its infancy. Memories of the Nixon shock still plague the minds of economists across the world, and only time will tell if Tether Limited lives up to its promise of having a dollar in reserve for every Tether issued.

What are your thoughts on Tether? Does its lack of volatility make it attractive as a means of payment? Let us know in the comments below.

Images courtesy of Tether, The Economist