The bitcoin market, notorious for its rollercoaster-like volatility, has once again plunged into a tumultuous phase, leaving traders and investors on edge as prices oscillate unpredictably.

Crypto strategist Benjamin Cowen, a prominent voice in the digital asset arena, has declared that the market is now entering one of its most “brutal” stages within its cyclical nature.

Cowen, sharing his insights on the social media platform X, pointed out that Bitcoin’s (BTC) dominance, which represents its total share of the crypto market capitalization, is on the rise. This phenomenon comes as risk appetite for the broader asset class appears to be waning.

“We’ve been discussing this phase of the market cycle for a while,” Cowen wrote. “Namely, where BTC drops, but BTC dominance (BTC.D) goes up because altcoins are dropping more. It is always the most brutal part of the market cycle.”

We’ve been discussing this phase of the market cycle for a while.

Namely, where #BTC drops, but BTC dominance goes up, because altcoins are dropping more.

It is always the most brutal part of the market cycle. pic.twitter.com/ueLIcwUkOw

— Benjamin Cowen (@intocryptoverse) October 9, 2023

Bitcoin Dominance On The Rise Amid Market Turbulence

Cowen employed Fibonacci retracement levels to provide his perspective on Bitcoin’s dominance trajectory. He suggested that Bitcoin’s dominance is likely to peak at around 60%, much as it did in the previous cycle.

“I’m still a believer in the 60%. It could be slightly different. Like, it could be 59%,” he said. “It could be 63%. And some people say, Well, what about stablecoins? I think the stablecoin market is why it doesn’t go to 65% or 70%.”

BTC market cap currently at $539 billion. Chart: TradingView.com

While the crypto market grapples with this intense phase, cryptocurrency traders found themselves reeling from substantial losses during a recent market rout. The turmoil in the Middle East, escalating tensions, and uncertain global geopolitical events contributed to a sharp downturn in digital asset prices.

Market Turmoil And Losses: $100 Million Liquidated In A Day

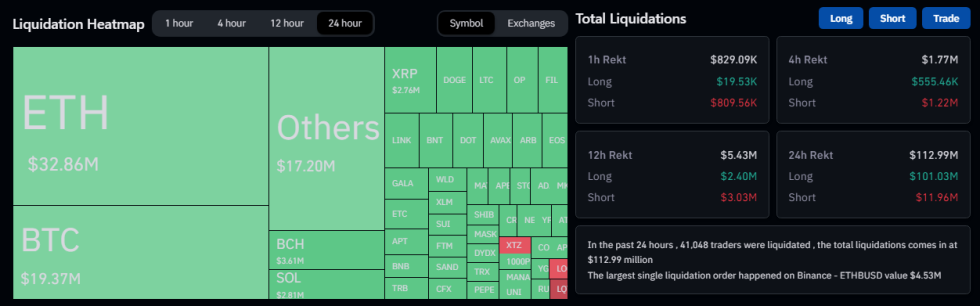

According to data from CoinGlass, over $100 million in losses resulted from liquidations on Monday alone, as digital asset prices experienced a sharp and abrupt decline. This figure primarily represents long positions, indicating traders who had anticipated price increases and were subsequently forced to exit their positions.

Source: Coinglass

Monday’s market meltdown saw a staggering $105 million in long liquidations within the US afternoon trading session. This marked the most significant amount of long liquidations witnessed in a single day since the fateful events of September 11.

As of the latest market data, Bitcoin (BTC) is currently trading at $27,590 on CoinGecko, experiencing a 24-hour decline of 1.3%. These price fluctuations serve as a stark reminder of the crypto market’s inherent unpredictability, where fortunes can change within minutes.

In this environment of heightened volatility and uncertainty, crypto enthusiasts and traders must exercise caution and closely monitor market developments. The crypto market’s ability to surprise, both positively and negatively, remains one of its defining characteristics, and participants must navigate these treacherous waters with vigilance and adaptability.

Featured image from iStock