Amid the continuous downtrend in the non-fungible token (NFT) market trading volume, bankrupt cryptocurrency hedge fund Three Arrows Capital (3AC) has managed to turn its financial misfortune into a remarkable success story.

According to a report published by Reuters earlier today, on Friday, Auction house Sotheby’s announced the sale of seven NFTs from the defunct firm, fetching a whooping sum of $2.5 million.

Auction Of Three Arrows’ NFT Assets

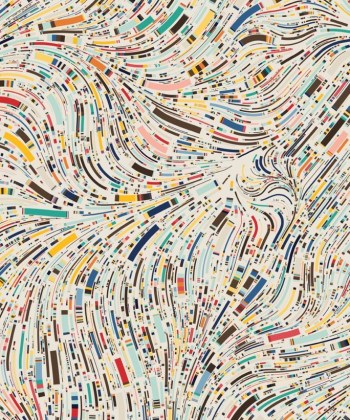

Among the collection of NFTs put up for auction, it was the artwork titled “Fidenza #725” that stole the show, commanding an impressive price tag of over $1 million. The visually captivating image, characterized by its graphic dashes and curves in a subtle blend of cream, yellow, pink, and black, garnered significant attention from bidders.

Interestingly, Three Arrows Capital had acquired this particular NFT for 135 ether, equivalent to approximately $341,786 at the time, as reported by DappRadar. This remarkable increase in value showcases the substantial appreciation potential within the NFT market, despite its current drop in volume.

The auction of Three Arrows Capital’s NFT assets is a crucial part of the firm’s ongoing liquidation process. Since its collapse in 2022 due to the sharp decline of cryptocurrencies Luna and TerraUSD, the Singapore-based company became the first major crypto firm to file for bankruptcy that year.

In a filing seen by crypto news site The Block, the firm estimated its overall assets to be worth around $1 billion, with the NFT collection alone valued at approximately $22 million. This auction provides a unique opportunity to liquidate the NFT holdings and potentially recover some of the losses incurred by the firm’s unfortunate downfall.

The Power Of NFTs In A Volatile Market

The significant success of Three Arrows Capital’s NFT auction serves as a testament to the enduring value and appeal of digital assets, even in times of financial distress. NFTs have emerged as a groundbreaking and innovative sector within the crypto space, attracting both collectors and investors alike.

The ability to tokenize and authenticate unique digital content has opened new avenues for artists, creators, and investors to participate in a vibrant and dynamic ecosystem. This recent auction exemplifies the transformative potential of NFTs, as they remain more than just unique digital collectibles.

While the bankruptcy of Three Arrows Capital initially cast a shadow over the firm’s future, the unexpected success of the NFT auction highlights the resilience and adaptability of the crypto industry. This outcome reinforces the notion that NFTs can serve as valuable assets, capable of generating substantial returns for investors, even amidst market volatility and challenging circumstances.

Beyond the financial implications, the auction also highlights the broader impact of NFTs on the art world and the way ownership in the digital age is perceived. NFTs have disrupted traditional notions of art ownership by enabling artists to retain a stake in the value of their work and receive royalties on subsequent sales.

This revolutionary shift empowers creators and encourages artistic innovation in a digital landscape that was previously challenging to monetize effectively.

While NFTs have proved to have huge potential as a blockchain technology application, these unique digital assets remain a part of the crypto space. Meanwhile, the crypto market has been in a blend of bulls and bears in the past week.

Over the past 24 hours, the global crypto market has seen a 0.2% gain after recording a slight decline as of yesterday. The crypto market currently has a value sitting firmly above the $1 trillion mark.

-Featured image from iStock, Chart from TradingView