- Bitcoin has undergone a strong rally over the past few weeks.

- The market has dropped in the near term due to a strong decline in the Dow Jones and S&P 500 index.

- One crypto-asset analyst who called the V-shaped reversal that we saw in March remains bullish.

- He says that Bitcoin could undergo “50% pumps” heading into the end of Q4 and the start of 2021.

Bitcoin Will See a Big Q4, Analysts Say

Bitcoin has undergone a strong rally over the past few weeks that has brought it from $10,200 to highs of $13,350.

The coin currently trades for $12,900, having undergone a slight drop in the face of a strong decline in the Dow Jones and S&P 500 index.

While the weakness in the stock market is worrying for some, especially considering the severity of the move, analysts remain bullish.

One crypto-asset analyst who called the V-shaped reversal that we saw in March and into the spring and summer recently commented on the matter:

“$BTC about to light up. Finished my chart studies, will review in the morning and if all still makes sense, share my thoughts Looks like remaining of Q4 and early 2021 is going to be filled with volatility in both directions (50% pumps, 30+% dumps) – swing trade heaven.”

$BTC about to light up

Finished my chart studies, will review in the morning and if all still makes sense, share my thoughts

Looks like remaining of Q4 and early 2021 is going to be filled with volatility in both directions (50% pumps, 30+% dumps) – swing trade heaven

— //Bitcoin 𝕵ack 🐐 (@BTC_JackSparrow) October 25, 2020

As he explains, Bitcoin could undergo “50% pumps” heading into the end of Q4 and the start of 2021. He added that these 50% pumps will be marked by 30+% dumps as well, seemingly referencing how volatile the leading cryptocurrency was in 2017’s rally.

To elaborate on his legitimacy, this analyst wrote on March 14th, a day after the crash, that he expected a rapid recovery to $10,000 by May or June.

Bitcoin did so, proceeding to rally from the lows of $3,500 to $10,000 by the range in time he specified.

Expect Some Volatility Ahead of the Futures Close

While he does expect Bitcoin to move higher in the medium-term, he did note that investors should expect strong price action to the upside an downside as futures expiries come in:

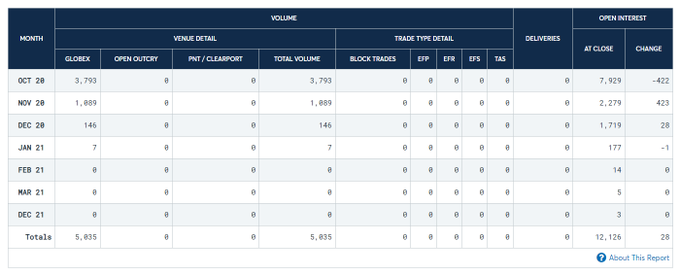

“There is volatility for the CME October contracts to be expected, that haven’t rolled over to November or December yet, expiring end of this week. ~40K worth of BTC ($500M) still open with 5 trading days to go. Deribit also has about 40K BTC option contracts expiring on Friday.

Table of BTC's CME futures data for the next year. Chart from Bitcoin Jack (@BTC_JackSparrow on Twitter).

There is also some volatility to expected in the near term due to the presidential election, along with uncertainty about the next fiscal stimulus bill.

Photo by Paweł Czerwiński on Unsplash Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Analyst Who Called Bitcoin's V-Shaped Reversal Thinks Q4 Will Be Big for Bulls