Bitcoin has surged aggressively, breaking its March all-time high (ATH) and pushing past the $82,000 mark. This latest rally reflects a strong, bullish sentiment in the market, with investors and traders anticipating further gains.

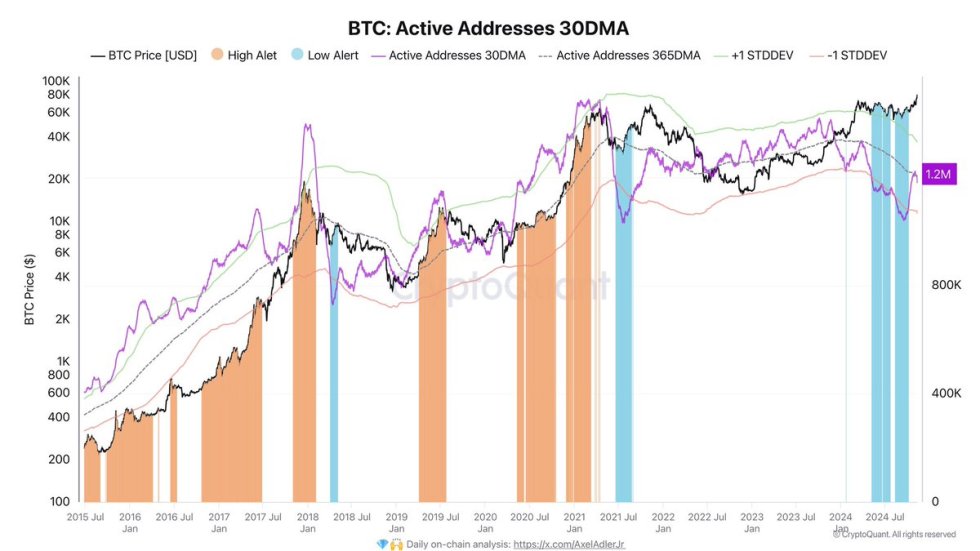

Despite the rapid price increase, data from CryptoQuant reveals a notable metric that suggests the uptrend may still have room to grow: the average number of active addresses remains at the median level rather than peaking, which often indicates that the current rally is not yet overextended.

This metric implies that there’s still significant room for fresh demand to enter the market, supporting further upside for BTC in the coming weeks. As BTC explores uncharted territory, the balance between steady accumulation by investors and growing momentum from active participants suggests that the rally is only in its early stages.

Bulls appear to be in control, and many analysts believe Bitcoin’s momentum will continue, drawing attention from both retail and institutional investors. With active addresses holding steady, the next phase of BTC’s rally could see even higher price levels as it captures increasing interest in the crypto space.

Bitcoin Uptrend Only Starting

Bitcoin’s bullish phase is just beginning, and despite its recent surge, it has been less than a week since the price broke its March all-time highs. The aggressive price action has fueled optimism, with many investors now expecting further upside in the coming months.

Key data from CryptoQuant analyst Axel Adler provides valuable insight into Bitcoin’s current market dynamics. He notes that the average number of active addresses is currently at the median level. Typically, when this metric rises above +1 standard deviation (STDDEV), it signals an increase in selling pressure, often marking a local top.

However, as the metric remains below this threshold, the absence of significant selling pressure suggests that Bitcoin’s cycle peak is still far off.

This lack of selling pressure and a favorable macroeconomic environment indicate continued bullish price action. BTC has gained momentum in response to the positive sentiment from Donald Trump’s victory in the US elections and the Federal Reserve’s interest rate cut. These factors contribute to a more favorable backdrop for BTC, allowing it to thrive in an environment of increasing investor confidence.

As the market absorbs new demand, Bitcoin’s bullish trend appears poised to persist. The absence of strong selling signals and the macroeconomic support suggest that Bitcoin’s price could continue its upward trajectory in the months ahead, making this an exciting time for both long-term investors and short-term traders.

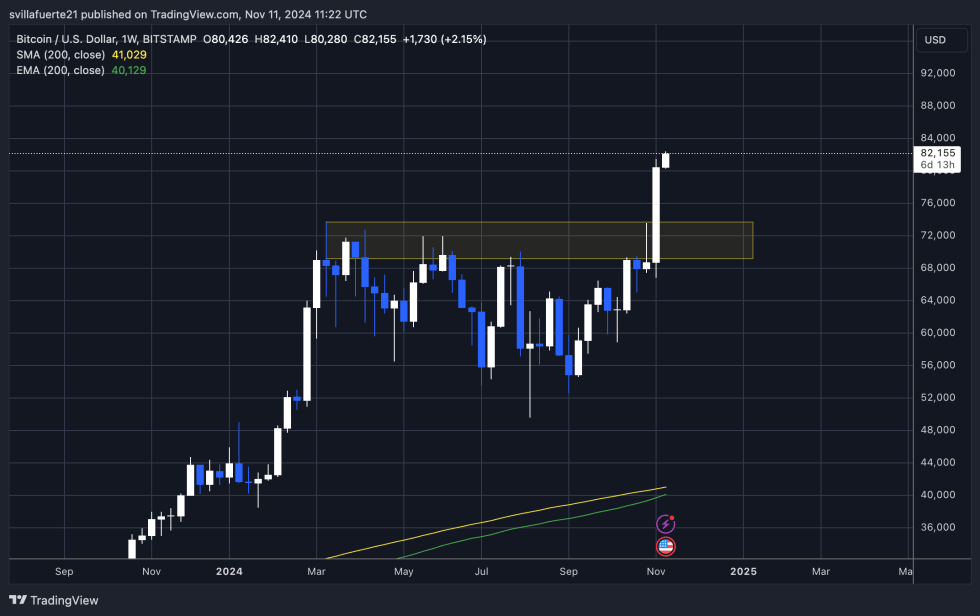

BTC Price Breaks Above $82,000

Bitcoin is trading above the $82,000 mark after breaking its all-time high (again) just a few hours ago. Bulls are firmly in control, and after 8 months of sideways consolidation and heavy selling pressure, BTC looks primed for a more aggressive upward move. The price action has been strong, signaling that BTC may continue to push higher in the short term.

However, as is often the case with fast-moving markets, bulls could grow tired, and some profit-taking may emerge in the coming days. This could lead to a short-term pullback, with a retrace to the $77,000 level being a healthy and natural move for BTC. Such a dip would provide a solid demand zone and allow the market to consolidate before pushing higher in the next leg of its bullish trend.

The current strength of Bitcoin’s price action is undeniable, but as the market matures and moves toward new highs, healthy corrections will be needed to keep the trend intact. Suppose the price holds above key support levels like $77,000. In that case, the foundation will be set for a continuation toward even higher price levels, signaling the ongoing strength of the current bullish cycle.

Featured image from Dall-E, chart from TradingView