Bitcoin is approaching the most pivotal point in its current cycle, trading just 7% below its all-time high. With intense anticipation, top analyst and investor Axel Adler has shared an analysis on X, outlining the critical demand drivers shaping BTC’s price action this week.

According to Adler, several forces could steer Bitcoin’s direction, from retail traders reacting to recent bullish momentum to macroeconomic factors like the upcoming U.S. election and the Federal Reserve’s upcoming rate decision. The convergence of these elements creates a unique backdrop for BTC, adding layers of complexity to its short-term outlook.

Retail interest is already climbing as investors eye the potential for a breakout into price discovery territory. Meanwhile, the Federal Reserve’s stance on interest rates could influence institutional confidence, potentially sparking significant inflows into BTC if a dovish stance prevails.

With the U.S. election also in play, BTC’s resilience and potential for a breakout make this a defining week for the asset as market participants gauge whether these demand drivers can collectively propel BTC to new all-time highs.

Can Bitcoin Demand Push The Price Above ATH?

Bitcoin is gearing up for a volatile week as the highly anticipated U.S. election takes place tomorrow, followed by the Federal Reserve’s interest rate decision on Thursday. Top analyst Axel Adler from CryptoQuant has highlighted the potential impact of these events on Bitcoin’s price in his latest analysis.

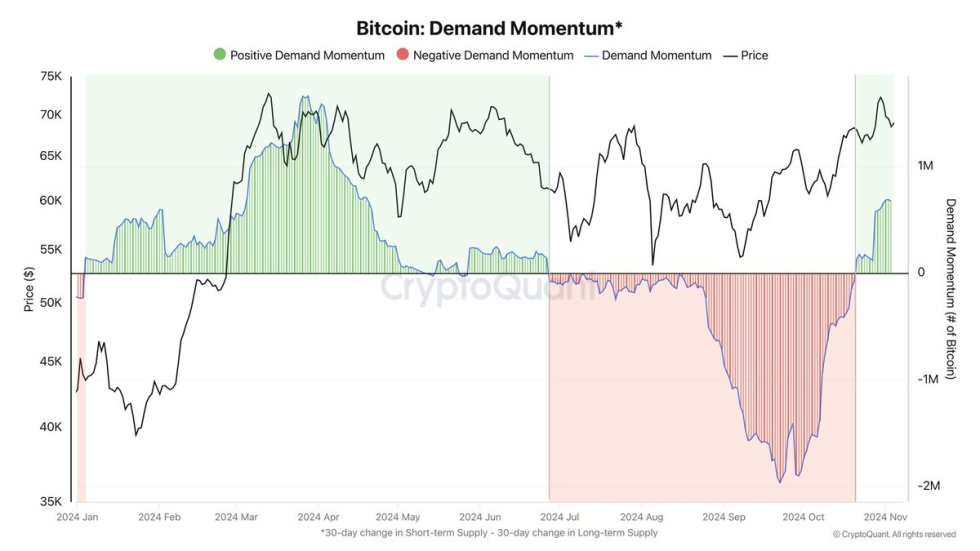

He shared a chart illustrating the BTC Demand Momentum, a technical indicator that reveals a notable increase in short-term holder demand, suggesting a positive outlook for BTC. Adler emphasizes that this week, retail investor demand is the first of three critical drivers influencing Bitcoin’s price.

He also notes that the outcome of the election could significantly affect market sentiment. A win for Donald Trump, for instance, is likely to create bullish momentum for BTC, while a victory for Kamala Harris may not generate the same level of enthusiasm. The political landscape plays a vital role in shaping investor behavior, especially in the crypto space, where sentiment can shift rapidly.

Furthermore, Adler points to the Federal Reserve’s decision regarding interest rates as a potential catalyst for Bitcoin’s price movement. If the Fed opts to lower the key rate by 25 basis points, it could provide the final push for BTC to rally. This monetary policy shift would likely increase liquidity in the market, making BTC more attractive to investors seeking alternative assets.

With both the election and the Fed’s decision on the horizon, BTC is poised for a week filled with potential volatility and significant price fluctuations as market participants react to these influential events.

BTC Holding Strong Above $68,000

Bitcoin is currently trading at $68,900 and appears primed for a potential push above its all-time highs shortly. After reaching a local high of $73,600, the weekly close around $68,700 was less than bullish, but the overall sentiment remains positive. Importantly, BTC continues to hold above the critical $68,000 mark, with significant liquidity resting above the previous all-time highs, which bodes well for future price movements.

However, the coming days are expected to be filled with volatility and uncertainty due to unpredictable events such as the U.S. election and the Federal Reserve’s decision on interest rates. These factors could significantly influence market sentiment and price action. A daily close above the $70,000 mark would be a crucial signal, indicating that BTC is not only gaining momentum but also setting the stage to test its all-time high of $73,794.

As market participants navigate this pivotal moment, the outlook for Bitcoin remains cautiously optimistic, with traders closely watching key levels and awaiting confirmation of a breakout above the previous ATH.

Featured image from Dall-E, chart from TradingView